The best way to pay off a high interest credit card is to focus on making larger payments and reducing expenses. Paying more than the minimum balance each month will help you pay off the debt faster and save on interest charges.

Additionally, cutting back on unnecessary expenses can free up extra money to put towards your credit card payments. By following these strategies, you can effectively pay off your high interest credit card and improve your financial situation.

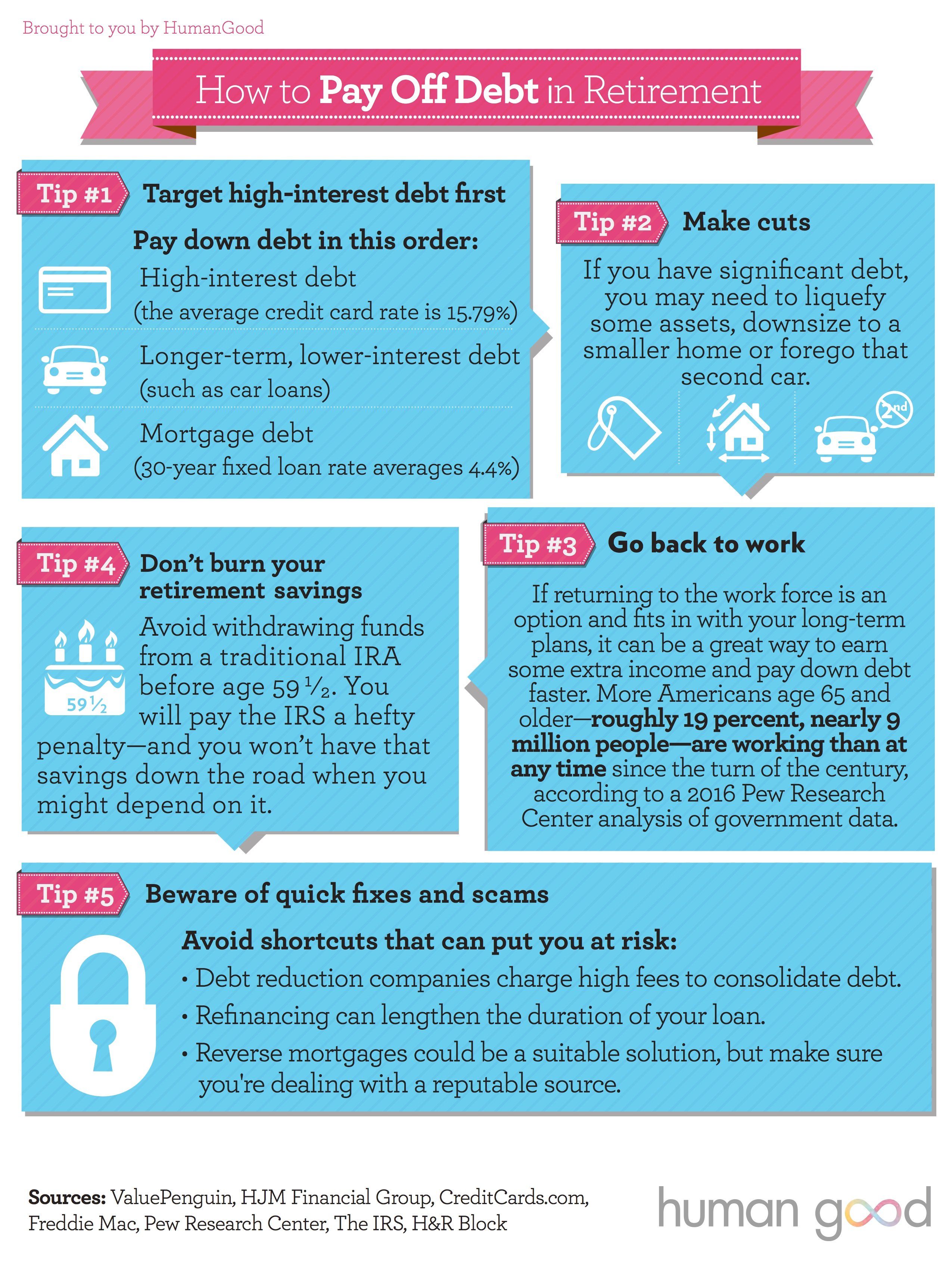

Credit: www.humangood.org

Table of Contents

Evaluate Your Current Credit Card Situation

Evaluate your current credit card situation to find the best way to pay off a high interest credit card. Analyze your debt, create a repayment plan, and consider balance transfers or debt consolidation options to save on interest and become debt-free sooner.

