To save money on a budget, prioritize expenditures and cut unnecessary expenses. Here are some simple yet effective ways to do so.

In today’s world, saving money has become more necessary than ever before. Almost everyone is looking for ways to save money, but it’s not always easy to do so. Following a budget can be an excellent way to manage expenses and maximize savings.

Without proper budgeting, money can easily slip through your fingers without your even realizing it. Prioritizing expenditures and identifying unnecessary expenses are the first steps to make a budget. Once you’ve done that, you can explore ways to cut back on those expenses and save money. This article will delve into some useful tips and tricks to help you save money on a budget.

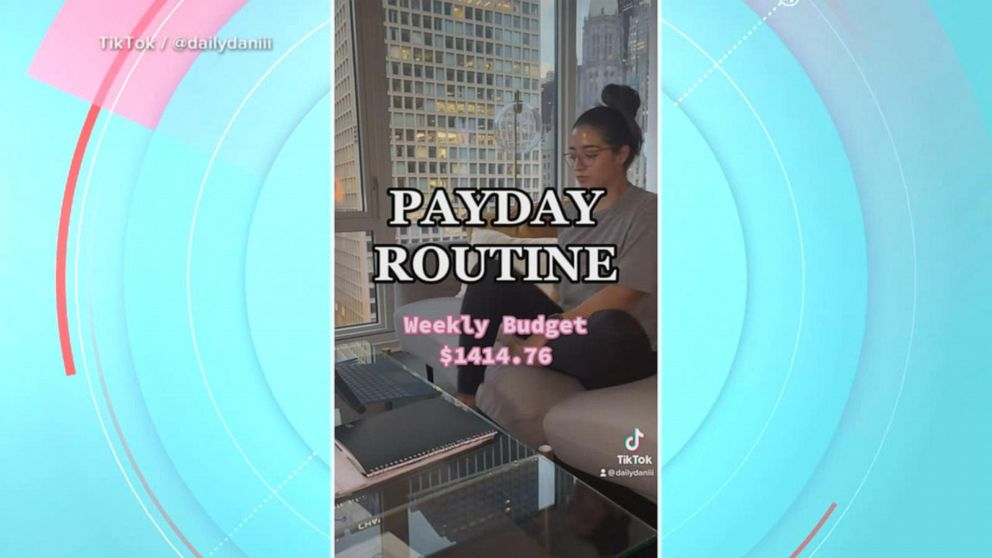

Credit: www.goodmorningamerica.com

Table of Contents

Assessing Your Finances

Understanding Your Current Financial Situation

Before you start saving money, it is important to assess your current financial situation. Understanding your financial situation will help you make informed decisions. Here are some key points to help you do it:

- Calculate your monthly income: Write down all your sources of income and add them up to know your monthly income.

- Calculate your expenses: Write down all the expenses that you have over one month, including groceries, rent, bills, and other expenses. Subtract this total from your monthly income to see the difference.

- Know your debts: Write down all your debts and the total you owe. This will include loans, credit card debt, and other debts.

- Understand your credit score: Your financial reputation is reflected in your credit score. Check your credit score to have an understanding of your credibility as a borrower.

Identifying Areas Of Overspending And Opportunities To Save

After understanding where your money is going, it’s time to identify areas of overspending and opportunities to save. Here are some tips that can help:

- Eliminate unnecessary expenses: You can save a lot of money by getting rid of expenses that you could do without, such as subscriptions you don’t need, unnecessary purchases, and dining out too often.

- Cut back on utilities: Try to save money on your utility bills by practicing energy-saving tactics such as turning off appliances when not in use, reducing water usage, and lowering the heat or air conditioning when possible.

- Plan your grocery shopping: Make a shopping list and stick to it. Buy generic brands, use coupons, and shop in bulk to save a lot of money.

- Settle debts: Try to pay off as many debts as possible, and make sure you pay them on time. This will help you avoid further interest charges and improve your credit score.

Creating A Budget Plan

Once you’ve found ways to save money, it’s time to create a budget plan. A budget plan will help you stay accountable and ensure that you’re directing your money towards things that matter most. Here are some tips to help you create a budget plan:

- Determine your priorities: Decide what’s important to you and your financial goals.

- Create a budget: Write down all your monthly expenses and allocate a budget for each category. Include savings as a category of your budget.

- Track your spending: Keep a close eye on your spending and ensure you’re sticking to your budget plan.

- Adjust your budget plan: From time to time, revisit your budget plan and make necessary updates as your financial goals change.

By following these tips, you’ll be on your way to saving money while sticking to your budget. Remember, every little bit helps, so start today and enjoy a more financially stable tomorrow!

Cutting Down Expenses

When you’re trying to save money on a budget, one of the most effective things you can do is cut down on your expenses. Here are some strategies you can try:

Grocery Shopping Tips On A Budget

- Plan your meals: Before heading to the grocery store, plan out your meals for the week. That way, you can buy only the ingredients you need and avoid wasting food.

