With just a swiping of your credit card, you pay a handsome bill of thousands to lacs worldwide instantly without any penny with you. Your credit cards make it possible. However, such wide-accepted safe transaction has not been successful overnight. There goes a long history of credit cards to come today’s perfection. Let’s find in short:

Table of Contents

History of Credit Cards

Credit cards have a long history to reach today’s destination. We will present the whole story and history in some short details to give you an overview.

Pre-history of Credit Cards

The history begins with the idea of credit cards in science by Edward Bellamy in his book Looking Backward, first published in 1888. The credit card was cited 11 times in the book!

Then, Charge/Courtesy cards in the 1920s and Charga Plate in 1934 made the ideas of the cards more realistic and implementable.

Modern Card History

The tribute for credit cards goes to Frank McNamara, who devised the idea of dining now, pay later concept. There is a story that he went for dinner in a restaurant in New York City but forgot to carry his wallet. When the bill arrived, he was embarrassed and thought of the idea of ways to pay later. The game started in 1949.

In 1950, he and his friend Ralph Schneider started Dinners Club primarily with 27 restaurants and 200 members. They charged $3 yearly from members and 7% from the merchants. The concept was so successful that it increased to 20000 members in the first year. The success spread the card out of the USA to Canada, France by 1953.

Around the same time, Alfred Bloomingdale started Sign and Dine cards in Los Angeles. Hearing the story of Diners Club, he contacted and discussed with Frank and Ralph and consolidated their card business.

Bank of America introduced cards in 1958, and the cards soon spread all over the world.

Few World Statistics

- First credit card issuer bank is Bank of America

- Walter Cavanagh won the Guinness Book of World Records with 1,497 cards, a credit line of $1.7 mill.

- Around 2.8 billion cards are issued

- Canada has the highest % of card users(82.58%)

- VISA is the highest number of the card issuer, followed by Mastercard, Discover, and American Express.

Few Insights in American Aspects

- 79% of Consumers have at least one credit/charge card

- Visa is the most used card, followed by Mastercard.

- Discover and Amex are the third and fourth in the queue of service providers.

History of Credit Cards in Bangladesh

Credit cards have become a must-have possession for the last couple of years in Bangladesh. Almost all the banks and financial institutions are vying severely to give a card with lots of sweet talks and offers. People from all walks of life, especially jobholders, are the main targets of these card issuers. Cards are distributed and activated with many colorful aspirations, but life gets caught with the debts and loans after a few months.

Credit cards in Bangladesh

Formal orientation of credit cards in Bangladesh happened with Standard Chartered Bank in January 1, 1997. SCB was then with the name ANZ Grindlays Bank. At first, the VISA and Mastercards were in BDT. National Bank Limited in 1997 initiated the dual currency cards. And now? There is hardly any banks/NBFIs that do not issue credit cards.

You need not take me wrong that I am discouraging with the drawbacks of any credit card. But, it’s not like that. Today, I will share both pros and cons of a credit card but be sure that I will focus mainly on the wrong aspects to keep your life easy, comfortable, and debt-free for long. Taking benefits of the modern tools has never been bad, but if the benefits can not outweigh your problems, I must suggest not approaching that sweet topic.

Few statistics in Bangladesh

The number of ATM, POS, CDM, and CRM up to May 2021 totals 12270, 81911, 1648, and 896 respectively

Up to May 2021, the number of Credit cards issued was 17,58,884 with 2,83,8557 transactions of Tk. 1708.40 crore on a monthly basis.

Credit Card Products in Bangladesh

Each bank?NBFI is different in its card names and features. Some of the names of cards are as the list goes:

VISA

- Visa Classic Credit Card

- Visa Gold Credit Card

- Visa Platinum Credit Card

- Diners Club International

- Visa Corporate Platinum Credit

- VISA SIGNATURE CARD

- Visa Infinite Credit Card

- RFCD card

- ERQ Platinum

- Visa Islamic banking cards

MasterCard

- Mastercard Gold Card

- Mastercard Titanium Credit Card

- Mastercard World Credit Card

City Bank American Express

- American Express Credit Card (Local/Dual)

- American Express Gold Credit Card

- American Express Platinum Credit Card

- American Express Gold FC Credit Card

- American Express Platinum FC Credit Card

Diners Club International

EBL Diners Club International

JCB Cards

JCB Credit Cards

Co-branded/Private Label Cards

Meena Bazar Co-Branded Visa

EBL Shwapno Co-Branded

EBL Basis Co-Branded Credit

Advantages of Credit Cards in Bangladesh

The evolution of credit cards presents the history of problem solutions. Cards were born to drive away holders’ limitations and shortcomings. Let’s explore the advantages of credit cards in the perspective of Bangladesh.

