The effective bond market plays a vital role in the economic development of a country and presents long-term financing opportunities to the issuers by creating an alternative source of finance and provides a stable source of income to the investors. The bond market in Bangladesh will be presented with every bit of information you need to know.

In Bangladesh, most of the debt financing need is fulfilled from the banking sources, which burdens the overall banking sector while presenting significant systemic risk. Therefore, the development of a well-functioning bond market would ensure financial stability by enhancing the ability of financial institutions to manage risks.

Table of Contents

Government Security:

Government Security is a tradable instrument issued by a sovereign Government. It acknowledges the Government’s debt obligation. Such securities are short-term (usually called treasury bills, with original maturities of less than one year) or long-term (usually called Government bonds or dated securities with an original maturity of one year or more).

The Government borrows funds from domestic sources by issuing tradable and non-tradable securities to finance the budgetary deficits.

- Tradable T-Bills:14-day, 91-day, 182-day, and 364-day T-Bills;

- Tradable T-Bonds: 2- year, 3-year FRTB, 5-year, 10-year, 15-year, and 20-year T-Bonds;

- Non-tradable securities include Sanchayapatras and Prize bonds.

Eligible Investors: Resident Individuals and institutions, such as banks, NBFIs, insurance companies, corporations, provident funds, pension funds, etc., can purchase and trade T-bills and T-bonds. However, foreign/non-resident individuals and institutions can invest only in T-bonds.

As per the agreement between The Government of Bangladesh and Bangladesh Bank in 1985 (Treasury rules-1998 (Appendix-1, Section-3) and Bangladesh Bank (BB) Order-1972, article 20 empowers BB to issue new loans and manage public debt for the Government

Features of Treasury Bills

- The market determines the price

- They are issued at a discount and redeemed at face value at maturity.

- Tradable in the secondary market.

- Issued in scriptless form.

- The Central Bank releases a monthly calendar through the BB website.

Features of Treasury Bonds

- A risk-free fixed coupon-bearing debt instrument

- Maturities are available within 2-20 years.

- It carries a half-yearly coupon payment, and the principal is repaid on maturity.

- The market determines yield.

- Tradable instruments in the secondary market.

- Issued in scriptless form.

Participation in Auctions and Trading

- Weekly (usually on Sunday) auctions of Treasury Bills are held following a pre-announced auction calendar with a specified amount. Bidders quote their prices. The Auction Committee determines the cut-off price from the offered prices.

- Weekly (usually on Tuesday) auction of BGTB of a particular tenor is held following a pre-announced auction calendar with the specific amount. In case of a new issue, bidders quote their expected yields, and in re-issue auctions, they have to quote price.

- Primary Dealers (PDs) can place bids in the auction. Other commercial banks and Non-Bank Financial institutions, Insurance companies, corporate, individuals, provident funds, etc., can also participate in the auction through PDs.

- The minimum bid amount is Taka one lac, and its multiples.

- Scheduled Banks and financial institutions maintaining accounts with Motijheel Office of Bangladesh Bank will take the initiative to open Business Partner Identification (BP ID) in favor of their individual/institutional customers. BP ID holders can access the Market Infrastructure (MI) Module of Bangladesh Bank to participate in the auctions. Individuals may also buy or sell government securities in the secondary market over the counter (OTC)/Trader Work Station (TWS) of the MI module.

Benefits Can you derive by Investing Treasury Bonds

- It is a risk-free investment since the sovereign Government issues it.

- One can get an attractive rate of interest since the yield is determined in the market.

- Since these bonds are tradable in the secondary market, one can obtain instant liquidity by selling them in the market.

- All receipts of interest and maturity are fully repatriable in case of foreign investment.

- One can get the best services from the Central Bank of Bangladesh, which maintains a fully automated scriptless depository system named Market Infrastructure (MI) Module.

