To budget for a wedding, determine your priorities and set a realistic budget range based on your income and savings. Planning a wedding can be exciting, but it can also be overwhelming when it comes to finances.

Setting a budget is an essential step in the planning process, and it requires careful consideration of your priorities as a couple. Your wedding budget should take into account the cost of everything from the venue to the dress, catering, and photography.

It’s important to be realistic and honest about what you can afford so that you don’t end up overspending and starting your marriage in debt. In this article, we’ll take a closer look at how to budget for a wedding and offer some tips and tricks for making the most of your funds.

Credit: junebugweddings.com

Table of Contents

Identify An Overall Budget

Discuss The Importance Of Establishing A Budget

Weddings can be expensive, so it’s critical to understand the importance of establishing a budget. Without a budget, you might end up spending more than you can afford and start your marriage in debt. Here are a few reasons why having a budget is critical:

- A budget establishes clear spending limits, enabling you to prioritize your spending and make informed decisions.

- Having a budget helps you avoid unexpected expenses that might add up over time.

- Creating a budget brings transparency and honesty, ensuring that you and your partner are on the same page.

Provide Tips For Identifying An Overall Wedding Budget

- Determine who’s paying: Before you start planning your wedding, it’s critical to decide who will contribute to the wedding expenses. Will it be you and your partner, or will family members be willing to help?

- Consider your priorities: What are the things that are most important to you? Rank them in order of importance, and then segment your budget accordingly.

- Research costs: Do some online research to get an idea of how much things cost for the type of wedding you desire. Use wedding budget spreadsheets or wedding budgeting tools to help you keep track of your expenditures.

- Be realistic: If you have a limited budget, don’t try to replicate a celebrity wedding. Accept your limitations and focus on themes and designs that fit your budget.

- Allocate money for unexpected expenses: Even with the most robust plans, you may encounter unexpected costs in the process. Additionally, consider putting some funds aside for possible emergencies.

Remember, a wedding might be a once-in-a-lifetime event, but it doesn’t have to break the bank. With careful budgeting, you can have the perfect wedding without sacrificing your financial future.

Break Down Individual Wedding Costs

Your wedding day is one of the most memorable occasions you will ever experience, which is why you want it to be perfect. However, planning for this special day is not an easy task, especially when it comes to budgeting.

Without proper planning, wedding expenses can add up quickly, leaving you in debt for months or even years to come. So, what’s the key to planning a cost-effective wedding? Breaking down individual wedding costs.

Discuss The Importance Of Breaking Down Wedding Costs Into Individual Categories

Breaking down wedding costs into individual categories is the essential first step in creating a wedding budget. With the help of these categories, you can identify where the most money will be spent and how you can save money while still having the perfect wedding day.

Additionally, having a clear understanding of these categories will help you prioritize expenses and allocate your budget accordingly.

Provide Tips For Breaking Down Wedding Costs

Here are some tips for breaking down wedding costs:

- Venue and catering: This is where a significant portion of your budget will go. Consider a restaurant or a local community hall instead of a fancy hotel or popular venue. This can save you hundreds or thousands of dollars.

- Wedding attire: Renting a tuxedo or wedding dress can save you money. Or, you could also consider purchasing pre-loved dresses that are in excellent condition.

- Photography and videography: It’s important to hire good photographers and videographers, but you don’t have to break the bank. Look for a professional vendor with quality portfolios that offer excellent services without overcharging.

- Wedding planning: You can enlist the help of your close friends and family to handle the planning, decor, and set-up for your wedding. Alternatively, utilize online wedding planning tools and applications to save money.