Less physical theft

Carrying a handsome amount of cash is risky of theft and robbery. Your cards can save you from them. You are taking only a plastic card to avoid the scenario as the cards are not readily usable as cash. In addition, cards are password and authentication protected, so thieves are not very interested in stealing them.

Reward points

It is bizarre but true that buying in cash hardly provides rewards nowadays. But, with some specialty cards, you can lot of offers, rewards, and concessions. So, have some ideal cards and avail the bonuses and discount offers on almost all outlets. Accumulating reward points will give you options of encashment or availing of free purchases.

Safety

Cards are issued and maintained by the reputed and most prominent organizations. They are worldwide entities concerned a lot about security and reputation, and your safety is their concern. With cards, you are not only safe from physical theft; the issuers will handle online scams if you follow timely steps. In addition, the platform and the reputation will ensure you more cybersecurity than cash transactions.

Comfortable

Carrying a card is much more comfortable than having a good amount of cash notes. In terms of space, comfort, and ease, cards outweigh the facilities of cash.

Transportable

Cards are easy to transport and carry compared to cash. A plastic card will facilitate you with a few lacs of cash equivalent. You are carrying a plastic card that can provide all the cash requirements readily. Taking bundles of cash has become obsolete with the arrival of cards.

Digital

In the digital world era, cards are the perfect partner in your digital journey and lifestyle. With credit cards, you can harvest the true potentials of digitization. Your life gets more virtual than ever with the virtue of a card. Payments, receipts, transfers are all made with some taps of fingers.

Versatile

Credit cards offer you a true sense of versatility. Previously cards were well known for facilitating credit purchases. The time has changed a lot to provide booking, ticketing of bus, train, theatre, cinemas, mobile recharge, fund transfers and many more. Nothing that involves money is out of the purview of cards nowadays.

Remote payment

Suppose you will pay another city/country. Can cash help you comfortably? Cards may be the right choice here. You can pay anyone, anywhere.

Prepayment

Suppose you will visit another city/country next month and need to pay for your hotel bills in advance. Cards are the perfect tool to make your advance bills in seconds from your home.

Status

Having a credit card is no longer limited to status; it is getting to necessity. Still, it has always been a symbol of status. To maintain the friend circle and society’s class, you may need to own one or more cards to use on different occasions and locations.

Lounge

If you are to use airports now and then for official/business/personal tours, you must feel the necessity to avail the lounge facilities offered to credit card holders. For a safe and honorable stay at lounges without any extra charges(in most cases), you will require to have a card. So, credit cards are not only for transactions; they are sometimes for relaxation.

Foreign payments

Those who pay for various bills and subscriptions in foreign currencies can feel the relaxation with cards. Dual-currency cards can make your foreign payments hassle-free. You need not visit any bank branch or money changer to make the payment.

The Quickest

Credit cards are the quickest payment solution for your busy life. You need not waste your valuable time in counting, checking cash. All you need is to authenticate the transactions. Besides, you need not visit the banks and grocery outlets. You can make everything from home. You can pay with cards and take home delivery.

Emergency fund

Credit card debt may be a good source of emergency funds. You may withdraw with card checks or cards and even can transfer to MFSs without any extra charge. So, when you require urgent funds, your cards are just saviors.

Grace period

You may purchase on credit cards at home and abroad as there is a grace period of around 45-50 days maximum based on the billing cycle. For example, suppose your bill generate on the 4th, and the last payment date is the 20th. If you make a transaction on the 5th, you will get a grace period of 45 days. If you transact on the 4th, your grace period comes down to 15 days.

