The escrow balance refers to the amount of money held by a third party, typically a bank or an escrow company, for the purpose of fulfilling financial obligations related to a transaction, such as the purchase of a property. With the escrow balance, the funds are securely held until all conditions of the transaction are met, ensuring protection for both the buyer and the seller.

This balance serves as a safety net, guaranteeing that the necessary funds are available to cover expenses like property taxes, insurance premiums, or repairs. When all obligations are fulfilled, any remaining funds are typically returned to the buyer or applied towards future expenses.

Overall, understanding the escrow balance is essential when engaging in complex financial transactions.

Table of Contents

What Is Escrow Balance And Why Is It Important?

An escrow balance refers to the funds held by a third party to ensure smooth real estate transactions. It plays a crucial role in safeguarding the interests of both buyers and sellers. The escrow balance serves as a buffer, where the funds are collected and held until all the terms and conditions of the transaction are met.

This includes verifying the title, completing inspections, and fulfilling any contractual obligations. The purpose of the escrow balance is to protect the involved parties by minimizing the risk of financial loss and ensuring that all parties fulfill their obligations. It acts as a neutral party, holding funds until the transaction is finalized, providing security and peace of mind to all parties involved in the real estate transaction.

Understanding the escrow balance is important for anyone involved in real estate transactions, as it ensures transparency and trust in the process.

How Escrow Balance Is Calculated

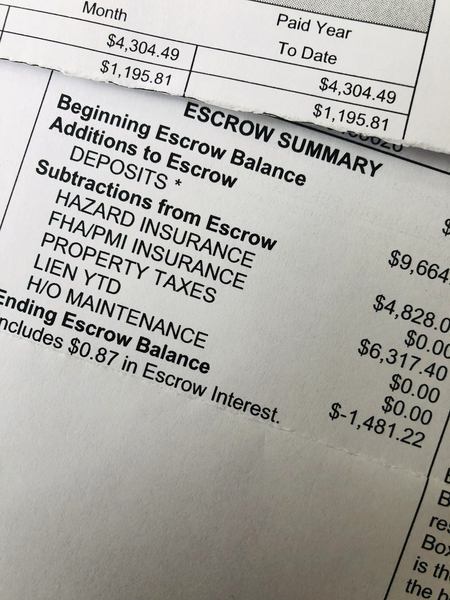

Escrow balance is the amount of funds held by a third party to cover expenses related to your mortgage. It is calculated by considering several components. These components include property taxes, homeowner’s insurance, and mortgage insurance premiums. Other factors that impact the escrow balance amount are changes in tax rates or insurance premiums.

The calculation method for determining the escrow balance involves adding up all the expenses and dividing it by the number of payments made per year. By maintaining a sufficient escrow balance, you ensure that the necessary funds are available to cover the expenses when they become due.

This helps to avoid any financial strain and ensures that your property taxes and insurance premiums are paid on time.

Common Questions About Escrow Balance

The escrow balance is the amount held by a third party, typically a lender, to cover upcoming property-related expenses. It can change over time due to fluctuations in insurance and tax payments. If there is a shortage in the escrow balance, the lender may require you to make up the difference.

To review and understand your escrow statement, carefully examine the breakdown of expenses, including insurance and taxes. Ensure that the amounts match what you expect to pay. Pay attention to any adjustments or changes in the escrow balance and contact your lender if you have any questions or concerns.

Understanding your escrow balance is essential for managing your homeownership expenses smoothly.

Understanding The Escrow Account

An escrow balance refers to the amount of money held in an escrow account. This account is established to hold funds that are used to pay expenses related to a property or transaction. The purpose of an escrow account is to ensure that these expenses are paid in a timely manner.

How does an escrow account work? When a transaction occurs, such as the sale of a house, the buyer will deposit money into the escrow account. The escrow agent then uses these funds to pay for expenses like property taxes and insurance premiums.

The escrow agent is responsible for managing the funds in the account and ensuring that they are used appropriately. Understanding the escrow account and its balance is important for both buyers and sellers in real estate transactions.

Managing And Maintaining The Escrow Balance

The escrow balance is an important aspect of managing your finances. It is crucial to keep it accurate and up-to-date. If you notice any discrepancies in your escrow balance, there are actions you can take to address them. One tip is to monitor and review your escrow account activity regularly.

By doing so, you can identify any errors or inconsistencies and take appropriate steps to rectify them. It’s important to stay proactive in managing and maintaining your escrow balance to ensure that it remains accurate and reflects the correct amount.

By following these tips, you can have a better understanding of your escrow balance and avoid any unnecessary complications.

Escrow Balance And Homeownership Costs

Escrow balance refers to the funds held by a third party on behalf of the homeowner. It is used to pay for property-related expenses. The relationship between escrow balance and homeowners insurance is crucial. The balance determines if there are sufficient funds to cover insurance premiums.

Similarly, the escrow balance affects property taxes. Having a low balance may result in a shortage when taxes are due. To ensure all costs are covered, homeowners must manage their escrow balance carefully. This includes accounting for other expenses like HOA fees.

By doing so, homeowners can avoid potential financial difficulties and ensure that their property-related costs are adequately covered.

Potential Challenges With Escrow Balance

The escrow balance refers to the amount of money held by a lender or mortgage servicer to pay for property taxes, insurance premiums, or other related expenses on behalf of the homeowner. However, there can be potential challenges associated with the escrow balance.

Homeowners may face common issues such as discrepancies or errors in their escrow account, which can lead to incorrect payments being made. To address such problems, it is essential to communicate with the lender or servicer, providing any necessary documentation or proof to rectify the situation.

Additionally, understanding the role of escrow analysis is crucial. This process involves a periodic review of the escrow account to determine if adjustments need to be made to the balance to ensure accurate payments. By keeping an eye on these aspects and taking proactive steps, homeowners can ensure their escrow balance remains accurate and avoids any potential issues.

Tips For Effective Escrow Balance Management

Effective escrow balance management is crucial for homeowners. Accurate calculation and maintenance strategies are essential. Timely communication with the escrow agent or mortgage lender is important. Homeowners can utilize resources and tools to manage their escrow balance effectively. By following these tips, homeowners can ensure smooth and reliable management of their escrow balance.

Credit: www.neighborhoodescrow.com

Frequently Asked Questions On What Is The Escrow Balance?

What Should My Escrow Balance Be?

The optimal escrow balance depends on your individual situation and mortgage terms.

Should I Pay Off My Escrow Balance?

Yes, it’s advisable to pay off your escrow balance to avoid potential penalties or increased costs.

Is Escrow Balance Money I Owe?

No, the escrow balance is not money you owe. It’s a separate account to cover future insurance and tax costs.

Why Would I Have An Escrow Balance?

An escrow balance is held to ensure funds are available for payments or refunds, providing security for both parties involved in a transaction.

Conclusion

Understanding the concept of the escrow balance is crucial for anyone involved in real estate transactions. Whether you are a buyer, seller, or lender, the escrow balance plays a significant role in ensuring a smooth and secure transaction. It serves as a safety net for both parties, guaranteeing that funds are available to cover future expenses such as property taxes and insurance premiums.

By maintaining a proper escrow balance, both buyers and lenders can have peace of mind knowing that financial obligations will be met in a timely manner. Monitoring your escrow balance regularly and staying informed about any changes can help avoid surprises and prevent financial hardships.

Overall, the escrow balance is an essential component of the real estate process, providing protection and stability for all parties involved.