Article by A.Y.M. Solaiman

Reviwed by Mahbubur Rahman

The “six-month moving average rate of treasury bills (SMART)” is a new monthly reference lending rate formula introduced by Bangladesh Bank on June 19, 2023, to be implemented in July 2023. It replaced the single-digit 6%-9% interest cap regime. The rate is fixed based on the weighted average rate of a six-month treasury bill plus a premium/margin.

The current margin is a maximum of 3.75% for banks and 5,75% for non-banking financial institutions since the last week of November.

The margin was up to 3% for banks and 5% for non-banking financial institutions at first when declared in June. Later, in October, it was increased to 3.50% for banks and 5,50% for financial institutions

Table of Contents

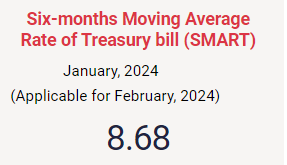

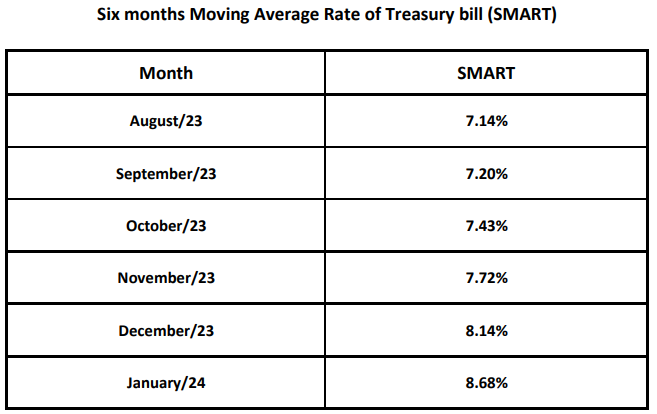

Existing SMART Rate by BB

The Rate is from the Bangladesh Bank Website:

If we want to understand the SMART framework, we may take an example.

The prevailing Short-term Moving Average Rate of the Treasury Bill (SMART) is 8.68% as declared by BB applicable for February 2024. According to this framework, Banks can charge a maximum of 12.43% while FIs will be able to charge a 14.43% maximum on their credits. In the case of CMSMEs and consumer Loans, Banks can charge a maximum of 13.43% while Agricultural and Pre-Shipment Export Loans will be charged an 11.43% maximum. The below table may help with the calculation:

| Particular | Lending Rates |

| Banks | SMART+ max 3.75% margin (Max 12.43%) |

| CMSMEs & Consumer Loans | An additional fee of up to 1% may be charged. (Max 13.43%) |

| Agricultural and Pre-Shipment Export Loans | SMART+ max 2.75% margin (Max 11.43%) |

| FIs | SMART+ max 5.75% margin ( Max 14.43%) CMSMEs & Consumer Loans (Max 15.43% including 1% charge) |

| Credit card loans | 20% as before (not tagged with SMART) |

The previous rate was as follows:

The smart rate will be reviewed every six months, and it may be adjusted up or down depending on market conditions.

SMART Reference Lending Rate in Bangladesh

The smart rate is very different from the previous single-digit lending rate cap, which was set in 2019. The Bangladesh Bank has said that the new rate is necessary to control inflation and ensure the stability of the financial system.

The SMART Reference Lending Rate is a new lending rate mechanism introduced by the Bangladesh Bank in July 2023. It is based on the six-month moving average rate of treasury bills (T-bills). Banks can add up to 3.75 percentage points to the SMART rate to fix their lending rates.

The current SMART rate for February 2024 is 8.68%. This means that banks can lend at a maximum rate of 13.43%, including the addition of a 1% supervision fee. The lending rate for agricultural and rural loans is 11.43%, and the lending rate for credit cards remains unchanged at 20%.

The SMART rate is reviewed every month, and it is expected to be adjusted in line with market conditions.

The SMART Reference Lending Rate is a more market-based and transparent lending rate mechanism than the previous system, which was based on the repo rate. It is expected to help reduce the spread between lending and deposit rates, and it provides banks with more flexibility in setting their lending rates.