Smart

With digitization at its peak, smart payments and transactions are getting priority. Credit cards ensure smart payments at ease. Cards may be one of the most used ways available near you.

Supplementary Card

Another great feature you can enjoy is the supplementary card. You can avail supplementary cards for your family members who do not fulfill the conditions to get a card by themselves. Receiving a supplementary card is very easy, contact the issuer card division or your known representative to avail one.

Insurance Coverage

Some card issuers provide insurance benefits for credit card users get insurance benefits in case of an accident, permanent total disability, and death. Usually, dues are waived and some prefixed amount is given to the cardholder /nominees.

Disadvantages of Credit Cards

Excessive and unnecessary expenses

As you do not have to carry cash, you can expense any amount. But, again, as you are not paying now, you consume even for unnecessary and less urgent items. Carrying cash puts a limit, but cards encourage consumption with offers and reward points.

Falling in debt

Most of the credit cardholders fall into debt over time with unnecessary consumption. The first few months are easy to manage with help from the near and dear ones, but situations get tougher and unmanageable over time. Then, debts start piling, and you may be a victim of the loans.

High-interest rate

Credit cards are payment solutions, not fund sources. If you finance from cards by not paying your dues, you must bear an unbearable interest rate. The effective rate and charges now is around 25% in Bangladesh,(The declared interest rate from October 2020, as per Bangladesh Bank is 20%) though banks’ lending rate is under 9%.

Lots of fees

Using credit cards becomes sour when you miss the last date of payment. You are charged a heavy extra in the name of late payment fees. In addition, the interest gets higher if you are to make any amount for delayed payments.

Pressure in date management

If you are several cardholders, you will feel the hard pressure of managing the dates to make the bill payments in time.

Inaccessibility

Another ignored sad story may be the inaccessibility or unavailability of services. Suppose you are out of home with your card and found that the services will not be available for scheduled maintenance; life will become a burden as you have no cash as a digital life lover. However, card issuers send messages/emails before causing any maintenance. So, be careful to avoid such wrong timings.

Not allowing own account.

Withdrawal of funds from card checks is cheap, but the problem is that you can not place the check in your account. Instead, you have to deposit it in another person’s account. It creates some complexities.

Extra Charges

Things are not always rosy for credit cardholders in Bangladesh. Some retailers may want to charge you 1%-2% extra if you pay in cards. If you have ever visited and tried to pay with credit cards in IDB for electric items, you must have faced such a weird situation, I believe.

Origins of credit card traps

Too many cards

The trap and burden of credit cards start when you are opting for multiple cards. Having several cards may not harm you until you pay the dues of one card with another card’s funds.

Too much limit

A man, by nature, is not self-regulated. Some regulations and limitations make him abide by the existing policies. When you have access to a considerable amount, you are expected to spend more in most cases. Try to keep your limit as minimum as possible to keep out of spending addiction.

Using cash withdrawal facilities

You will hardly fall prey to the debt burden if you are not taking cash facilities from credit cards. Taking funds makes you more prone to fail in non-payments on due dates. Credit card funds are expensive, and when you are using this facility, you will have to pay a lot as an interest charge.

Missing full payments

It is crucial to pay your monthly bills in full. Usually, interest is heavily charged until you complete full payment. Paying the minimum amount is not enough to avoid an interest charge. If you pay partially, interest is charged on full dues.

Waiting the last minutes and forgetting the last dates

Many cardholders wait for the last date to pay for cards and sometimes miss the deadline due to being busy, sick, or having other issues. As a result, some of you may forget to pay at last. If you have several cards, it is natural that few dates will be out of your memory. When you miss the deadline, you are to pay a high charge.

Carrying always with you

If you desire to be out of the credit card trap, you should not always carry your cards with you. Instead, when you are going shopping or for other purposes, take the card with you. This method will help you avoid unnecessary expenses.

