An escrow reserve payment is a designated amount of money set aside to cover potential expenses or liabilities. This can include property taxes, insurance premiums, or maintenance costs, ensuring that the funds are available when needed.

Table of Contents

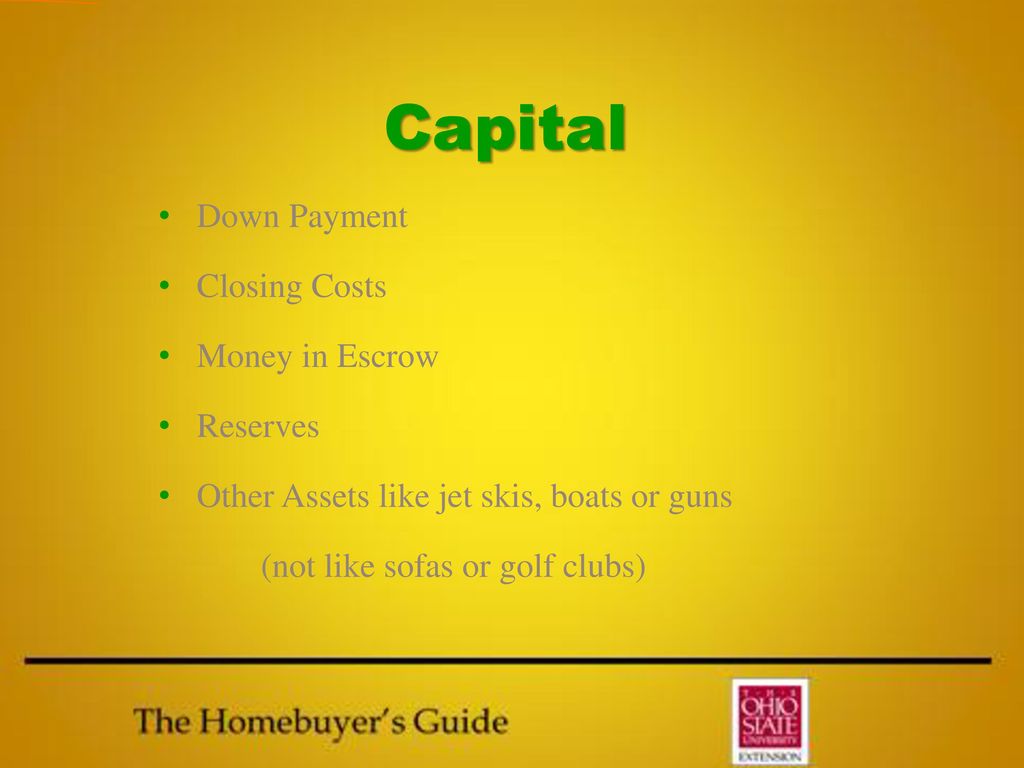

What Is An Escrow Reserve Payment?

An escrow reserve payment refers to a fund set aside for specific purposes in real estate transactions. It is used to ensure that there is enough money available to cover future expenses related to the property. The purpose of an escrow reserve payment is to protect both the buyer and the seller by providing a safeguard against unexpected costs.

It also offers various benefits, such as promoting transparency and accountability in the transaction. In practice, the buyer contributes a certain amount to the reserve fund, which is then held in an escrow account managed by a neutral third party.

This reserve is then used to cover expenses like property taxes, insurance premiums, and maintenance costs. The escrow reserve payment plays a crucial role in real estate transactions, providing financial security and ensuring a smooth process for all parties involved.

How To Set Up An Escrow Reserve Payment

Setting up an escrow reserve payment involves understanding the requirements. This process includes creating an escrow account, considering documentation and legal aspects, as well as acknowledging the financial obligations of all parties involved. Establishing an escrow reserve payment requires careful attention to detail, as it ensures the secure holding of funds until certain conditions are met.

By following the necessary steps to create an escrow account, you can protect your interests and guarantee a trustworthy transaction. Documenting the terms and conditions, as well as any additional legal requirements, is crucial to ensure a smooth and transparent process.

Additionally, understanding the financial obligations of all involved parties will help to avoid any misunderstandings or complications throughout the transaction. By following these guidelines, you can successfully set up an escrow reserve payment.

Common Issues And Challenges With Escrow Reserve Payments

Escrow reserve payments can present a range of common issues and challenges. These include potential risks and pitfalls that can arise during the process. Disputes and conflicts between parties can lead to delays and complications, affecting the smoothness of transactions.