Evolution of the Government Securities Market in Bangladesh

| Year | Initiatives/Events |

| 1972 | Introduction of the issuance of 90-day (3-month) treasury bills (T-Bills) in August on a tap basis |

| 1995 | In October, treasury bills started being sold through auction at the market-determined rate |

| 1996 | Introduction of 30-day and 180-day treasury bills in February |

| 1997 | In March, the auction of 1-year treasury bills was introduced |

| 1998 | Issuance of 30-day, 90-day, 180-day, and 1-year bills through weekly auctions In September, existing T-bills were replaced by newly introduced 28-day, 91-day, 182-day, 364- day |

| 2002 | Introduction of Central Bank Repo facility against T-bills Introduction of IB Repo facility against G-Sec |

| 2003 | Issuance of Bangladesh Government Treasury bonds (BGTB) Rules, 2003 in September Introduction of Primary Dealer (PD) system Issuance of 5-year and 10-year BGTBs |

| 2006 | Introduction of auction calendar for the first time based on a deficit budget |

| 2007 | Issuance of 15-year and 20-year BGTBs Introduction of liquidity Support (LS) to the PDs against government securities (G-Sec) Introduction of bidding commitments and underwriting obligations on PDs for T-bills and BGTBauctions Introduction of underwriting commission for the PDs |

| 2008 | Suspension of the issuance of the 28-day T-bills Introduction of mark-to-market requirements under the accounting framework for government securities (G-Sec) |

| 2009 | Introduction of automated delivery versus payment (DvP) settlement system |

| 2011 | Introduction of the Market Infrastructure (MI) Module for the automation of G-Sec management and operations |

| 2013 | Introduction of re-issuance of BGTBs Issuance of 2-year BGTB |

| 2014 | Issuance of the circular directing funded pension provident funds of banks to be invested in GSec |

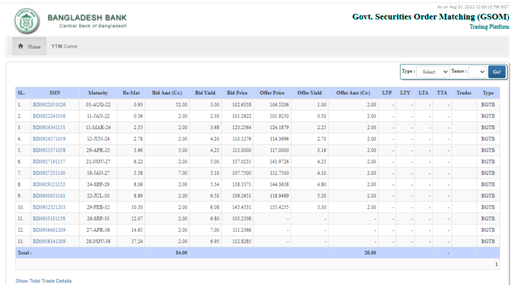

| 2016 | Introduction of Government Securities Order Matching Trading Platform (GSOM) in August Introduction of 14-day T-bills |

| 2017 | Started publishing report on G-Sec on an annual basis (from FY 2016-17) Publication of Bangladesh Compound Rate (BCR) as a reference rate |

| 2018 | Introduction of the secondary market yield curve (on a test basis) |

| 2019 | Introduction of 3-Year Floating-Rate Treasury Bond (FRTB) A working committee comprising members of BB, BSEC, and a commercial bank published the ‘Comprehensive Framework on the Development of the Bond Market in Bangladesh.’ |

| 2020 | A strategic decision was taken to enlist G-Sec on DSE’s trading platform |

| October 08, 2020 | Sukuk Guidelines, 2020‘ circulated by MoF |

| December 28, 2020 | First Sukuk Bond issued |

| December 02 2020 | Hiring Consulting Firm (National) for the Feasibility Study and Development of Guidelines on Green Sukuk for the Shariah Based Banks and Financial Institutions |

| August 16, 2021 | *On June 23, the Bangladesh Securities and Exchange Commission (BSEC) granted primary approval for the BEXIMCO Green-Sukuk with some conditions. On July 8, the Bangladesh Securities and Exchange Commission gave the final approval to BEXIMCO for issuing a Tk 3,000-crore Shariahcompliant Sukuk. On August 16, Beximco’s Sukuk IPO subscription starts |

Types of Bond Market in Bangladesh

Government Securities (G-Sec) Market

- Treasury Bills (T-Bills)

- Treasury Bonds (T-Bonds)

- Bangladesh Government Investment Sukuk

At the end of FY 2019-20, the total outstanding of the Government’s borrowing from the banking sector stood at BDT 279,601.97 crore; Constituted 10.00% of the GDP (compared to 7.86% at the end of June 2019). The total outstanding amount of T-bills was 62,783.52 crore, and T-bonds were 216,818.45 crores.

