When it comes to estate planning, one of the key roles is that of a trustee. A trustee is an individual or entity that holds the legal title of assets on behalf of another person or group. They play a crucial role in managing and administering the assets as per the terms outlined in the trust document. In this article, we will delve into the responsibilities, duties, and significance of a trustee in estate planning.

Table of Contents

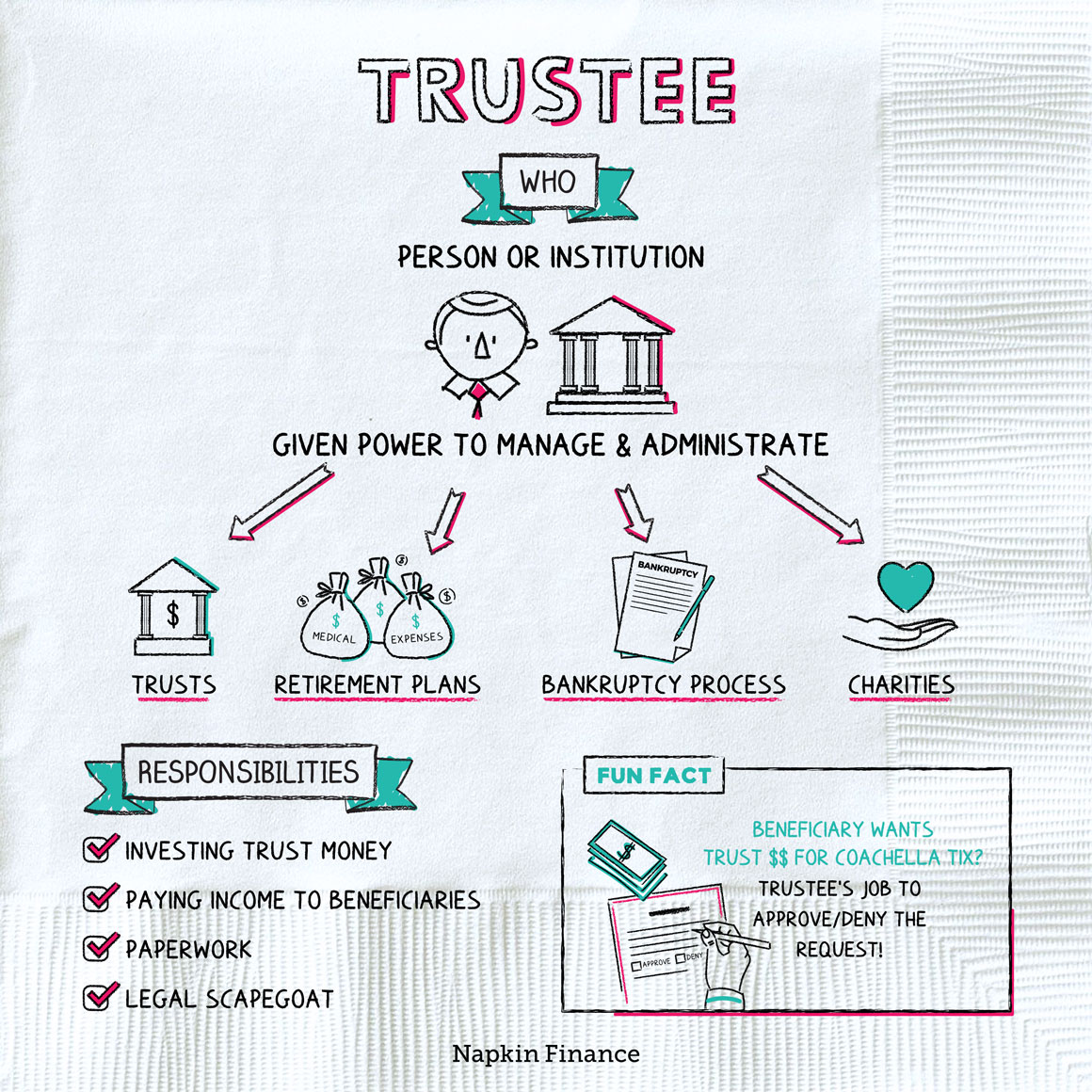

Responsibilities of a Trustee

Being a trustee comes with a set of important responsibilities that require careful attention and adherence to the trust’s provisions. Some of the primary responsibilities of a trustee include:

- Managing the assets held in the trust

- Investing the trust assets prudently

- Distributing income and principal to the beneficiaries

- Keeping accurate records and providing regular reports

- Filing taxes on behalf of the trust

- Acting in the best interest of the beneficiaries

These responsibilities are vital to ensuring that the intentions of the person creating the trust, known as the grantor, are carried out effectively and in accordance with the trust’s terms.

Duties of a Trustee

In addition to the specific responsibilities, a trustee also has certain fundamental duties that serve as the foundation of their role. These duties typically include:

- Prudent administration of the trust

- Loyalty to the beneficiaries

- Impartiality in dealing with multiple beneficiaries

- Proper management of trust assets

- Regular communication with beneficiaries

These duties embody the trustee’s obligation to act in the best interests of the beneficiaries and to carry out their fiduciary duties with the utmost care and diligence.

Credit: napkinfinance.com

:max_bytes(150000):strip_icc()/Trust_Final_4187588-1f106d576ccb468abf04872f4a866e86.jpg)

Credit: www.investopedia.com

Significance of a Trustee in Estate Planning

The role of a trustee is of paramount importance in estate planning for several reasons. Firstly, a trustee serves as a crucial link between the grantor and the beneficiaries, ensuring that the grantor’s wishes are fulfilled and the beneficiaries’ needs are met. This intermediary role helps in maintaining the continuity and integrity of the trust arrangement.

Furthermore, a trustee’s management of the trust assets can have a lasting impact on the financial well-being of the beneficiaries. By making sound investment decisions and prudently administering the trust, a trustee can contribute to the long-term financial security of the beneficiaries.

Moreover, in cases where beneficiaries may not have the financial acumen or capability to manage the trust assets themselves, the trustee’s expertise and oversight become indispensable in safeguarding and growing the trust assets for the beneficiaries’ future benefit.

Choosing the Right Trustee

Given the critical nature of the trustee’s role, the selection of the right trustee is a decision that requires careful consideration. The ideal trustee should possess a blend of integrity, financial acumen, and a commitment to upholding the terms of the trust.

While some individuals may opt to name a family member or friend as their trustee, others may choose a professional trustee, such as a corporate trustee or a trust company. Each option has its own set of advantages and considerations, and the choice often depends on the specific needs and dynamics of the trust and the beneficiaries.

Frequently Asked Questions On Trustee

Faq 1: What Is A Trustee And What Do They Do?

A trustee is a person or institution appointed to manage and administer assets on behalf of beneficiaries. They have a legal responsibility to act in the best interests of the beneficiaries and make decisions in line with the trust’s objectives.

Faq 2: How Do I Choose The Right Trustee?

When selecting a trustee, it is important to consider their financial expertise, integrity, and ability to carry out fiduciary duties. Look for someone who understands your goals and values, and has a track record of successful trust management.

Faq 3: Can I Be My Own Trustee?

Yes, as long as you meet the eligibility requirements set by the law. Being your own trustee gives you control over your assets and allows you to make decisions based on your own objectives. However, it’s essential to understand the legal responsibilities that come with being a trustee.

Conclusion

In conclusion, the trustee plays a pivotal role in estate planning by responsibly managing and administering trust assets for the benefit of the beneficiaries. Their fiduciary duties, coupled with the significance of their role in maintaining the integrity of the trust, underscore the importance of selecting the right trustee and ensuring that they are equipped to carry out their responsibilities effectively. By understanding the role of a trustee in estate planning, individuals can make informed decisions to safeguard their legacy and the financial security of their loved ones.