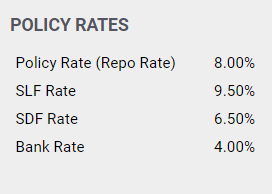

Bangladesh Bank, in its Monetary Policy Statement for the July-December 2023 period, focuses more on being market-driven in both interest rate and exchange rate. As a step towards removing restrictions on banks’ lending and investment activities and setting up market-oriented interest rates, BB has introduced a new method of reference rate called SMART (Short-term Moving Average Rate of Treasury-Bill). The prevailing lending interest rate cap at 9% will be lifted from the beginning of July. The new interest rate framework is said to be market-driven in the sense that the offers for the yield on 182-Day T-bills usually come from participating financial institutions/individuals through primary dealers and the yield is not set by BB. Banks will have space to add margin depending on their different factors.

In this method, BB publishes the rate on the first day of every month on its website. The calculation methodology will take into account the yield of the 182-day Treasury bill. This reference rate will be active on 01-July-2023 and the lending interest cap will be set in the following manner.

SMART Reference lending rate calculation

The calculation of the smart rate by BB is a 3-step process shown as follows:

- Weighted average rate of a six-month treasury bill

Firstly, BB will calculate the weighted average yield of the 182-Days T-bills on a weekly basis. The weighted average rate of a six-month treasury bill is the average interest rate that commercial banks pay when they borrow money from the Bangladesh Bank through treasury bill auctions. The weighted average rate is calculated by taking the total amount of money borrowed by commercial banks and dividing it by the total interest paid. It is done by the Debt Management Department, BB.

- Premium

In the following step, BB will calculate a simple average of the four weeks’ weighted average yields every month. The premium is a margin that is added to the weighted average rate to determine the smart rate for loans and advances. The premium is intended to compensate commercial banks for the risks associated with lending money.

The premiums to be added are:

3.75% for banks (3.75% + 1% supervision fee can be added to personal, car, and consumer loans)

2.75% for Agricultural and Pre-Shipment Export Loans

5.75% for FIs

- Lending rate

In the final stage, BB will compute the moving average of the yields over the past six months and this rate will be made public on the first working day of each month through the BB website. The lending rate is the rate of interest that commercial banks charge their customers when they borrow money. The lending rate is calculated by adding the weighted average rate and the premium.

Here are some of the factors that will be considered when setting the smart rate:

- The inflation rate

- The interest rate environment in other countries

- The demand for and supply of credit in the domestic market

- The stability of the financial system

The smart rate is reviewed every six months, and it may be adjusted up or down depending on market conditions. The Bangladesh Bank will consider several factors when setting the smart rate, including the inflation rate, the interest rate environment in other countries, the demand for and supply of credit in the domestic market, and the stability of the financial system.

Reference rates worldwide

All over the world, there are reference rates that commercial banks follow as a base rate for their lending operation. They may add the required premium or several premium factors to finalize their domestic lending rate. The rates may vary from entity to entity, individual to individual depending on various factors. In some countries, the central bank policy rate acts as the reference rate for commercial banks. For example, the Fed Funds Rate, the policy rate in the USA, is the reference rate in the USA.

For international lending operations, the LIBOR rate used to be the popular one. As the LIBOR phase-out is in transition, SOFR (Secured Overnight Financing Rate) for USD lending, SONIA (Sterling Overnight Index Average) for GBP lending, EONIA (Euro Overnight Index Average) for EUR loans, TONAR (Tokyo Overnight Average Rate) for JPY lending are becoming popular nowadays in replacement for LIBOR rate of different currencies.

The Story and History of SMART

Banks can charge a maximum of 12.43 percent interest on loans for now (a 1% charge can be added for CMSME and Consumer loans). The rate will be 14.43 percent (a 1% charge can be added for CMSME and Consumer loans) for non-bank financial institutions, meaning the spread between the lending and deposit interest rates will be a maximum of 3.75 percentage points.