If you find yourself burdened with a high-interest credit card, it’s essential to assess your current situation before taking any steps towards paying it off. Evaluating your credit card situation will give you a clear understanding of where you stand and help you make informed decisions on how to tackle your debt.

Check Your Current Interest Rate

Determining your credit card’s interest rate is the first step to understanding the financial implications of your debt. Interest rates play a significant role in how much you will ultimately pay back to the credit card issuer. To find your interest rate:

- Log in to your online credit card account.

- Locate the section that details your card’s terms and conditions.

- Look for the section that mentions the annual percentage rate (APR) or interest rate.

- Take note of the interest rate percentage, as this will help you evaluate the impact it has on your debt.

Review Your Credit Card Balance, Ensuring

Knowing your credit card balance is crucial when strategizing to pay off a high-interest credit card. To review your balance:

1. Log in to your online credit card account.

2. Locate the section that provides you with your current balance.

3. Take note of this amount, as it will determine the principal amount you need to pay off.

Explore Balance Transfer Options

Looking to pay off your high-interest credit card? Explore balance transfer options to find the best way to tackle your debt and save on interest charges. Move your balance to a lower interest rate card and take control of your finances.

Research Credit Card Offers With Low Interest Rates

Understand Balance Transfer Fees

When it comes to paying off a high-interest credit card, exploring balance transfer options can be a smart move. By transferring your outstanding balance to a credit card with a lower interest rate, you can save money on interest charges and pay off your debt more efficiently.Research Credit Card Offers With Low Interest Rates

One of the first steps in exploring balance transfer options is to research credit card offers with low interest rates. Look for cards that specifically advertise balance transfer options or have promotional rates for new cardholders. Comparing different offers allows you to evaluate which credit card would be the most beneficial for your situation. Remember to pay close attention to the length of the promotional period, as well as any potential fees associated with the transfer.Understand Balance Transfer Fees

To make an informed decision about balance transfers, it’s crucial to understand balance transfer fees. While a card may advertise a low or even 0% interest rate for a certain period, it’s common for there to be fees associated with the transfer. These fees are typically a percentage of the balance transferred, so it’s important to factor them into your calculations when determining if a balance transfer is the best way to pay off your high-interest credit card. Additionally, some credit cards may also have a maximum cap on the amount that can be transferred, so be sure to check for any limitations before proceeding with a balance transfer.By researching credit card offers with low interest rates and understanding balance transfer fees, you can navigate the world of balance transfers more effectively. This way, you’ll be able to choose the best option to pay off your high-interest credit card and save money on interest charges. Remember to weigh the pros and cons of each offer and consider consulting with a financial advisor if necessary.

Create A Repayment Plan

A repayment plan is the best way to tackle a high interest credit card. By creating a structured plan, you can systematically pay off your debt, saving money in interest fees and improving your financial health.

Determine How Much You Can Afford To Pay Each Month

Before you start tackling your high-interest credit card debt, it’s important to determine how much you can afford to pay each month. Assessing your finances and understanding your current expenditure will help you create a realistic repayment plan.

- Step 1: List down all your monthly income from various sources.

- Step 2: Deduct your expenses, including rent, utility bills, groceries, transportation, and other necessary costs.

- Step 3: Identify how much money is left after subtracting your expenses from your income.

Once you’ve calculated this amount, you know how much you can allocate towards paying off your high-interest credit card debt.