To navigate these challenges, it is important to adhere to best practices. This includes clearly outlining the terms and conditions of the escrow reserve payment, communicating effectively with all parties involved, and promptly resolving any disputes that may arise. By taking these steps, the likelihood of experiencing complications and delays can be minimized, ensuring a more efficient and successful escrow reserve payment process.

Credit: slideplayer.com

Escrow Reserve Payment Vs Regular Payments

Escrow reserve payments and regular payments have notable differences worth considering. Escrow reserve payments involve setting aside funds for future use, while regular payments are made on a regular schedule. The advantage of using an escrow account is the assurance that funds are readily available when needed.

However, it can tie up cash flow and limit investment opportunities. Regular payments, on the other hand, offer flexibility but may require careful budgeting to ensure timely payments. Various factors should be considered when deciding between the two, such as the specific financial goals, cash flow requirements, and the overall financial situation.

It is important to assess which type of payment is most appropriate for the particular situation at hand. Making the right choice can contribute to effective financial management and goal attainment.

Escrow Reserve Payment: Legal And Regulatory Aspects

Escrow reserve payments, though widely used, are subject to various legal and regulatory requirements. Understanding the laws and regulations governing escrow accounts is crucial. Compliance plays a key role in ensuring smooth transactions. Escrow agents and parties involved must adhere to their obligations and responsibilities.

Neglecting compliance can lead to severe consequences. Non-compliance may result in legal disputes and financial penalties. It is essential to stay up-to-date with the latest regulatory changes to avoid any pitfalls. Proper knowledge and adherence to the legal framework surrounding escrow reserve payments are vital to protect all parties involved.

By following the necessary regulations, escrow transactions can be conducted with transparency and confidence.

Tips For A Successful Escrow Reserve Payment Process

When selecting an escrow agent for your reserve payment, thorough due diligence is crucial. Ensure you conduct extensive research to find a reputable and reliable agent. Effective communication is vital throughout the process, so choose an agent who values transparency and keeps you informed at every step.

It’s important to set realistic expectations and timelines from the beginning to avoid potential misunderstandings. By doing so, you can make sure the escrow reserve payment process goes smoothly and efficiently.

Case Studies: Real-Life Examples Of Escrow Reserve Payment Success

Successful completion of a real estate transaction using an escrow reserve payment is a prime example. One case involved an acquisition deal, wherein an escrow reserve payment played a crucial role. Additionally, another illustration showcased the utilization of an escrow reserve payment in a construction project.

These examples demonstrate the effectiveness and relevance of implementing this payment method in various scenarios. With an escrow reserve payment, parties can mitigate risks, ensure secure transactions, and provide a sense of assurance to all stakeholders involved. It is clear that harnessing the benefits of an escrow reserve payment can lead to successful outcomes in diverse settings, fostering trust and achieving desired objectives.

Such case studies highlight the significance of this payment mechanism in today’s business landscape.

Frequently Asked Questions Of Escrow Reserve Payment

Should I Cash My Escrow Surplus Check?

Yes, cash your escrow surplus check to access the extra funds.

Should You Pay The Escrow Shortage?

Yes, you should pay the escrow shortage to avoid potential issues.

Why Am I Making Escrow Payments?

Escrow payments are made to ensure that funds are available to cover expenses related to your mortgage or insurance.

How Do I Reduce My Escrow Payment?

To reduce your escrow payment, follow these steps: 1. Review your property tax assessment to ensure accuracy. 2. Check your homeowner’s insurance policy to see if you can find a better rate. 3. Consider refinancing your mortgage if your interest rates have dropped.

4. Make additional principal payments to decrease the amount in escrow.

Conclusion

An escrow reserve payment is an essential component of financial transactions that provides peace of mind and security for both buyers and sellers. By setting aside funds in a designated account, it ensures that unexpected expenses or liabilities can be covered without disrupting the overall transaction.

As we have discussed throughout this blog post, escrow reserve payments offer numerous benefits, such as protection against financial risks, simplified budgeting, and enhanced transparency. This financial tool helps to mitigate potential risks and uncertainties, allowing participants to proceed with confidence in their transactions.

Whether you are buying a house, conducting a business deal, or implementing a large-scale project, an escrow reserve payment serves as a safeguard that ensures the smooth flow of the transaction. With its numerous advantages and widespread use, it is clear that an escrow reserve payment is a valuable tool that should be considered in various financial arrangements.