SMART Launched

To trace the history, the Banking Regulation and Policy Department of Bangladesh Bank published a circular for the banks on June 19, 2023, about the interest rate with a special focus on the market-based rate with a new concept of SMART. It was applicable from July 2023. The prevailing lending interest rate cap at 9% is to be lifted from the beginning of July 2023.

Soon after the circular for banks, on June 20, 2023, the Department of Financial Institutions and Markets, Bangladesh Bank published another circular regarding interest rates for the FIs.

FIs can let their depositors enjoy interests of up to 2% above the SMART reference rate on deposits, and 5% above the SMART rate for loans and advances.

Margin Increased to 3.50%

Later, BB increased the margin from 3.00% to 3.50% for banks on October 05, 2023.

Margin Revised to 3.75%

On November 27, 2023, the Banking Regulation and Policy Department of Bangladesh Bank published another circular for the banks allowing more 25 basis points on margin. So, banks now can add 3.75% margins to the existing SMART rate. So, the maximum rate now maybe 8.68% + 3.75%=12.43%. (11.43% for Agricultural and Pre-Shipment Export Loans whereas 13.43% for CMSMEs and Consumer loans as a 1% supervision charge can be applied)

Consequently, on November 29, 2023, the Department of Financial Institutions and Markets, Bangladesh Bank published another circular regarding interest rates for the FIs.

FIs can let their clients enjoy interests of up to 2.75% above the SMART reference rate on deposits, and charge 5.75% above the SMART rate for loans and advances.

More Insights

Policy Rates in Bangladesh

As MPS mentioned, this new interest rate framework will act as a catalyst to make the interest rate dynamics in the market act freely as banks will be able to adjust the lending rate depending on market variations and other considerations. This will help efficient credit allocation of banks’ funds and expedite the competitiveness among banks. The interest rate will also be able to capture inflation expectations which will be incorporated while calculating SMART and it is said to have an impact to hold the rein of inflation.

It is mention-worthy that the SMART is more complicated than the previous single interest rate cap and it is variable in nature. The rate will vary every month. This might make some complications in calculating the end lending interest rate of commercial credits.

However, as per the circular, the interest rate cannot be changed within six months of its imposition. This means that even if the interest rate increases, the bank cannot raise it for existing customers.

The band or the corridor is too narrow to consider as market-aligned. Nonetheless, this move to make the interest rate free from the cage and to pave the way to have a rein on runaway inflation is appreciable.

Why did BB introduce a SMART Rate?

Bangladesh Bank recently introduced a SMART lending reference rate (SLRR) for banks to set their lending rates based on market conditions. This new system replaces the traditional base rate system. In this article, we will discuss the ten reasons why Bangladesh Bank introduced the SLRR system to list some of the potential advantages of the smart rate:

1. To Encourage Banks to Offer Competitive Rates

Under the traditional base rate system, banks set their lending rates based on their cost of funds and overheads. This led to high-interest rates, making it difficult for borrowers to obtain loans. By introducing the SLRR system, Bangladesh Bank hopes to reduce lending rates and make loans more affordable for businesses and individuals.

2. To Promote Financial Inclusion

By reducing lending rates, the SLRR system aims to encourage more people to take out loans, promoting financial inclusion across the country. Small and medium enterprises (SMEs) and low-income individuals, who previously struggled to access loans due to high-interest rates, will now be able to obtain credit at more affordable rates.

3. To Improve the Transparency of Lending Rates

The SLRR system is based on market conditions, which means that lending rates will be transparent and visible to borrowers. This increased transparency will help borrowers make better-informed decisions about their borrowing requirements.

4. To Support Economic Growth

By making loans more affordable, the SLRR system will encourage businesses to invest in new projects and expand existing ones, leading to job creation and economic growth.

5. To Reduce the Dependence on Informal Sources of Credit

Many low-income individuals and small businesses in Bangladesh have no choice but to turn to informal lenders for credit, as they cannot access formal loans due to high-interest rates. The SLRR system aims to reduce the dependence on these informal sources of credit by making formal loans more affordable.