Best Credit Cards in Bangladesh

Best cards with lower interest rates and charges

- Dutch Bangla Bank Limited cards

- Prime Bank Limited Cards

Best cards with lounge facilities

- EBL cards

- City Bank Amex Cards

- BRAC Bank Cards

Best cards for shopping

- Diners Club

Best cards from International issuers

SCB cards

FAQs

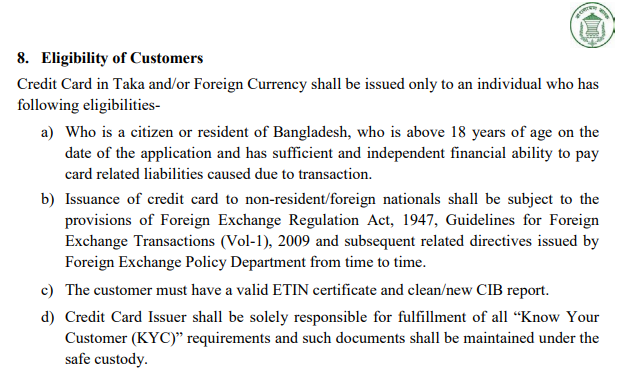

What are the requirements for a credit card in Bangladesh?

Basic Documents

- Application form

- Copy of valid N Identity Card/Machine Readable Passport

- Copy of valid passport for dual/international card

- Copy of E-TIN Certificate

- Two copies of photographs

- CIB Enquiry & CIB Undertaking forms

Supplementary Card

Copy of National ID Card/Passport/Birth Registration Certificate for a supplementary cardholder.

For Salaried Persons

- Salary Certificate/ Pay Slip

- Latest 3 months’ bank statement

Based on your profession, the documents required may vary from bank to bank. so, please collect the documents list from the representative while applying.

What are credit card CVV and expiration dates? How long is a CVV number?

Card verification value (CVV) is a security and identity feature. It reduces theft and fraud. Card verification code (CVC) or card security code (CSC) also refers to the same issue. For online payments/transactions, you will require to confirm the CVV and expiration dates. CVV is usually 3/4 numbers.

Do you have to pay for a credit card?

There are yearly and SMS charges you are to pay for a credit card. However, you may have some offers and conditions to avoid the charges, especially the yearly charge with some specified transactions.

What are the best dual-currency cards for freelancers?

Bank Asia SHADHIN Mastercard and EBL Aqua card are easy to get and convenient dual-currency cards specially designed for freelancers.

Is MasterCard available in Bangladesh?

Mastercard Debit and Credit cards are widely available and usable in Bangladesh. You can use almost all POSs and ATMs over the country.

Is VISA Card available in Bangladesh?

VISA is one of the most issued cards in Bangladesh, backed by most of banks and non-bank financial institutions. You can avail of and use them on almost all ATMs, POSs, and online platforms.

How can I pay my VISA card bill online in Bangladesh?

Paying your VISA card bill is more comfortable and flexible than you think. You may pay with dropboxes(particular banks), visiting bank branches, online banking or apps, Mobile Financial Services, and many more ways.

How can I pay my Mastercard bill online in Bangladesh?

You can pay for MasterCard by bank branches, dropboxes, online platforms. However, Bkash is not providing services for these card payments though it supports VISA and Amex bill payments.

Is a credit card company/network and issuer same?

May be the same as Amex and Discover or different as Visa and Mastercard.

Checklist for a credit card selection?

Getting a credit card is very easy in Bangladesh. But before taking any card, be aware of the following checklist:

- Annual fee

- Interest Rate

- Late Fee

- Credit Limit

- Wide Acceptability

- Necessity

- Loyalty/Reward points

- Lounge Facilities

- Payment options

- Fund Transfer

- Grace Period

- Security Deposits

- EMI coverage

Personalized course on Personal Finance

Nafeez Al Tarik, CFA, FRM, Managing Director, Dhaka Bank Securities Limited has brought a Personal Finance course with 10 Minute School to help you out of debt. Follow this link to know more and be debt free:

Final Notes

Over the years credit cards have been usually the boons all over the world. However, there are many instances that people have submerged in debts with the misuse of cards. If you look before leaping. The use of cards (credit cards, priority, shopping cards, and debit cards ) in Bangladesh may make your lifestyle comfortable and worth living. Avoid the debt trap and enjoy the virtues of innovation. Find details on Bashundhara.

1 comment