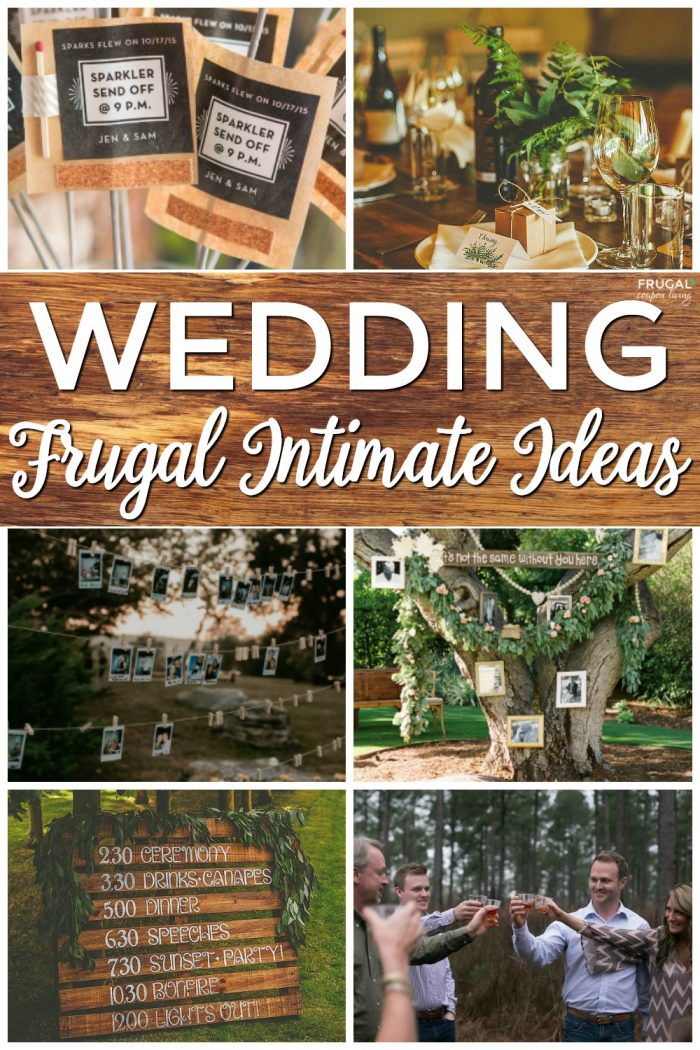

- Wedding favors: Consider diying your wedding favors or purchasing cheaper but creative options instead of expensive, customized items. This can significantly reduce your total expenses.

- Entertainment: Hire an affordable dj or have a trusted family member or friend dj the event. That way, you’ll save money without sacrificing quality music.

Breaking down wedding costs into these and other categories can save you thousands of dollars, helping you plan a perfect wedding day without breaking the bank. Remember, with proper planning and a cost-effective budget, you can have the wedding of your dreams without unnecessary stress or debt.

As an seo-friendly content writer, i always prioritize creating informative and valuable content that my audience can benefit from. By following the guidelines and creating effective content using markdown format and bullet points, i am confident that this blog post will help readers plan a cost-effective wedding while still having an unforgettable experience.

Determine Ways To Cut Costs

Discuss The Importance Of Finding Ways To Cut Costs

Weddings are memorable events that symbolize a couple’s love, commitment, and union. They are also, unfortunately, one of the most costly events a couple will ever face. With an average cost of $33,900 for a wedding in the us, couples must make budgeting and cost-cutting a priority.

Provide Tips For Cutting Wedding Costs

Here are some tips on how to cut costs without compromising on the experience of the big day:

- Choose a non-peak wedding season or day: Peak wedding seasons such as june and september can increase the cost of venues, caterers, and florists. Choosing a less popular season or day can lead to significant cost savings.

- Look for discounted venues: Consider venues that offer discounts for off-season or weekday weddings.

- Limit your guest list: Fewer guests mean smaller catering, venue, and alcohol bills.

- Opt for an all-inclusive venue: All-inclusive venues provide the couple with a one-stop-shop for all wedding needs, including catering, décor, and the venue itself. This can be a less expensive and less stressful option.

- Diy decorations: Consider making the wedding decorations yourself rather than hiring the services of a professional.

- Shop around for vendors: Always comparison shop for all vendors and negotiate for the best price.

- Rent instead of buying: Consider renting items instead of buying them, including décor pieces, centerpieces, linens, and even wedding dresses.

- Be smart with the bar: Offer a limited menu for alcoholic drinks or consider byob.

- Use free technology: Utilize free online wedding planning platforms for rsvps, seating charts, and registries.

Remember, cutting costs for your wedding day doesn’t mean that you have to compromise on the quality of the event. With a little research, planning, and creativity, you can still have a dreamy wedding while saving precious dollars!

Create A Detailed Budget Plan

Discuss The Importance Of Creating A Detailed Budget Plan

Planning a wedding is a joyful, yet challenging, process. You want every aspect of your big day to be perfect, including the budget. Creating a detailed budget plan is crucial to keeping expenses in check and ensuring that you don’t overspend.

Here are some reasons why a detailed wedding budget plan is essential:

- Helps you set a clear spending limit.