In FY 2019-20, the banking sector was the leading investor category,

- with 73.79% of the total outstanding of G-Sec;

- Long-term investors, like insurance companies and provident funds, accounted for 12.39% of the total holding;

- Bangladesh Bank held about 12.40% for its monetary operations.

Corporate Bonds

- Governed by Bangladesh Securities and Exchange Commission (BSEC)

Corporate Bond Market

BSEC governs the corporate bond market in Bangladesh. For issuing debt instruments through private offers, issuers are required to apply under the Securities and Exchange Commission (Private Placement of Debt Securities) Rules, 2012;

The outstanding size of the public, the corporate bond market is insignificant compared to the G-Sec market.

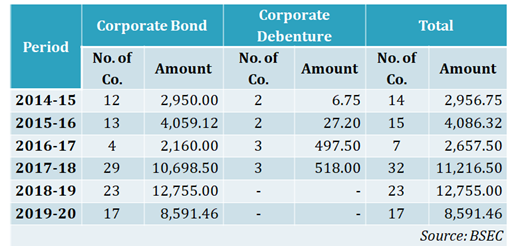

Key Indicators of Corporate Bond Market: Private Offer

For debt instruments through public offers, Bangladesh Securities and Exchange Commission (Public Issue) Rules, 2015, Securities and Exchange Commission (Private Placement of Debt Securities) Rules, 2012 apply.

Key Indicators of Corporate Bond Market: Public Issues

The outstanding size of the public corporate bond market is insignificant comparing to the G-Sec market.

Operation of G-Sec Market

Primary Market Operation

Debt Management Department (DMD) of Bangladesh Bank acts as the debt manager of the Government in consultation with the MoF; Cash and Debt Management Committee (CDMC) has been formed for the supervision of the Government’s borrowings chaired by Secretary, Finance Division;

BB is authorized to conduct auctions for raising loans on behalf of the Government of Bangladesh. The process of raising loans involves the issuance of government securities. The Auction Committee, chaired by the Deputy Governor of BB, determines the cut-off rate of the auction of government securities.

Bangladesh Bank has its depository system for the transaction and settlement of Government securities in the Market Infrastructure (MI) Module. In 2011 BB introduced this automated system to expedite the primary auction and secondary market.

Secondary market of Government securities

Bangladesh Bank initiated Market Infrastructure (MI) Module to automate trading and settlement of Government securities transactions in October 2011. The secondary market of Bangladesh’s Government securities comprises Over the Counter (OTC) and Trader Work Station (TWS). Both the procedures are integral parts of the Market Infrastructure Module (MI Module)-government securities’ automated auction and trading platform.

Over-the-Counter (OTC):

Participants must submit a sale/buy order in the OTC platform while the counterparty confirms the order in the OTC market. Once they complete the trading process and the system accepts trades, the data automatically flows to Core Banking System (CBS) to clear and settle funds to achieve the settlement of funds in CBS. Further, the trading securities have been transferred automatically to the buyer securities account in MI.

Trader Work Station (TWS):

Bangladesh Bank has introduced the Trader Work Station (TWS)- an Order Matching system. The TWS is an electronic, screen-based, order-driven trading system for dealing in Government securities. In addition, the platform highlights the existing facility of the Over-The-Counter (OTC) market in Government securities. Further, the TWS brings transparency in secondary market transactions in Government securities. Members can place bids (buy orders) and offer (sell orders) directly on the TWS screen. The system is order-driven that matches all bids and offers, focusing on price/time. In particular, it matches the order on a first-come and first-serve basis among the similar price orders. In addition, the TWS facilitates Straight-Through-Processing (STP) system. In that system, trades are automatically sent to the CBS for settlement.

