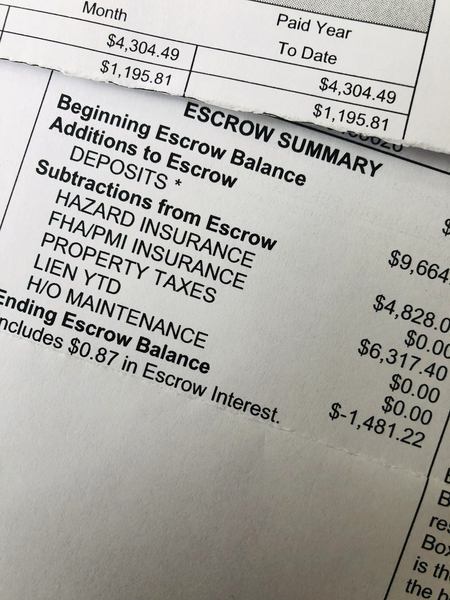

An escrow analysis is a review of your escrow account to determine if the current monthly deposit is enough to cover your annual expenses, such as property taxes and insurance. Escrow analysis ensures that you have enough funds to pay these expenses throughout the year.

This analysis takes into consideration changes in the account balance and annual expenses, and it may result in an adjustment to your monthly payment. It is crucial to understand the escrow analysis as it impacts your budget and financial planning.

We will explore the details of an escrow analysis, its significance, and how it affects homeowners. So, let’s delve into the world of escrow analysis and its role in accurately managing your housing expenses.

Table of Contents

How Escrow Analysis Benefits Homebuyers

Escrow analysis is a beneficial process for homebuyers. It provides a comprehensive overview of escrow accounts. Escrow analysis ensures that the funds collected through mortgage payments are allocated correctly. It calculates the actual amount needed for property taxes, insurance premiums, and other expenses.

By analyzing the escrow account annually, homebuyers avoid surprises and potential shortages. The analysis adjusts monthly payments to ensure they align with actual costs. This protects homebuyers from significant financial burdens and allows for better budgeting. Additionally, escrow analysis provides transparency and peace of mind.

Homebuyers can have a clear understanding of how their funds are being managed and allocated. Understanding escrow analysis is crucial for homeowners to effectively manage their finances and ensure a smooth homeownership experience.

The Importance Of Escrow Analysis

Escrow analysis is a vital process for homeowners. It helps avoid unexpected shortages in the escrow account, ensuring financial stability. Effective management of escrow payments is crucial to prevent any financial setbacks. By carefully analyzing escrow accounts, homeowners can identify any potential shortfalls and take proactive measures.

This analysis enables them to ensure that adequate funds are allocated for property taxes, homeowners insurance, and other expenses. Taking timely action can prevent the burden of unexpected escrow shortages and provide peace of mind. Homeowners must closely monitor their escrow accounts and review them regularly to avoid any financial surprises.

Proactive management of escrow payments is key to maintaining stability and financial well-being in homeownership.

Factors Impacting Escrow Analysis

Escrow analysis is influenced by various factors like changes in property taxes, insurance premiums, and assessments. Fluctuations in property taxes can impact your escrow analysis by increasing or decreasing the monthly escrow payment. Similarly, changes in insurance premiums can also affect your escrow analysis, causing adjustments to be made based on the updated premium amount.

Additionally, assessments, such as those for community improvements or special projects, can impact your escrow analysis by increasing or decreasing the amount set aside in your escrow account. These factors should be carefully considered and reviewed periodically to ensure that your escrow analysis accurately reflects any changes in expenses related to your property.

Regular monitoring of these factors will help you maintain a well-managed escrow account.

Credit: www.neighborhoodescrow.com

Frequently Asked Questions For Escrow Analysis

How Is Escrow Analysis Calculated?

Escrow analysis is calculated by adding up property taxes, insurance premiums, and other escrow fees and dividing by 12 months.

Why Is My Escrow Analysis So High?

Your escrow analysis may be high due to changes in property taxes or insurance premiums.

Why Did My Mortgage Go Up After Escrow Analysis?

Your mortgage increased after escrow analysis because of changes in insurance, taxes, or other fees.

What Happens After Escrow Analysis?

After escrow analysis, adjustments may be made to your monthly mortgage payments to ensure accurate tax and insurance payments.

Conclusion

Understanding the concept of escrow analysis is crucial for both homeowners and lenders. It ensures that the right amount of money is being placed into the escrow account to cover property taxes and insurance costs. By conducting regular escrow analysis, homeowners can avoid unexpected shortfalls or overages in their escrow accounts and have peace of mind knowing that their bills will be paid in a timely manner.

Lenders also benefit from escrow analysis as it allows them to accurately calculate monthly mortgage payments and ensure that the correct amount is collected from homeowners. Remember that escrow analysis is not a one-time process but rather an ongoing evaluation to ensure financial stability.

So, stay informed and work with your lender to optimize your escrow account and manage your expenses effectively.