Debt is a trap because it’s easy to get into and hard to get out of. Interest payments can make it difficult to pay off the principal, and late fees can add up quickly. If you’re not careful, debt can spiral out of control and ruin your financial life.

Debt is a trap. It’s a vicious cycle that can be hard to break out of. You’re always paying for something that you may not even need anymore.

The payments add up and before you know it, you’re in over your head.

It’s important to be mindful of your spending and to live within your means. That doesn’t mean you can’t enjoy life or have nice things, but it does mean being conscious of how much debt you’re taking on.

If you’re struggling with debt, there are resources available to help you get back on track. You don’t have to go through this alone. Talk to a financial advisor or credit counselor about creating a plan to get out of debt and start fresh.

Table of Contents

Is Debt a Trap?

Debt can be a trap if it is not managed properly. When an individual takes on too much debt, they can quickly find themselves struggling to make payments and falling deeper into debt. High-interest debts, such as credit card debt, can be particularly difficult to pay off. Additionally, relying on debt to finance luxuries or make ends meet can lead to a cycle of debt that is difficult to break. However, when used responsibly, debt can be a valuable tool for financing large purchases and investments. It’s important to be mindful of the amount of debt you’re taking on and to make sure that you can afford the monthly payments.

Debt is often thought of as a trap, and while it can be difficult to get out of debt, it doesn’t have to be a trap.

Why is Debt a Trap?

Debt is a trap because it’s easy to get into and hard to get out of. Once you’re in debt, you’re constantly paying interest on the money you owe, which makes it difficult to save money or make any progress toward getting out of debt. The more debts you have, the harder it is to keep up with your payments and the more likely you are to fall behind and end up in even more debt.

So why is debt such a trap?

Let’s take a closer look. The first reason is because of the high interest rates that are associated with most forms of debt. If you have ever tried to pay off a credit card balance, you know how quickly the interest can add up.

And the longer you carry that balance, the more interest you will accrue. This is one of the main reasons why so many people are stuck in credit card debt – they can only make the minimum payment each month and the rest goes towards paying off the accumulating interest charges. Another reason why debt is such a trap is because it can be easy to fall behind on payments.

One missed mortgage payment can lead to late fees and penalties that make it even harder to catch up. And if you fall too far behind, your home could even be foreclosed on . The same goes for car loans – if you miss too many payments, your vehicle could be repossessed .

In both cases, not only have you lost whatever asset you were trying to finance , but now you also have major negative marks on your credit report which will make it even harder (and more expensive) to borrow money in the future . So next time someone tells you that taking on some debt is no big deal , think twice before doing so . It might seem like an easy way to buy something now , but down the road it could end up costing you much more than anticipated .

If you’re struggling with debt, there are some things you can do to get back on track. First, try to create a budget so that you can see where your money is going each month and make adjustments accordingly. You may also need to cut back on expenses in order to free up more money to put toward your debts.

If you’re unable to make significant progress on your own, there are also organizations that can help you get out of debt. Whatever route you choose, getting out of debt won’t happen overnight but it is possible if you stay focused and committed.

Debt Trap Examples

When you’re in debt, it can feel like you’re stuck in a never-ending cycle of making payments but never getting any closer to becoming debt-free. This is what we call the debt trap. The debt trap occurs when the interest on your debts is so high that even if you make all your required monthly payments, the amount you owe only keeps growing.

As your debt grows, so do your minimum monthly payments, which makes it harder and harder to get out of debt. And the cycle continues. Let’s say you have 10,000,00 in credit card debt with an annual interest rate of 20%.

Your minimum monthly payment would be 20,000, but if you only paid that each month, it would take you over 25 years to become debt-free! And during that time, you would end up paying more than 26,000,00 in interest alone – more than double the original amount of your debt.

Debt traps come in many different forms. Here are a few examples:

1. Payday loans: These short-term, high-interest loans are easy to get but hard to pay off.

You may be tempted to take out a payday loan when you’re in a financial bind, but the steep interest rates and fees can make it difficult to repay. Once you’re stuck in a payday loan cycle, it can be tough to break free.

2. Credit cards: It’s easy to overspend with credit cards, especially if you’re using them to finance purchases that you can’t afford. The interest on credit card debt can add up quickly, making it hard to get ahead.

3. Personal loans: Like credit cards, personal loans can be easy to obtain and tempting to use for larger purchases or consolidate other debts. But the interest on personal loans can also add up quickly, making them difficult to repay.

4. Auto loans: Many people rely on their cars for transportation, so it’s not surprising that auto loans are common debt traps. If you’re struggling to make your car payments, you may end up upside down on your loan (owing more than the car is worth). This can make it hard to sell or trade in your vehicle and get out from under the debt trap.