6. To Encourage Banks to Adopt Good Lending Practices

The SLRR system takes into account the risk profile of borrowers, encouraging banks to adopt good lending practices and assess the creditworthiness of borrowers before granting loans.

7. To Increase Competition in the Banking Sector

The SLRR system aims to promote competition among banks by encouraging them to offer lower lending rates. This increased competition will benefit borrowers and promote innovation in the banking sector.

8. To Align Lending Rates with Market Conditions

Under the traditional base rate system, lending rates were not always aligned with market conditions, leading to high-interest rates even when market rates were low. The SLRR system aims to correct this by setting lending rates based on market conditions.

9. To Promote Financial Stability

The SLRR system takes into account the risks associated with lending, promoting financial stability by encouraging banks to adopt prudent lending practices.

10. To Align with International Best Practices

The SLRR system aligns with international best practices, making it easier for Bangladesh to attract foreign investment and integrate with the global economy.

11. To tame inflation.

The Bangladesh Bank believes that the smart rate will help to control inflation by making it more expensive for businesses to borrow money. This will discourage businesses from borrowing money and investing, which will help to slow down the economy and bring down inflation.

12. To ensure the stability of the financial system.

The Bangladesh Bank believes that the smart rate will help to ensure the stability of the financial system by making it more difficult for banks to make risky loans. This will help to prevent a financial crisis, which could have a devastating impact on the economy.

13. To make the lending rate more market-driven.

The previous lending rate cap was set by the Bangladesh Bank, which meant that commercial banks were not free to set their own lending rates. The smart rate will be based on market conditions, which will give commercial banks more flexibility in setting their lending rates. This could lead to more competition among banks, which could benefit consumers by lowering the cost of credit.

The introduction of the SMART lending reference rate system by Bangladesh Bank is a positive step towards promoting financial inclusion, encouraging good lending practices, and supporting economic growth. The system aims to reduce lending rates, increase transparency, and align with international best practices, making it easier for borrowers to access credit and encouraging banks to compete on rates.

Impacts of the SMART Rate

The smart rate is a new tool that the Bangladesh Bank will use to manage the country’s monetary policy. It remains to be seen how effective the rate will be in achieving its objectives. However, it is a significant departure from the previous lending rate cap, and it could have a major impact on the availability and cost of credit in Bangladesh.

- The cost of credit could increase, which could make it more difficult for businesses to borrow money and invest. This could slow down the economy and lead to job losses.

- The availability of credit could decrease, as banks may be less willing to lend money at higher interest rates. This could make it more difficult for businesses and consumers to access credit, which could hurt the economy.

- The smart rate could lead to more competition among banks, as they will be trying to attract customers by offering lower interest rates. This could benefit consumers by lowering the cost of credit.

- More market-based and transparent lending rate mechanism. The SMART rate is based on the six-month moving average rate of treasury bills, which is a more market-based indicator than the previous lending rate regime, which was based on the repo rate. This means that the SMART rate is more responsive to changes in market conditions, and it is also more transparent, as it is based on an observable market rate.

- Reduced spread between lending and deposit rates. The SMART rate is expected to help reduce the spread between lending and deposit rates. This is because the SMART rate is more market-based, which means that it is more likely to reflect the true cost of funds for banks. As a result, banks will be less likely to mark up their lending rates above the cost of funds, which will help to narrow the spread between lending and deposit rates.

- More flexibility for banks in setting lending rates. The SMART rate provides banks with more flexibility in setting their lending rates. This is because banks can add up to 3 percentage points to the SMART rate to fix their lending rates. This flexibility will allow banks to better compete for customers and to offer more competitive lending rates.

- Improved efficiency of the lending market. The SMART rate is expected to improve the efficiency of the lending market. This is because the SMART rate is more market-based and transparent, which will make it easier for borrowers and lenders to find each other. As a result, the SMART rate is expected to help to reduce the cost of credit for borrowers and to improve the efficiency of the lending market.

