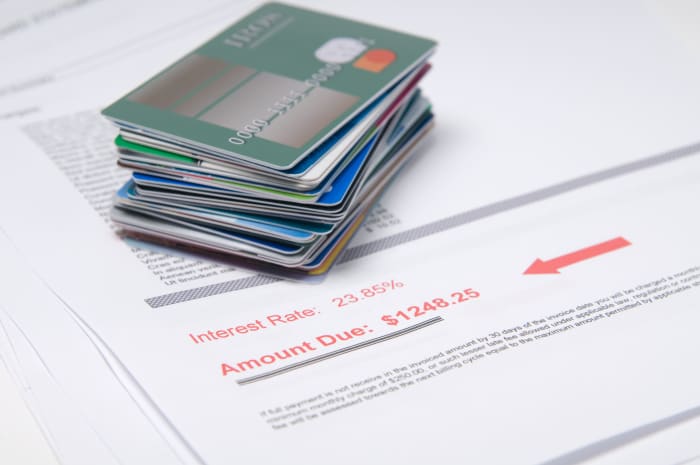

Tricks to pay off credit cards faster include making extra payments and prioritizing high-interest debt. Paying off credit cards quickly can help save money on interest charges and improve overall financial well-being.

We will explore a variety of strategies and tips that can help individuals pay off their credit card debt more efficiently. By implementing these tricks, individuals can take control of their finances and achieve their goal of becoming debt-free. Whether it’s creating a budget, using balance transfer cards, or seeking professional help, there are numerous approaches to pay off credit card debt faster.

Let’s dive in and explore these strategies in detail.

Credit: www.linkedin.com

Table of Contents

1. Prioritize High-interest Debt

Pay off your credit cards faster by prioritizing high-interest debt. Start by paying off the cards with the highest interest rates first to save money and become debt-free sooner.

When it comes to paying off credit card debt, it’s important to have a strategy in place. One of the most effective tricks is to prioritize high-interest debt. By tackling your high-interest cards first, you can save a significant amount of money on interest payments in the long run. Here are some practical steps to help you get started:Pay Off High-interest Cards First

Start by identifying the credit cards with the highest interest rates. These are the ones that are costing you the most money in interest charges each month. By focusing on paying off these high-interest cards first, you can make a significant dent in your overall debt. To do this, carefully examine your credit card statements and make a list of the interest rates associated with each card. Once you have this information, prioritize your payments accordingly. Allocate the majority of your available funds towards paying off the card with the highest interest rate while making minimum payments on the others.Consider Balance Transfers

In addition to prioritizing high-interest debt, another trick to pay off credit cards faster is by considering balance transfers. A balance transfer involves moving the balance from one credit card to another with a lower interest rate. This can be a savvy move if you can secure a promotional interest rate and if the new card offers favorable terms. When considering a balance transfer, be sure to read the fine print and understand any fees or charges associated with the transfer. Additionally, pay attention to the promotional interest rate period to ensure you can realistically pay off the debt within that timeframe. It’s important to note that a balance transfer alone won’t solve your debt problem. It’s merely a tool to help you save money on interest charges. Once you transfer the balance, make a plan to pay off the debt as quickly as possible. By prioritizing high-interest debt and considering balance transfers, you can accelerate your journey towards becoming debt-free. These tricks can help you save money on interest payments and provide a clear roadmap for paying off credit cards faster. Remember to stay disciplined in your approach, stick to your repayment plan, and celebrate each milestone along the way.2. Create A Budget And Stick To It

Creating a budget is a crucial step towards paying off your credit cards faster. It helps you gain control of your finances and enables you to allocate your money wisely. A budget ensures that you are aware of your expenses, income, and debt obligations, making it easier to track your progress and stay on top of your financial goals.

Track Your Expenses

Tracking your expenses is the first step to creating an effective budget. It allows you to understand where your money is going and identify areas where you can cut back. By keeping a record of every purchase you make, whether it’s a cup of coffee or a monthly subscription, you can pinpoint patterns and habits that might be draining your funds unnecessarily.