Personalized course on Personal Finance

Nafeez Al Tarik, CFA, FRM, Managing Director, Dhaka Bank Securities Limited has brought a Personal Finance course with 10 Minute School to help you out of debt. Follow this link to know more and be debt free:

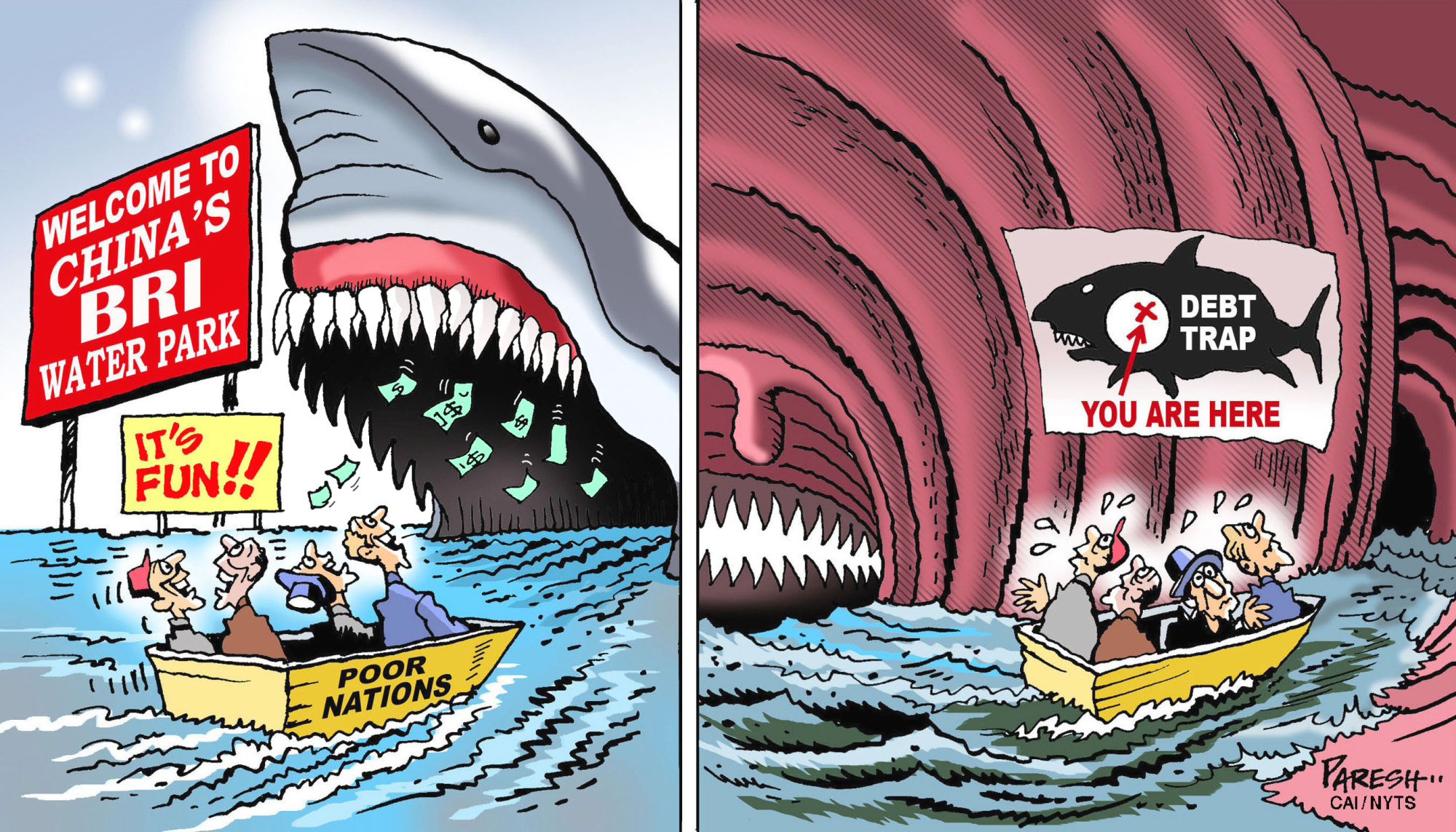

What is Debt Trap Diplomacy?

Debt trap diplomacy is a type of economic statecraft in which a country deliberately takes on unsustainable levels of debt in order to further its geopolitical aims. The debtor country then uses the threat of defaulting on its loans as leverage to extract concessions from its creditors. This strategy is often employed by rising powers as a way to quickly build up their military and economic might, at the expense of more established nations.

