Most investors come to the stock market for higher profits, but they do not understand investing and managing the portfolio. Many experienced investors also struggle to organize a diversified portfolio that pays off well. We will share 22 proven ways to beat the stock market in 2022 for both new and existing investors.

Table of Contents

Beating the stock market meaning

Beating the stock market means making more money from investment portfolios than the market benchmarks like DSEX, DS30, S&P 500. Securing more returns than established benchmark standards is beating the stock market.

ways to beat the stock market

Investment in the stock market is a source of wealth for many but a cause for poverty for others. Here are the stock market secrets to win the stock market investment.

1. Company and management

It is wise to know the detail of the company and its management before investing. Reputed companies are expected to be stable and well performers. There goes the saying, Pick companies, not stocks.

2. Budget for investmernt

Maintain a well-balanced budget for investment based on personal and financial realities. Schedule different types of investments according to your financial plan and risk tolerance. Do not put all your money in stocks. Manage the investment strategies in a way to avoid the volatility of stock prices.

3. Beware of loans

Try to avoid taking loans in the stock market. Before taking a loan, make a decision considering the consistency of your loan repayment and the terms of the loan. Also, do not take extra loans to buy stocks for the long run or rumors.

4. Avoid Rumour

There are lots of investors who have made huge profits following rumors. But, it is not necessary to follow rumors. Acting on others’ mouths of words may lead to a radical loss for you. So, instead, invest in fundamental solid stocks. The return may be lower, but you will not lose the lion’s share of your portfolio. In addition, it is not wise to be attracted to uncertain information or flashy advertisements.

5. Portfolio size

The size of your portfolio will depend on how many shares you invest. For example, if you have an investment size of one-two lacs Tk, you should try to buy a maximum of 3 shares. 4 shares for three to six lacs, 5 for less than seven to ten lacs, and a maximum of 8 shares for ten-20 lacs.

It will allow you to monitor those companies a lot more. And if you have bought more shares, it will be challenging to watch all the shares with relevant news.

6. Opportunity Money

In the first case, we recommend buying shares up to a maximum of 75% of the total investment. The remaining 25% should be reserved as Opportunity Money in extra cash for speculation. Then, if the stocks of a good company are available at a much lower price, buy those shares.

Again, you have invested in good stocks, but the price has dropped drastically for no reason; buy more from the reserve money to lower the average price.

7. Time frame

You need to set your time frame for investment. Then, fix the time you can hold your shares during that time.

If you want to keep shares for less than one year, you must invest by targeting all the dividends-paying companies. In other words, if there is a December closing ahead, then you have to invest in banks, finance, insurance, multinational companies. Then you can expect a good profit before the dividend.

If you want to invest for 2-5 years, i.e., long-term, you have to target a good cash dividend, EPS growth, and sponsor, director, and institution shareholding is good.

Such information is available on the Dhaka Stock Exchange Ltd website. It is ideal to invest in the stock market for the long term.

8. Analysis period

Find the maximum and minimum price of 52 weeks(if possible 2 years and more) before buying the shares. First, it helps to find out the limit of the shares. After that, you have to try to purchase the shares in a few steps towards the lowest price.

9. Watch list

You have to keep a watch list for stocks you once held. You do not have to analyze the shares in a new way every time. It will safeguard from the waste of time.

No matter which stock you buy, you have to collect all the news about that stock, analyze it and think about the effect of that news.

10. Dividend Matters

If you invest for the long term, you must determine the dividend pay-out ratio or yield. So that you can understand how much money you get by investing.

11. Prudence

It would help if you had more than luck to succeed in the stock market business; it is prudence. If the total market is downward, you need to invest for the short term. If there is profit, you have to take it. You need to set a limit to take a specific loss called a stop-loss; if you decide to sell a share with a 5% loss, that is your stop loss level. If there is an uptrend market, then investing for the long term is more profitable.

12. Realize

If you are an active stock trader, try to sell the stock at a good profit, i.e., 5-10% short-term (3 months). However, frequent buy-selling will increase your risk. For example, suppose your profit is 5%, and you think the share price will go up further, we suggest you sell some % of the total holding. Then sell it step by step of the entire holding. It will increase your equity value and reduce the chances of loss.

