Betterment, Robinhood, Personal Capital, and Wealthfront rank among the largest wealthtech companies as the key players in the innovative financial sector.

Wealthtech companies are revolutionizing the financial industry by leveraging technology to manage personal and institutional wealth. These firms utilize algorithms, big data, and user-friendly interfaces to provide services ranging from automated investing to financial planning. Addepar specializes in data aggregation and analysis for wealth managers, while Personal Capital offers digital wealth management and financial advising.

Wealthfront and Betterment pioneer in robo-advising, providing automated, algorithm-based portfolio management. Robinhood has disrupted the brokerage industry with its commission-free trading model, appealing to a new generation of investors. These companies are at the forefront of making investment advice and management more accessible and affordable, reshaping how individuals and institutions approach their financial future.

Table of Contents

The Rise Of Wealthtech

The financial services industry is witnessing a transformative era, marked by the escalation of Wealthtech companies. Technology has permeated the realm of wealth management. It generates innovative solutions for both consumers and providers. The Wealthtech sector is bustling with activity, reshaping investment strategies, and democratizing financial advice.

Early Beginnings And Evolution

Wealthtech’s roots trace back to the aftermath of the 2008 financial crisis. During this period, trust in traditional financial institutions waned. Innovative startups seized the opportunity. They began offering digital tools aimed at investment and personal wealth management. As technology advanced, so did these companies. They developed robust platforms harnessing big data, artificial intelligence, and machine learning. This evolution disrupted the way people interact with their wealth.

- Automated advisors, such as robo-advisors, emerged to offer low-cost investment guidance.

- Peer-to-peer lending platforms arose to connect borrowers and lenders directly.

- Personal finance management tools were created to help users track and plan their finances.

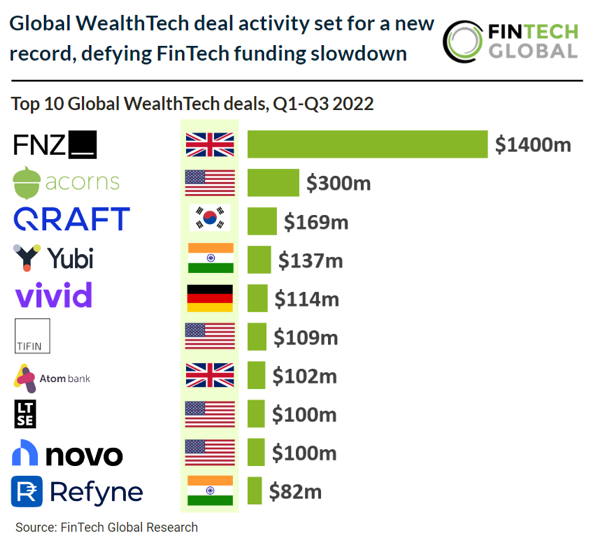

Current Landscape And Growth Drivers

The landscape of Wealthtech is now teeming with large, influential companies. These industry leaders are defined by their impressive user bases and substantial capitalization. The traction of the Wealthtech segment springs from several key drivers:

| Growth Driver | Impact on Wealthtech |

|---|---|

| Technological Advancements | Digital platforms evolve to offer sophisticated investment tools. |

| Regulatory Changes | New regulations encourage transparency and consumer protection. |

| Shift in Consumer Behavior | A preference for digital-first financial services becomes prominent. |

| Democratization of Finance | Investing and financial advice become accessible to a wider audience. |

| Global Connectivity | Borderless financial ecosystems facilitate growing international investments. |

These drivers are the backbone of the sector’s rapid expansion. As a result, Wealthtech companies have mushroomed globally. They deliver innovative financial services at the fingertips of the everyday investor. Some of these firms have reached unicorn status. They have valuations soaring over the billion-dollar mark.

Measuring The Giants

In the realm of wealthtech, size matters. How large a company stands within this innovative financial landscape often affects its market influence and customer reach. Wide-scale operations, extensive service offerings, and heavyweight portfolios characterize the sector’s giants. To gauge their true magnitude, we must examine specific factors and metrics.

Factors Determining Size And Influence

Determining the size and sway of leading wealthtech enterprises involves looking at their:

- Assets under management (AUM): A vital indicator of wealthtech influence.

- User base: More users suggest greater market acceptance.

- Geographical presence: Companies spanning multiple regions boast increased prominence.

- Funding and valuation: Higher numbers often imply robust financial health and investor confidence.

- Partnerships and integrations: Collaborations can extend a firm’s reach and functionality.

- Innovation and technology adoption: Cutting-edge solutions propel firms ahead.

Metrics For Success In Wealthtech

Success in wealthtech not only reflects size but also longevity and growth prospects:

| Metric | Description |

|---|---|

| Revenue growth | Reflects a firm’s expanding financial footprint. |

| Client retention rates | High rates mean satisfied customers and stable income. |

| Operational efficiency | Streamlined operations lead to cost savings and improved experiences. |

| Scalability | Capacity to grow without sacrificing service quality. |

| Market share | Larger share hints at dominance and influence. |

| Innovation index | The frequency and impact of new product launches. |

Therefore, wealthtech titans not only possess substantial AUM but also exhibit sustained revenue escalation, high client loyalty, operational finesse, and consistent innovation. Their dominance is a composite of financial prowess, strategic partnerships, and technological foresight.