Prioritize Your Debt Payments

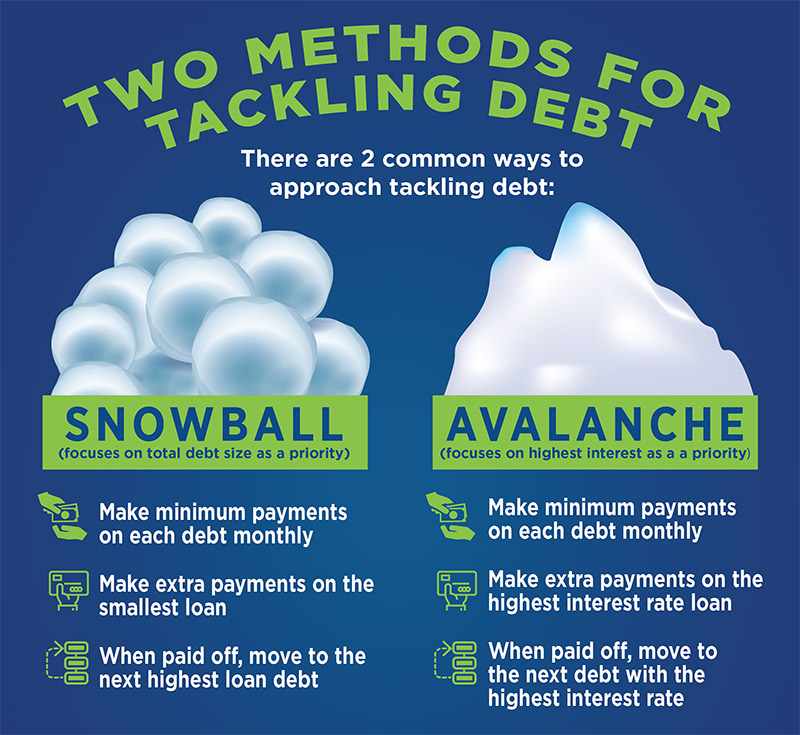

To effectively pay off your high-interest credit card, it’s essential to prioritize your debt payments. By strategically allocating your funds, you can snowball your payments and save money on interest in the long run.

- Step 1: Make a list of all your credit card debts, including the balance and interest rate for each.

- Step 2: Identify the credit card with the highest interest rate, as this is the one costing you the most money.

- Step 3: Allocate the maximum amount you can afford towards paying off this high-interest credit card, while making minimum payments on your other credit cards.

- Step 4: Once you’ve paid off the card with the highest interest rate, move on to the one with the next highest interest rate and repeat the process.

By prioritizing your debt payments based on interest rates, you’ll effectively reduce the amount of interest you pay over time.

:max_bytes(150000):strip_icc()/debt-avalanche-vs-debt-snowball-which-best-you.asp_v1-b62b7fef4c6949aa96550aa2c33b391e.png)

Credit: www.investopedia.com

Consider Debt Consolidation

Consider debt consolidation as a potential solution to pay off your high-interest credit card. By consolidating your debts, you can streamline your monthly payments and potentially lower your interest rates. Here, we will discuss how to research and evaluate your options for debt consolidation, so you can make an informed decision.

Research Options For Consolidating Your High-interest Debt

When considering debt consolidation, it is important to research and explore the various options available to you. Look for reputable financial institutions, credit unions, or online lenders that offer debt consolidation services. You can also consult a credit counselor or financial advisor who can guide you through the process and help you find the best option for your specific situation.

Evaluate The Pros And Cons Of Debt Consolidation

While debt consolidation can be an effective way to manage your high-interest debt, it is essential to evaluate the pros and cons before making a decision. Let’s take a closer look at both:

| Pros | Cons |

|---|---|

|

|

By carefully evaluating these pros and cons, you can determine if debt consolidation is the right choice for you. Consider your financial goals, budget, and overall debt situation when making this decision. Remember, what works for one person may not work for another, so it’s important to choose an option that aligns with your individual circumstances.

Credit: www.crcu.org

Frequently Asked Questions For Best Way To Pay Off A High Interest Credit Card

How Do I Pay Off My Credit Card If My Interest Is High?

To pay off a credit card with high interest, focus on these steps: 1. Make larger payments than the minimum amount due. 2. Prioritize paying off cards with the highest interest rate first. 3. Consider transferring the balance to a card with a lower interest rate or exploring debt consolidation options.

4. Try negotiating with your credit card company for a lower interest rate. 5. Avoid accumulating more debt by using cash or a debit card for purchases.

How To Pay Off $3 000 In 6 Months?

Pay off $3,000 in 6 months by creating a budget, cutting expenses, and prioritizing debt repayments. Increase income through side hustles or part-time work. Avoid unnecessary spending and consider selling unwanted items. Stay committed and track progress to stay on target.

What’s The Smartest Way To Pay Off A Credit Card?

To pay off a credit card smartly, make consistent payments, prioritize high-interest cards, and consider debt consolidation or a balance transfer. Avoid adding more debt, create a budget, and explore options like snowball or avalanche methods.

How To Pay Off $10,000 Credit Card Debt?

Pay off $10,000 credit card debt by following these steps: 1) Create a budget and cut unnecessary expenses. 2) Increase monthly payments to pay off the principal faster. 3) Consider balance transfers to lower interest rates. 4) Explore debt consolidation options.

5) Seek professional advice to create a personalized repayment plan.

Conclusion

Paying off a high-interest credit card can seem daunting, but with the right approach, it’s entirely possible. By focusing on strategies like consolidation, balance transfers, and making extra payments, you can take control of your debt. Remember to create a budget, track your expenses, and prioritize reducing your credit card balance.

With discipline and determination, you’ll soon be free from the burden of high-interest debt and on your way to financial freedom. Start today and take the first step towards a debt-free future.