Capital budgeting is the process of making decisions about investments in long-term assets for a company. The goal of capital budgeting is to find projects that will increase the value of the firm and create shareholder wealth.

There are several methods that can be used in capital budgeting, including net present value, internal rate of return, and payback period.

Each method has its own advantages and disadvantages, so it is important to understand all of them before making any investment decisions.

The most important thing to remember when doing capital budgeting is that future cash flows are estimated and therefore subject to uncertainty. This means that there is always some risk involved in any investment decision, but this risk can be minimized by using careful analysis and sound judgment.

As a business owner, you’re always looking for ways to invest in your company and ensure its long-term success. One of the most important aspects of this is capital budgeting. Capital budgeting is the process of allocating funds for major investments, such as new equipment or facilities.

There are a few different methods you can use to approach capital budgeting. The most common is the payback period method, which looks at how long it will take for an investment to “pay back” its initial cost. Another popular method is the net present value (NPV) method, which takes into account the time value of money when making investment decisions.

Whichever method you choose, capital budgeting is an important tool for ensuring that your business makes smart, profitable investments.

Table of Contents

Capital Budgeting

Capital budgeting is a process used by organizations to determine which long-term investments or projects are worth Pursuing. These investments could include things like new facilities, equipment, products, or processes.

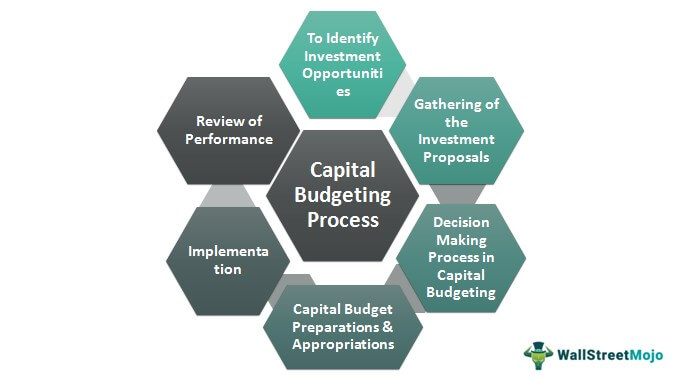

The goal of capital budgeting is to ensure that an organization’s limited resources are being used in the most efficient way possible. There are several steps involved in capital budgeting:

- 1. Defining the project scope and objectives

- 2. Identifying potential projects

- 3. estimating the costs and benefits of each project

- 4. Evaluating the risks associated with each project

- 5. Selecting the most feasible option

- 6. Implementing and monitoring the chosen project

- 7. Reviewing results and modifying plans as necessary

Organizations use different methods to evaluate potential projects and make decisions about which ones to pursue. Some common methods include net present value (NPV), internal rate of return (IRR), payback period, and profitability index (PI). Each method has its own advantages and disadvantages, so it’s important for organizations to choose the one that best fits their needs.

Which method you use will also affect how you calculate your estimates—you’ll need different information if you’re using NPV vs IRR, for example. But in general, you’ll need to consider both financial and non-financial factors when making your calculations.

Credit: www.wallstreetmojo.com

What are the Methods of Capital Budgeting?

There are three methods of capital budgeting: the payback method, the net present value method, and the internal rate of return method.

The payback method is a simple capital budgeting technique that calculates how long it will take for an investment to “pay back” its initial cost. The payback period is determined by dividing the initial investment by the annual cash flows from the project.

One advantage of using payback period is that it’s relatively easy to calculate; however, a major disadvantage is that it doesn’t take into account the time value of money like NPV and IRR do.

The net present value (NPV) method is a more sophisticated capital budgeting technique that takes into account the time value of money. NPV calculations discount future cash flows back to their present value, and then compare this number to the initial investment. If the NPV is positive, then the investment should be accepted; if it is negative, then it should be rejected.

The internal rate of return (IRR) is another popular capital budgeting technique that also takes into account the time value of money. IRR calculations find the interest rate at which an investment’s NPV equals zero – in other words, it’s the “hurdle rate” that an investment must clear in order to be accepted. Like NPV, if an investment’s IRR exceeds its required rate of return, then it should be accepted; if not, it should be rejected.

The advantage of using IRR over other methods is that it takes into account the time value of money by discounting all future cash flows from an investment at a specific interest rate.

What is Capital Budgeting And Types?

There are several different methods that can be used in capital budgeting, each with its own advantages and disadvantages.

Some of the most common methods include net present value, internal rate of return, and payback period. Net present value (NPV) is one of the most popular methods for evaluating capital projects or investments. NPV takes into account the time value of money by discounting all future cash flows from an investment at a specific interest rate.

The NPV method essentially estimates how much an investment is worth today based on its expected future cash flows. The internal rate of return (IRR) method is another common technique for analyzing capital projects or investments. IRR measures the expected percentage return on an investment over its lifetime.

Payback period is another commonly used method for evaluating capital projects or investments. Payback period simply measures how long it will take for an investment to “pay back” its initial cost.

Conclusion

Capital budgeting is a process of allocating resources to long-term investments. The purpose of capital budgeting is to determine whether an investment will generate enough return to justify the initial cost. The decision rule for capital budgeting is simple: if the present value of cash flows from an investment exceeds the cost of that investment, then it should be accepted; if not, it should be rejected.

However, there are many factors that can complicate this decision rule, such as risk and uncertainty. As a result, businesses often use different methods to evaluate investments, such as net present value and internal rate of return.