13. Transaction costs

Active traders need to consider the trading costs seriously. Too much trading may not be profitable as 0.50% to 1.00% of the trading amount goes to the houses. Therefore, selecting low investment fees charging houses is very important for active traders.

14. Diversification

Investing in a single stock, industry, sector is risky. Instead, try to build a balanced portfolio with versatile stocks. Stocks in a single entity or industry pose more risks than those of different sectors.

15. Not for daily income

The stock market is not a place to earn income every day. There are some downtrends when you must incur losses if you try to sell-off. So, never expect to win every day. Instead, take the opportunity and realize when there is profit. However, if any item is without potential, dispose of it soon to avoid more loss.

16. Consider as a product

The stock market is very different from other real-life investments. Still, there are similarities too. Try to think of stocks as other products. You can now decide what stocks to buy, sell or hold based on the demand, supply, opportunity cost, prospects.

17. Control your emotions

Controlling emotions in the stock market matters significantly. Use your brain, not the emotions. Impulsive trading may lead to great losses.

18. Every second matters

Timing matters a lot in stock market investment. track and act timely to get the best out of your portfolio.

19. Avoid behavioral biases

Know and avoid the common behavioral biases while making investment decisions in the stock market. Follow the data to invest, hold or withdraw.

20. Index and mutual funds

If you are a passive investor with less time for analysis and follow-up, invest in the index, mutual funds, exchange-traded funds. Such funds are managed by professionals. However, mutual funds are not still very popular or profitable in Bangladesh.

21. Investment literacy

Never jump into the stock market without some basic knowledge. It is good news that you may receive training free of charge from the BSEC, BICM, DSE, and many other spaces.

22. The longer, the better

A longer time horizon pays better in the stock market. It reduces the risk to a great extent. So, long-term investors usually enjoy higher returns. However, it is not guaranteed that a longer horizon must pay a better return. There are some controversies about the meaning and impact of long-term too.

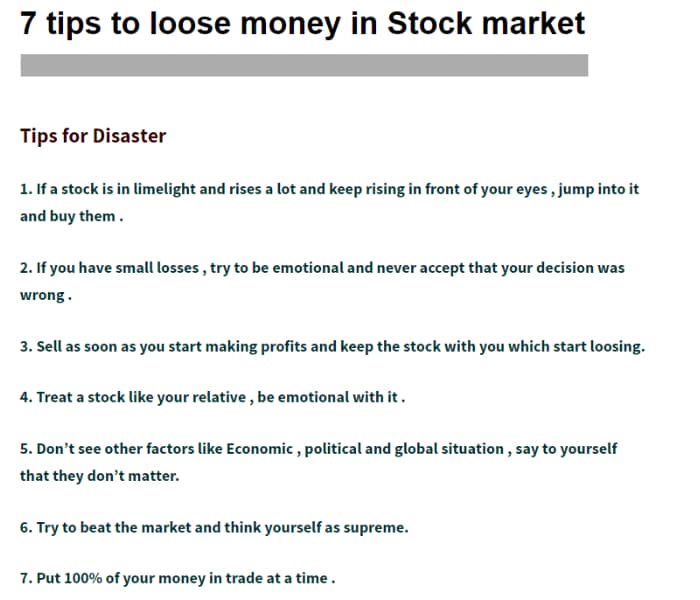

Want to lose money, follow the tips!

All are ready to win, no one wants to lose. If you follow the disaster tips by Jagoinvestor.com below, you are sure to lose your money in the stock market. Please beware of these issues.

FAQs

What percentage of investors lose?

As per the references at home and abroad, around 90% of investors lose money in the stock market. The percentage is alarming but realistic. Such loss is fuelled by rumor-based trading, going for quick money, lack of investment literacy, impatience, behavioral biases, etc.

Is it possible to beat the stock market?

It is possible to beat the stock market, and 5-10% of investors do this tough job. Individual investors face hardship to win the stock market game.

Why is it so hard to beat the market?

Lack of knowledge and behavioral finance biases are the main odds to beat the stock market. Income taxes including the capital-gains tax rate, brokerage fees, annual account service fee, etc., may prevent beating the market easily.

Is it worth taking investment advice?

Stock market investing requires lots of experience and knowledge to master a successful strategy. Taking service from financial advisors or financial planners is worth the money.

Nice write up. It will enrich the fundamental financial literacy of general investors who Don’t possess very sophisticated financial knowledge.