The term “debt trap diplomacy” was first coined by Indian economist Jayati Ghosh in 2011, though the phenomenon itself is much older. One of the most famous examples occurred during the Cold War, when the Soviet Union used its status as a major creditor to gain political influence over developing countries in Africa and Latin America. In recent years, China has been accused of using debt traps to expand its influence in Asia and beyond.

There are several ways that a country can fall into a debt trap. One common scenario is when a nation takes out loans for infrastructure projects that prove to be unviable or fail to generate enough revenue to service the debt. Another possibility is that a government borrows money from abroad only to have those funds siphoned off by corrupt officials.

Either way, once a country falls into a debt trap it can be very difficult to escape without making significant concessions to creditors.

Critics argue that debt trap diplomacy is an unethical way for powerful countries to take advantage of weaker ones. They also warn that this strategy could lead to an increase in global instability if rival nations start competing with each otherto lure indebted countries into their orbit.

Credit: www.japantimes.co.jp

How to Avoid Debt Trap?

Debt can be a trap, especially if you’re not careful. There are a few key things to remember if you find yourself in debt. Here are some tips to avoid getting into debt or deepening a debt hole:

- Create a budget: One of the most important steps in avoiding a debt trap is to create a budget and stick to it. This will help you to track your income and expenses and identify areas where you can cut back on spending.

- Live below your means: It’s important to live within your means, which means spending less than you earn. Avoid lifestyle inflation and resist the urge to keep up with others’ spending habits.

- Avoid unnecessary expenses: Avoid buying things that you don’t need, especially if you’re using credit to do so. Instead, focus on saving for the things that you really want or need.

- Pay off high-interest debt: High-interest debt, such as credit card debt, can quickly spiral out of control. Prioritize paying off this type of debt as quickly as possible to avoid falling into a debt trap.

- Use credit responsibly: When using credit, be sure to only borrow what you can afford to pay back and make sure to pay your bills on time. Late fees and interest can add up quickly, making it harder to get out of debt.

- Build an emergency fund: Having an emergency fund can help to protect you from falling into a debt trap. By having savings set aside, you can avoid having to rely on credit when unexpected expenses arise.

- Avoid impulse buying: Impulse buying can lead to overspending and ultimately falling into debt. Before making a purchase, take a moment to think about whether you really need the item and if it fits into your budget.

- Shop around for the best deals: When making a purchase, be sure to shop around for the best deals. This will help you to save money and avoid overspending.

- Avoid consolidation loans: Consolidation loans may seem like a good way to get out of debt, but they can actually make the problem worse. Instead, focus on paying off your debts one at a time.

- Seek professional help if needed: If you’re struggling to get out of debt, don’t be afraid to seek professional help. There are many organizations and financial advisors that can help you to create a plan to get out of debt and avoid falling into a debt trap in the future.

- Avoid using your credit card for cash advances: Cash advances typically come with high interest rates and fees, making it harder to pay off the debt. Instead, use your credit card for purchases and pay off the balance in full each month.

- Prioritize saving: Make saving a priority and set aside a certain percentage of your income each month. This will help you to build an emergency fund and have a cushion to fall back on in case of unexpected expenses.

- Avoid taking on too much debt: Be mindful of the amount of debt you’re taking on and make sure that you can afford the monthly payments. Taking on too much debt can make it difficult to keep up with payments and can lead to a debt trap.

- Avoid cosigner loans: Cosigner loans can put a lot of pressure on both parties involved. If you are unable to make the payments, it will affect your cosigner’s credit as well, it is better to avoid them.

- Avoid taking on too much student loan debt: While student loans can help to pay for education, it’s important to borrow only what you need and be aware of the long-term repayment implications.

- Avoid predatory lending: Predatory lending practices can trap individuals in a cycle of debt. Be aware of the terms and conditions of any loan you’re considering and avoid any lender that seems to be trying to take advantage of you.

- Avoid using debt to invest: using debt to invest in high-risk ventures is not advisable as it can put you in a worse position if the investment doesn’t pan out.

- Avoid using debt to pay off debt: using debt to pay off existing debt can lead to a vicious cycle of debt, it’s better to focus on paying off the debt you have and avoid taking on additional debt.

- Avoid using debt to finance luxuries: using debt to finance luxuries such as vacations or expensive cars can put you in a difficult financial position, it’s better to save up for them or avoid them altogether.

- Avoid procrastinating debt repayment: Don’t put off repaying your debts, the longer you wait the more interest and fees will accumulate, making it harder to pay off. It’s important to address your debts as soon as possible to avoid falling into a debt trap.

- Know your spending patterns: Track where you spend your money and how much you spend each month. This will help you identify areas where you can cut back.

- Stay away from high-interest debt. If at all possible, try to avoid borrowing money that comes with high-interest rates (like credit cards). This type of debt can quickly get out of control and become difficult to repay.