- Make a list: Stick to your meal plan by making a list of everything you need before going to the store. This will prevent you from impulse buying and overspending.

- Buy in bulk: Look for deals on bulk items like rice, beans, and pasta. These staples can be affordable when purchased in larger quantities.

- Use coupons and rewards programs: Many grocery stores offer coupons and rewards programs that can save you money on your purchases.

- Avoid processed and pre-packaged foods: Processed foods and pre-packaged convenience meals tend to be more expensive than cooking from scratch, so opt for fresh ingredients instead.

Strategies For Reducing Energy Bills

- Unplug appliances when not in use: Even when not in use, appliances continue to use energy when plugged in. So, make it a habit to unplug appliances when not in use.

- Lower your thermostat: Lowering your thermostat by just a few degrees in the winter and raising it by a few degrees in the summer can make a big difference in your energy bill.

- Keep windows and doors sealed: Check your windows and doors for leaks and seal them to prevent drafts that can lead to higher heating and cooling costs.

- Use energy-efficient light bulbs: Switch to led light bulbs which consume less energy and last longer than traditional light bulbs.

- Install a programmable thermostat: A programmable thermostat allows you to adjust the temperature in your home when you’re not there, which can save money on your energy bill.

Cutting Down On Subscription Services

- Cancel subscriptions you don’t use: If you’re not actively using a subscription service, cancel it. This can save you a lot of money in the long run.

- Share subscriptions with friends/family: Consider sharing a subscription service with friends or family to split the cost. For example, netflix allows multiple profiles under one account, so you can share with other people.

- Downgrade subscription packages: Many subscription services offer tiered pricing, so downgrade to a less expensive option if it still provides what you need.

Purchasing Second-Hand And Resale Items

- Shop at thrift stores: Thrift stores offer affordable clothing, furniture, and household items that are often in good condition.

- Look for deals online: Online resale platforms like ebay, facebook marketplace, and craigslist can help you find great deals on second-hand items.

- Attend garage sales and flea markets: Attend local garage sales and flea markets for affordable items and unique finds.

Creative Ways To Save Money

Saving money on a budget might seem like a daunting task, but with a little creativity, it can be easily achieved. Here are some off-beat but effective ways to save money:

Homemade Alternatives To Store-Bought Products

Making your own products at home can save you a lot of money in the long run. Here are some diy recipes that are worth trying:

- Homemade cleaning products: Combine white vinegar and water to create an all-purpose cleaner. Mix baking soda and vinegar to create a paste that will clean tough stains.

- Homemade beauty products: Make your own facial scrubs by mixing oatmeal with water, or create a hair mask by mixing honey and coconut oil.

- Homemade food products: Bake your own bread instead of buying store-bought bread. Make your own granola bars, energy bites or protein balls instead of buying them from the store.

Bargain Hunting And Sale Tracking

Being a smart shopper and keeping an eye out for discounts and sales can help you save a lot of money. Here are some tips that will help you become a successful bargain hunter:

- Explore thrift stores and yard sales: Look for gently-used items such as books, clothes, furniture, and kitchenware at thrift stores and yard sales. You might find stuff that is as good as new.

- Cashback apps: Use cashback apps such as ibotta, rakuten, and honey to earn cashback on online and in-store purchases.

- Couponing: Collect coupons from newspapers, magazines, and online platforms such as coupons.com and retailmenot.

Diy Home Repairs And Maintenance

Hiring professionals to take care of home repairs and maintenance can be quite expensive. Here are some diy hacks that will help you save money:

- Youtube tutorials: Look up youtube tutorials to learn how to repair any minor leaks, unclog drains, fix light fixtures, and do other basic repairs around the house.

- Diy cleaners: You can easily make your own cleaning solutions to tackle common household problems. For instance, mix baking soda and vinegar to clean drains, or use bleach to clean the toilet.

- Energy-efficient upgrades: Making small changes to your home can help you save a lot of money on energy bills. For example, switch to led lights to save energy and replace old appliances with energy-efficient ones.

Traveling On A Budget

Traveling can be expensive, but there are plenty of ways to explore new destinations without breaking the bank. Here are some budget-friendly travel tips:

- Look for off-season deals: Travel during the shoulder season when the hotel and airfare prices are low.

- Use travel rewards: Sign up for travel rewards credit cards and loyalty programs to earn points and miles that you can redeem later for free flights or hotel stays.

- House-sitting: Consider house-sitting or pet-sitting as a way to save on accommodation costs. Look for opportunities on websites like trustedhousesitters and housecarers.

Implementing these creative ways to save money will help you reach your financial goals while allowing you to still enjoy the things you love. Try them out and see how much you can save!

Maximizing Savings With Debt Management

Debt management is one of the most effective ways to save money on a budget. If you’re struggling to keep up with credit card and loan payments, debt management can help you take control of your finances and reduce your debt burden.

In this section, we’ll discuss three key debt management strategies to help you maximize your savings.