The Titans Of Wealthtech

Wealthtech has transformed the way we manage and invest money. The titans of this industry offer cutting-edge platforms. They make investing accessible and efficient for everyone. Below, we delve into the leaders paving the way in this financial revolution.

Defining “largest” in the wealthtech field depends on several factors, like market capitalization, assets under management (AUM), or revenue. Here are some potential contenders for the title, depending on the chosen metric:

By Market Capitalization:

- Charles Schwab Corp. (SCHW): $161.84 billion (as of October 2023) – A leading US brokerage firm with a focus on traditional and digital investing.

- Blackstone Inc. (BX): $111.89 billion – A global asset manager with significant investments in technology and digital solutions for wealth management.

- Intuit Inc. (INTU): $102.40 billion – A fintech giant known for its popular TurboTax software and expanding into wealth management through Rocket Money and other products.

- PayPal Holdings Inc. (PYPL): $95.92 billion – A digital payments giant offering investment and wealth management services through partnerships and its Venmo platform.

- Morgan Stanley (MS): $82.42 billion – A traditional investment bank actively investing in digital wealth management solutions and expanding its online presence.

By Assets Under Management (AUM):

- BlackRock Inc. (BLK): $10 trillion – A global leader in asset management, offering various wealth management solutions through its iShares ETFs and other products.

- The Vanguard Group: $8.1 trillion – A mutual fund giant known for its low-cost index funds and target-date retirement solutions.

- State Street Corp. (STT): $4.2 trillion – A major custodian bank with investment management services for individuals and institutions.

- Fidelity Investments: $3.3 trillion – A diversified financial services provider known for its mutual funds, brokerage services, and wealth management offerings.

- UBS Group AG (UBS): $2.2 trillion – A global wealth management leader with a strong digital presence and focus on personalized investment solutions.

By Revenue:

- BlackRock Inc. (BLK): $16.81 billion (2022 fiscal year) – Diversified revenue streams from asset management fees, technology solutions, and other services.

- Charles Schwab Corp. (SCHW): $15.03 billion (2023 fiscal year) – Revenue primarily from interest income, transaction fees, and investment management services.

- Fidelity Investments: $14.5 billion (2022 fiscal year) – Revenue from diversified sources like asset management fees, brokerage commissions, and wealth management services.

- Intuit Inc. (INTU): $12.32 billion (2023 fiscal year) – Revenue primarily from software sales and subscriptions, including its TurboTax and Quickbooks products.

Remember, these are just a few examples, and the rankings may change depending on market conditions and company performance. Additionally, there are numerous other successful and noteworthy wealthtech companies worldwide, focusing on different niches and areas within the broader wealth management landscape.

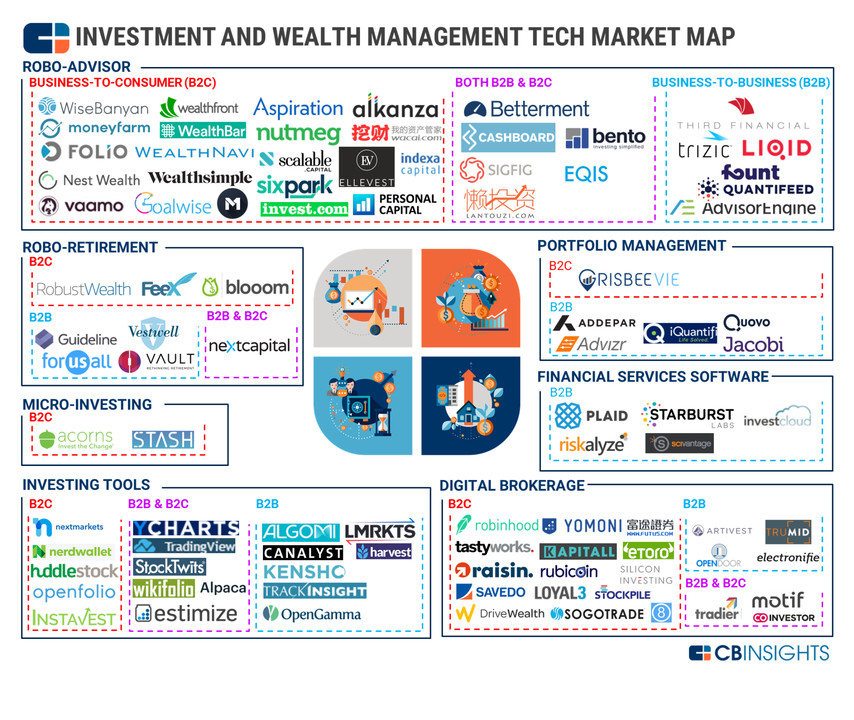

For a more comprehensive picture, consider researching specific sectors of wealthtech, like robo-advisors, digital brokerages, or wealth management platforms, to discover more potential leaders in the field.

Innovators Of Market Disruption

The Wealthtech sector thrives on innovative companies. They shake up traditional finance realms with technology. Here we spotlight the trailblazers. Their platforms offer unique, tech-driven solutions.

- Robinhood – Simplified stock trading with no fees

- Acorns – Micro-investing by rounding up purchases

- Betterment – Automated investing and robo-advisors