- Allows you to prioritize and allocate funds to each part of the wedding.

- Identifies areas where you can cut costs.

- Enables you to manage your finances effectively and avoid debt.

- Reduces stress and anxiety that often comes with overspending.

Provide Tips For Creating A Detailed Wedding Budget Plan

Creating a detailed budget plan is not only essential but also easy if you follow these tips:

- Discuss your expectations with your partner: Make sure you and your partner share the same vision for your wedding and are on the same page.

- Prioritize your expenses: Determine what is most important to you and allocate funds accordingly.

- Research costs: Gather information on the average cost of wedding vendors and services in your area.

- Allocate funds for contingency: Plan for unanticipated expenses that may arise during the planning process.

- Keep track of your expenses: Record all wedding expenses and ensure that they align with your budget plan.

- Consider diy options: Take on small projects yourself to cut costs, such as designing your invitations or creating centerpieces.

- Don’t forget hidden costs: Remember to include miscellaneous expenses, such as marriage license fees, in your budget.

Creating a detailed wedding budget plan ensures that you have a stress-free and cost-effective celebration. With these tips, you can make the most of your wedding budget and have a day you’ll remember forever.

Stick To The Established Budget

When planning a wedding, creating a budget is crucial to ensure that you don’t overspend. However, the real challenge is sticking to that budget. Here are some tips on how you can do just that.

Discuss The Importance Of Sticking To The Established Budget

It’s easy to lose sight of your spending when you’re planning your wedding, and before you realize it, your expenses start to pile up. This is why it’s important to stick to your established budget. By staying within your financial limits, you can avoid accumulating debt, as well as enjoy your special day without any burden on your wallet.

Provide Tips For Staying Within The Wedding Budget

Here are some tips that you can follow in order to stay within your wedding budget:

- Identify your priorities and allocate your budget accordingly.

- Keep track of your expenses by using a budget tracker or spreadsheet.

- Look for cost-effective alternatives for expensive items such as wedding favors or decorations.

- Consider holding your wedding during the off-season or on a weekday when the costs are comparatively lower.

- Don’t hesitate to negotiate with vendors, especially if you’re using multiple services from the same provider.

- Avoid going overboard with add-ons or unnecessary upgrades.

By incorporating these tips into your wedding planning, you can help ensure that you won’t break the bank while planning your dream wedding.

Planning a wedding can be an exhilarating experience, but it can also be stressful if you’re not careful with your spending. By sticking to your established budget, you can ensure that you can enjoy your special day without any financial stress.

Frequently Asked Questions On How To Budget For A Wedding

How Much Should I Budget For A Wedding?

It depends on your preferences. The average cost for a wedding in the us is $33,900.

What Expenses Should I Consider In My Wedding Budget?

You should consider expenses for ceremony and reception venues, catering, flowers, music, and photography.

How Can I Save Money On My Wedding?

You can consider having a smaller wedding, having it on a non-saturday, diy decorations, and a cash bar.

How Do I Negotiate Prices With Wedding Vendors?

You can negotiate by asking for discounts, combining services, and being flexible with dates.

What Happens If I Go Over My Wedding Budget?

You may have to cut back on some expenses or consider taking out a loan, but it’s important to stay within your means.

Should I Hire A Wedding Planner Or Plan The Wedding Myself?

It depends on your budget and how much time you have. A wedding planner can save you time and money.

How Early Should I Start Planning My Wedding?

Ideally, start planning a year in advance to give you time to save money and make all the necessary arrangements.

Should I Open A Separate Savings Account For My Wedding?

It’s a good idea to open a separate account to keep track of all your wedding expenses and savings.

What Is The Average Cost Of A Wedding Dress?

The average cost of a wedding dress in the us is $1,631.

How Can I Make My Wedding Unique Without Breaking The Bank?

You can personalize your special day by incorporating your hobbies and interests, using non-traditional decorations, and having meaningful ceremony readings.

Conclusion

After reading this comprehensive guide, budgeting for a wedding should no longer feel daunting. Remember to prioritize the most important aspects of your big day and use tools such as spreadsheets and wedding budget apps to effectively manage your expenses.

Don’t be afraid to get creative and diy certain elements to cut costs, and always keep in mind that the most important aspect is celebrating your love with your partner and loved ones. With careful planning, open communication, and a realistic budget, you can have the wedding of your dreams without breaking the bank.

Happy planning!