Table of Contents

Introduction

A stock dividend is a distribution of additional shares of a company’s stock to existing shareholders. Instead of paying out the dividend in cash, the company issues new shares to its shareholders. This means that the shareholders receive more shares of the company without having to buy them.

Credit: fastercapital.com

How Does Stock Dividend Work?

When a company decides to distribute a stock dividend, it determines a stock dividend ratio. This ratio represents the number of new shares that will be issued for every existing share held. For example, if the stock dividend ratio is 10%, shareholders will receive 1 new share for every 10 shares held.

Let’s say you own 100 shares of XYZ Company and the company announces a 10% stock dividend. As a shareholder, you will receive an additional 10 shares of XYZ Company’s stock.

Benefits of Stock Dividend

Stock dividends provide several benefits for both the company and its shareholders:

- Increased holdings: As a shareholder, you will own more shares of the company after the stock dividend is distributed. This can be advantageous in the long term as it increases your exposure to potential capital gains.

- Tax advantages: In many jurisdictions, stock dividends are treated differently than cash dividends for tax purposes. Stock dividends may be taxed at a lower rate or even be tax-exempt, resulting in potential tax savings for shareholders.

- Signal of financial strength: A stock dividend can be a positive signal to investors, indicating that the company is confident in its financial position and prospects for future growth.

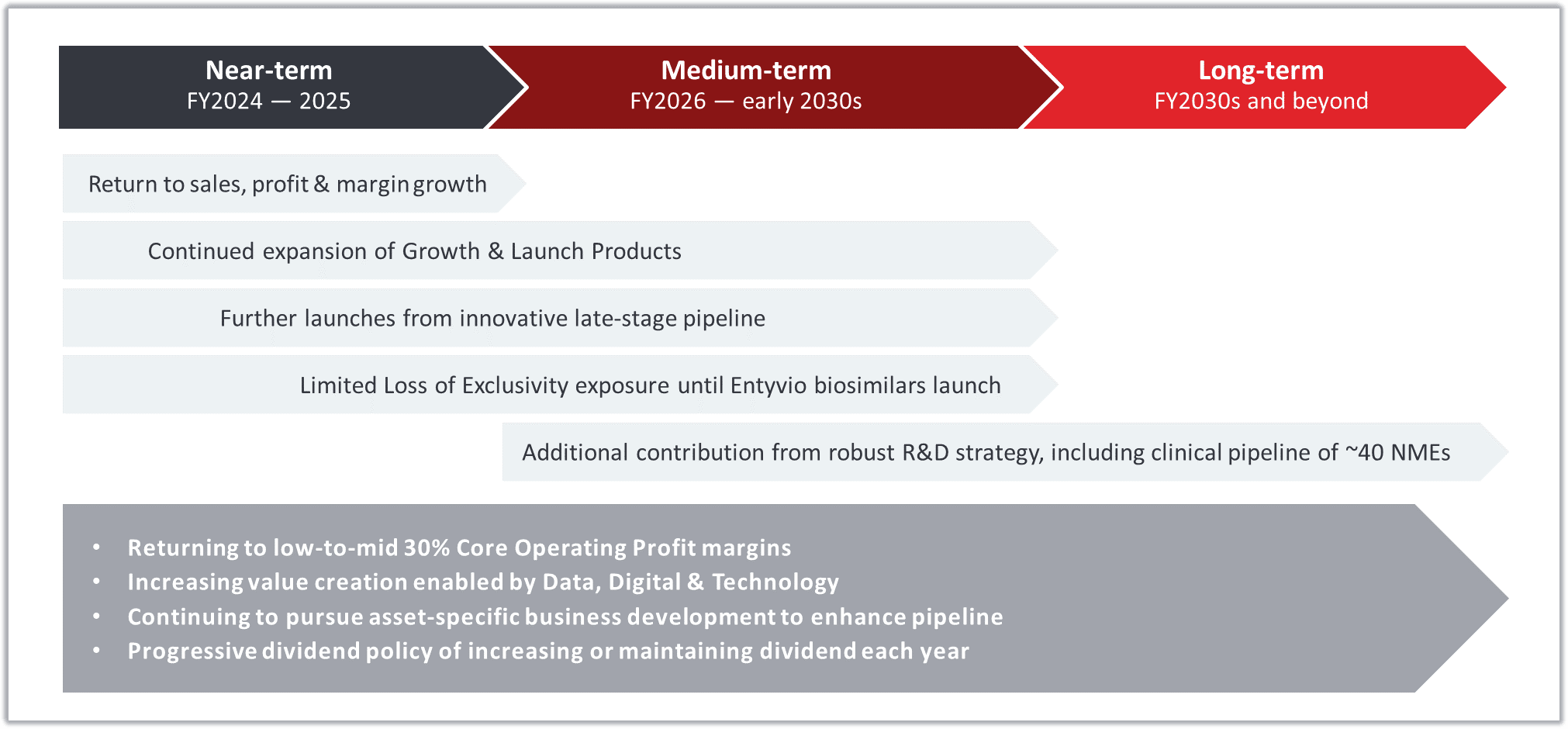

Credit: www.takeda.com

Impact on Share Price and Market Capitalization

When a stock dividend is distributed, the share price of the company’s stock typically decreases proportionally. This is because the total number of shares outstanding increases, diluting the ownership of existing shareholders.

However, the market capitalization of the company remains unchanged. Market capitalization is calculated by multiplying the number of shares outstanding by the current share price. Although the share price decreases, the increase in the number of shares compensates for it, resulting in no change in market capitalization.

Key Differences between Stock Dividend and Cash Dividend

| Stock Dividend | Cash Dividend |

|---|---|

| Additional shares are issued | Cash is paid to shareholders |

| Shareholder ownership increases | Shareholder ownership remains the same |

| May be tax-advantaged | Taxed at regular income rates |

| Signal of financial strength | No signal of financial strength |

Conclusion

Stock dividends are a way for companies to reward their shareholders by distributing additional shares of stock. They offer benefits such as increased holdings, potential tax advantages, and can serve as a signal of financial strength. Understanding the impact of stock dividends on share price and market capitalization is important for investors to make informed decisions.