Understanding Credit Card And Loan Interest Rates

Understanding the interest rates on your credit cards and loans is the first step towards effective debt management. Here are the key points to keep in mind:

- Credit card interest rates can vary widely, ranging from as low as 0% to as high as 30%.

- Loan interest rates can also vary, depending on the type of loan, your credit score and your lender.

- High-interest debt can be a significant burden on your finances, making it harder to pay off your debts and save money.

How To Negotiate With Creditors

Negotiating with your creditors can be an effective way to reduce your debt burden and save money. Here are some key tips to keep in mind:

- Start by contacting your creditors and explaining your financial situation.

- Ask if they’re willing to negotiate your interest rate or create a repayment plan that fits your budget.

- Be prepared to negotiate and compromise to find a solution that works for both you and your creditors.

Consolidating Debts Strategically

Consolidating your debts can be a great way to simplify your finances and reduce your debt burden. However, it’s essential to consolidate strategically to maximize your savings. Here are some key points to consider:

- Consider consolidation loans with lower interest rates than your current loans or credit cards.

- Be mindful of any fees associated with consolidation loans, such as balance transfer fees or origination fees.

- Consider the impact of consolidating your debts on your credit score and be sure to make payments on time.

By understanding interest rates, negotiating with creditors, and consolidating debts strategically, you can maximize your savings and take control of your finances. Remember, every little bit counts when it comes to saving money on a budget, and effective debt management can go a long way towards achieving your financial goals.

Building Wealth With Smart Investments

Investing your money is a crucial part of building long-term wealth, and it’s never too early or too late to start. By investing wisely, you can build up your savings, earn more money, and achieve your financial goals. Here are some key points to keep in mind when it comes to building wealth with smart investments:

The Importance Of Investing For Long-Term Financial Goals

When you’re investing your money, it’s essential to have a clear understanding of your long-term financial goals. These goals could be anything from saving for retirement to buying a house or paying for your children’s education. By having a clear sense of what you’re working towards, you can make informed decisions about where to invest your money.

Diversifying Your Investment Portfolio

One of the most important things to keep in mind when investing is the importance of diversification. This means spreading your money out across multiple investments to minimize risk. By diversifying your portfolio, you can protect yourself against drastic losses if one investment performs poorly.

Researching And Choosing Investments Wisely

When it comes to investing, it’s important to take the time to research different options and choose wisely. This means looking for opportunities that offer a good balance of risk and reward and taking the time to thoroughly understand each investment before committing your money.

Some tips for choosing investments wisely include:

- Investing with a reputable broker or financial advisor

- Choosing investments that align with your long-term goals

- Diversifying your portfolio across a range of investments, including stocks, bonds, and real estate

- Keeping track of your investments and regularly reviewing your portfolio to ensure it is still aligned with your goals and risk tolerance.

By following these tips and making smart investment decisions, you can start building wealth for the long term. Remember, investing is a journey, not a destination, and it’s essential to stay informed and adapt your strategy over time to ensure you’re always working towards your financial goals.

Frequently Asked Questions Of How To Save Money On A Budget

How Can I Save Money On A Budget?

To save money on a budget, you can start by creating a budget plan, cutting expenses, and looking for deals/offers while shopping.

Why Is It Important To Save Money?

Saving money helps you to build an emergency fund, achieve financial goals, reduce debt, and secure your financial future.

How Can I Create A Budget Plan?

Creating a budget plan involves tracking your income and expenses, prioritizing your spending, and setting financial goals.

What Are Some Expenses I Can Cut?

You can cut expenses by reducing discretionary spending like eating out, entertainment, shopping, or by negotiating bills, and shopping sales.

How Much Should I Save Each Month?

You should aim to save at least 20% of your income each month, but it depends on your financial goals, debt, and expenses.

How Can I Save Money On Groceries?

You can save money on groceries by buying in bulk, using coupons and local deals, meal planning, and avoiding processed foods.

How Can I Save Money On Utilities?

You can save on utilities by turning off lights and unplugging devices when not in use, installing energy-efficient appliances, and setting the thermostat lower.

How Can I Cut Down On Transportation Costs?

You can cut down on transportation costs by using public transportation, carpooling, biking, or walking instead of driving alone.

Should I Have A Separate Savings Account?

Yes, having a separate high-yield savings account can help you keep track of your savings and earn more interest on your money.

How Can I Stay Motivated To Save Money?

You can stay motivated by setting short-term and long-term goals, celebrating small wins, tracking your progress, and seeking support from family and friends.

Conclusion

After reading this post, you should have a good understanding of how to save money on a budget. By following these tips, you can make small changes in your lifestyle that can positively impact your finances in the long run.

Remember to set a goal and stick to it, monitor your expenses, cut unnecessary spending, and prioritize your needs over wants. With these simple steps, you can enjoy the benefits of living on a budget without feeling like you’re sacrificing too much.

Saving money may require a bit of sacrifice and discipline, but the rewards are worth it. You’ll have more financial stability, less stress, and more opportunities for growth and enjoyment. Start taking action today, and you’ll be on your way to achieving your financial goals sooner than you think.