- . Avoid using loans to cover everyday expenses. Loans should only be used for large purchases that you cannot afford upfront (like a car or home).

How Do You Break a Debt Trap?

Debt traps can occur when people take on too much debt and then find themselves struggling to repay it. This can happen for a number of reasons, such as losing a job or an unexpected expense. Once someone falls behind on their payments, they may start receiving calls from debt collectors or their creditors may start taking legal action.

This can all add up to a lot of stress and anxiety, making it even harder to catch up on payments. If you’re stuck in a debt trap, there are a few things you can do to try and break free.

First, take a close look at your budget and see where you can cut back on expenses.

Try to make some extra money by picking up some freelance work or selling unwanted items. Then, use this extra money to make bigger payments towards your debts. You might also want to consider consolidating your debts into one monthly payment with a lower interest rate.

This can make it easier to stay on top of your payments and get out of debt quicker. Finally, make sure you stay communication with your creditors and let them know what’s going on. They may be willing to work with you if they know you’re trying to get out of debt.

Breaking out of a debt trap can be difficult, but it’s not impossible. By following these tips, you’ll be one step closer to becoming debt-free!

Why Should We Avoid Debt?

Debt is something that can easily become a problem in our lives if we’re not careful. It can be difficult to keep up with payments and the interest can add up quickly, making it hard to get out of debt. Here are a few reasons why you should avoid debt:

- High-interest rates: Debt often comes with high-interest rates, making it more expensive to borrow money. For example, credit card debt can have an interest rate of 20% or more.

- Paying more than you borrow: With high-interest rates, you may end up paying more in interest than you borrowed in the first place. For example, if you borrow $10,000 at 20% interest, you will end up paying $12,000 over 5 years.

- Financial stress: Carrying too much debt can cause financial stress, which can affect your overall well-being. This can lead to anxiety, depression, and even physical health problems.

- Limited financial flexibility: When you have a high level of debt, you have less financial flexibility. You may have to put off saving for retirement or a child’s education because you need to make debt payments.

- Difficulty getting credit: High levels of debt can make it difficult to get approved for new credit, such as a mortgage or car loan. This can limit your ability to make large purchases in the future.

- Damage to credit score: Late or missed payments on debt can damage your credit score, making it harder to get approved for credit or loans in the future.

- Difficulty in making ends meet: High levels of debt can make it difficult to make ends meet, as you may have to devote a large portion of your income to debt payments.

- Risk of bankruptcy: Carrying too much debt can increase the risk of bankruptcy, which can have long-term consequences on your finances and credit score.

- Missed opportunities: High levels of debt can prevent you from taking advantage of opportunities, such as investing in a business or buying a home.

- Difficulty in living without debt: A high level of debt can make it difficult to live without debt, as you may have to rely on credit to make ends meet. This can lead to a cycle of debt that is difficult to break.

- Difficulty in saving for future: When you have high levels of debt, it can be difficult to save for future financial goals such as retirement or your children’s education.

- Difficulty in taking on new opportunities: High levels of debt can limit your ability to take on new opportunities such as starting a business or buying a home.

- Risk of losing assets: High levels of debt can increase the risk of losing assets such as a home or car through foreclosure or repossession.

- Difficulty in getting a good job: High levels of debt can make it difficult to get a good job as some employers may view you as a financial risk.

- Difficulty in getting a good insurance rate: High levels of debt can make it difficult to get a good insurance rate, as some insurance companies view debt as a risk factor.

- Difficulty in getting a good rent rate: High levels of debt can make it difficult to get a good rent rate, as some landlords may view debt as a risk factor.

- Difficulty in getting a good mortgage rate: High levels of debt can make it difficult to get a good mortgage rate, as some lenders may view debt as a risk factor.

- Difficulty in making large purchases: High levels of debt can make it difficult to make large purchases such as a car or home.

- Difficulty in getting a good car loan rate: High levels of debt can make it difficult to get a good car loan rate, as some lenders may view debt as a risk factor.

- Difficulty in getting a good personal loan rate: High levels of debt can make it difficult to get a good personal loan rate, as some lenders may view debt as a risk factor.

The minimum payments may seem manageable at first, but as the interest accrues, the balance may only grow larger over time. If you find yourself in this situation, don’t despair – there are options available to help you get back on track financially.

Conclusion

Many people view debt as a necessary evil – something that must be taken on in order to purchase a home, car, or education. However, what many people don’t realize is that debt is actually a trap. Once you’re in debt, it’s very difficult to get out.

The interest payments alone can keep you in a never-ending cycle of payments. Not to mention, if you miss a payment or two, your credit score will take a hit and it will become even harder to get out of debt.