Treasury/Government Securities (G-Sec) Management and Operational Process in Bangladesh

- Investment Process in Treasury Securities

1.1. Investor’s Securities Account (Business Partner ID) Opening

1.2. Investing in G-Sec via Banks and Financial Institutions

- Primary Market of G-Sec

2.1. Auction of New Issuance

2.2. Auction of Re-Issued Securities

- Secondary Market of G-Sec

3.1. Anonymous Order-Matching System (OMS)

3.2. Over-the-Counter (OTC)

- Open Market Operations

4.1. Repurchase Agreements (Repo)

4.1.1. Repo with the Central Bank

4.1.2. Inter-Bank Repo

4.2. Assured Liquidity Support (ALS) for Primary Dealers

- Trade Settlement Process via Core Banking Software (CBS)

- Report Generation and Management Functions in the MI Module

Circular on Business Partner ID in MI Module

Mi Module Functionalities

Govt. Securities Order Matching (GSOM)

Govt. Security Trading supports by Banks/NBFIs( Lanka Bangla Finance, for example)

Challenges in G-Sec Market

- Proper Cash Management

- Introduction of a Medium-Term Auction Calendar

- A Large Number of Securities in the Market

- Absence of Established Pension/Provident Funds

- Proactive Market Making Activities by PDs

- Prolonged Approval Period

- Lack of Debt Instruments Issued by Different Government Bodies

- Bonds Issued By Banks through Private Placement are Not Being Listed

- Overreliance on Bank Financing

- Absence of a Separate Trading Platform for Debt Securities

- Awareness Programs for the Investors and the Issuers

The Prospects of a Vibrant Long-Term Bond Market in Bangladesh

All the aspects discussed below offer a massive prospect for an active, long-term bond market in Bangladesh:

Diversified Investment: A developed and diversified financial system with a sound debt and equity market enhances risk-pooling and better risk-sharing opportunities for investors and borrowers. The fixed-income securities market links the issuers having short and long-term financing needs with investors willing to place funds in short and long-term interest-bearing securities. In addition, it makes the financial market more competitive by generating market-based interest rates.

Flexibility: A well-functioning market offers the Government and the private investors the flexibility to diversify their funding sources and provides them with alternative sources of raising funds having different maturities.

Deficit Financing: An active market allows the Government to finance large fiscal deficits without resorting to financial repression or foreign borrowing. The drive to develop the government bond market typically comes from the Government to facilitate the financing of large fiscal deficits.

Monetary Policy Implementation: The development of a well-functioning fixed-income market supports the efficient implementation of the monetary policy. It offers the instruments needed for the execution of monetary policy and improves the transmission mechanism of the monetary policy. Long-term bonds also facilitate the sterilization operations by the Central Bank as exclusive reliance on short-term instruments tends to drive up the short-term interest rates and encourage further inflows into such instruments.

Inflation Control: Developing a bond market, especially a vibrant G-Sec market, can improve access to local currency financing. An active G-sec market can offer local currency investors, such as retail and institutional investors, a way to invest in the local currency, and therefore, ensure better management of inflation and exchange rate risk. Also, a safe alternative investment compared to local currency bank deposits.

Low-Cost Financing: The long-term fixed-income market, being accessible to foreign investors, increases financial integration by attracting foreign capital, which can lower the cost of borrowing for the Government and improve risk-sharing across countries. Moreover, the local currency government bond market can function as a catalyst for developing corporate bond markets by providing a benchmark yield curve. Similarly, derivatives markets cannot flourish without a well-developed fixed-income market with underlying assets.

Less pressure on the Banking Sector: while the stock market capitalization of about 20% of the total financing requirement, 80% of debt financing comes from the banking sector. The banking sector cannot usually lend for longer than around five years, given that 70% of bank deposits are for one year or less. Funding long-term assets with short-term liabilities create a considerable maturity mismatch in the banking sector.

Conclusion:

With the timely initiatives from Mof, BB, and BSEC, the Bond market in Bangladesh has taken a constructive shape. As a result, the Government can get the lion’s share of the budget deficit from securities. However, we still have miles to go to reach and exceed the international standards regarding the bond market. A vibrant and efficient bond market is crucial for a stable capital market with more comprehensive depth and capitalization. Besides, it shares the pressure on the money market and provides access to finance for long-term projects. Know all about credit cards here.