- Improved risk management by banks. The SMART rate is based on the six-month moving average rate of treasury bills, which is a more stable indicator than the repo rate. This means that the SMART rate is less likely to fluctuate sharply, which will make it easier for banks to manage their risk. As a result, banks will be less likely to suffer losses due to unexpected changes in interest rates.

Overall, the impact of the smart rate is uncertain. It could have both positive and negative effects on the economy. Only time will tell how effective the rate will be in achieving its objectives. Reference rates are constantly evolving as the financial markets change. For example, the LIBOR is being phased out and replaced by new reference rates, such as the Secured Overnight Financing Rate (SOFR). This is because LIBOR has been criticized for being manipulated by banks and for not being a reliable indicator of the true cost of borrowing money.

Challenges of the SMART Rate

The smart rate is a new monetary policy tool that has the potential to both benefit and challenge the Bangladeshi economy. Some of the potential challenges of the smart rate include:

- Increased cost of credit: The smart rate is based on the weighted average rate of a six-month treasury bill, which is currently at 7.72%. This means that the smart rate is likely to be higher than the previous lending rate cap of 9%. This could make it more expensive for businesses and consumers to borrow money, which could slow down economic growth.

- Decreased availability of credit: If the smart rate is too high, banks may be less willing to lend money. This could make it more difficult for businesses and consumers to access credit, which could also slow down economic growth.

- Increased volatility in the financial markets: The smart rate is a market-based tool, which means that it is subject to change based on market conditions. This could lead to increased volatility in the financial markets, which could make it more difficult for businesses and investors to plan for the future.

- Difficulties in managing the tool: A SMART rate is a new tool, and it is not yet clear how the Bangladesh Bank will be able to effectively manage it. If the Bangladesh Bank is not able to manage the tool effectively, it could lead to unintended consequences for the economy.

In addition to the challenges mentioned above, there are a few other potential challenges that could arise from the implementation of the smart rate. These include:

- Lack of transparency: The smart rate is a complex calculation, and it is not clear how the Bangladesh Bank will calculate it. This lack of transparency could make it difficult for businesses and consumers to understand how the smart rate will affect them.

- Inflationary pressures: If the smart rate is too high, it could lead to inflationary pressures. This is because businesses may pass on the higher interest costs to consumers in the form of higher prices.

- Negative impact on the financial sector: The smart rate could hurt the financial sector. This is because banks may be less willing to lend money if the smart rate is too high. This could lead to a decrease in lending, which could hurt economic growth.

It is important to note that these are just potential challenges. The actual impact of the smart rate will depend on several factors, including how the Bangladesh Bank manages the tool and how the market reacts to it.

Is SMART really smart?

There are several reasons why the SMART Reference Lending Rate (SRLR) is considered to be “smart.” First, the SRLR is based on a weighted average of the lending rates of commercial banks. This means that it is more reflective of the actual cost of lending in the market, as opposed to the previous lending rate, which was set by the Bangladesh Bank.

Second, the SRLR is reviewed every month, which means that it can be adjusted more quickly to changes in market conditions. This can help to ensure that the SRLR remains a fair and competitive lending rate.

Third, the SRLR is transparent and publicly available. This means that businesses and consumers can easily see what the SRL is, and they can use this information to make informed decisions about their borrowing.

Overall, the SMART Reference Lending Rate is a positive development for the Bangladeshi economy. It is expected to help to reduce lending costs, improve the efficiency of the financial system, and promote economic growth.

However, some argue that the SRLR is not really “smart” after all. They also argue that the SRL is not responsive enough to changes in market conditions.

Only time will tell whether the SRLR is truly a “smart” lending rate. However, the early signs are promising, and the SRLR will likely have a positive impact on the Bangladeshi economy.

Last Lines

The SMART Reference Lending Rate is a new lending rate mechanism in Bangladesh that is based on the six-month moving average rate of treasury bills. It is more market-based and transparent than the previous lending rate regime, and it is expected to help reduce the spread between lending and deposit rates. The current SMART rate for February 2024 is 8.68%, and banks can add up to 3.75% points to this rate to fix their lending rates whereas FIs can add 5.75%.