Identify Areas To Cut Back

Once you have a clear picture of your expenses, it’s time to identify areas where you can make cuts. Look for non-essential expenditures that you can minimize or eliminate. For example, consider packing your lunch instead of eating out every day or cancelling unused memberships or subscriptions. These small adjustments can add up over time and free up more money to put towards paying off your credit card debt.

Allocate Extra Funds Towards Debt

Now that you have identified areas to cut back, it’s time to allocate the extra funds towards your credit card debt. Create a separate category in your budget specifically for debt repayment. Calculate how much extra money you have available each month and allocate a portion of it towards paying off your credit cards. By prioritizing debt repayment and sticking to this plan, you can accelerate your progress and become debt-free sooner.

Remember, creating a budget is just the first step. To effectively pay off your credit cards faster, you need to stick to your budget consistently. Avoid unnecessary expenses, stay disciplined, and remain focused on your goal of becoming debt-free. With proper planning and dedication, you can regain control of your finances and achieve financial freedom.

3. Increase Your Income

Pay off your credit cards faster and increase your income with these proven tricks. Boost your financial stability and minimize debt by implementing effective strategies that will help you achieve your goals sooner.

One effective way to pay off your credit cards faster is to increase your income. By earning more money, you’ll have more funds to dedicate towards paying down your credit card balances. Here are three strategies you can implement:

Take On Additional Work

If you’re looking for a quick way to boost your income, consider taking on additional work. This could involve picking up extra shifts at your current job, freelancing, or finding part-time employment. By putting in extra hours, you’ll be able to earn more money, which can be used to make larger payments towards your credit cards.

Start A Side Hustle

An alternative option is to start a side hustle. This could involve turning a hobby or passion into a profitable venture. For example, if you’re skilled at crafting, you could sell your handmade items online. Starting a side hustle not only provides an extra income stream but can also be a fulfilling way to explore your interests and talents.

Negotiate A Raise

Don’t underestimate the power of a negotiation. If you believe you deserve a raise at your current job, take the initiative and discuss the possibility with your employer. Prepare a compelling case that highlights your accomplishments, contributions, and the value you bring to the company. Remember, a higher salary means more money you can allocate towards your credit card payments.

Incorporating one or more of these strategies can significantly accelerate your journey towards becoming debt-free. By taking steps to increase your income, you’ll have the financial means to pay off your credit cards faster.

Credit: www.marketwatch.com

4. Use Strategies To Reduce Interest

Reduce the interest on your credit cards and pay them off faster with these effective strategies. By employing smart techniques, you can save money and accelerate your debt repayment journey.

Negotiate Lower Interest Rates

One effective strategy to reduce the interest on your credit cards is to negotiate with your credit card company for lower interest rates. Many people are unaware that this is a possibility, but it can make a significant difference in the amount you end up paying in interest.

You can start by calling your credit card company and asking to speak with a representative who can help you with lowering your interest rate. Be prepared to explain your situation and provide reasons why you believe you deserve a lower rate. Perhaps you have been a loyal customer for many years, or you have consistently made timely payments.

It’s important to note that this strategy may not always be successful, but it’s definitely worth a try. If you are able to negotiate a lower interest rate, it can save you a substantial amount of money over time.

Consolidate Debt

Another strategy to consider when trying to reduce interest on your credit cards is to consolidate your debt. Debt consolidation involves combining multiple credit card balances into one loan or credit line with a lower interest rate.

This can be done through various methods, such as transferring your balances to a new credit card with a lower interest rate or taking out a personal loan to pay off your credit card debts. The goal is to secure a loan or credit line with a lower interest rate than what you are currently paying.

By consolidating your debt, you simplify your financial situation and potentially save money on interest charges. However, it’s crucial to be disciplined and avoid incurring additional debt after consolidating.

Summary

Reducing the interest on your credit cards is an essential step in paying them off faster. Negotiating with your credit card company for lower interest rates and consolidating your debt are two popular strategies that can help you achieve this goal.

If you are successful in negotiating lower interest rates or consolidating your debt, make sure to continue making regular payments and avoid falling into the same debt trap again. With dedication and perseverance, you can become debt-free faster and save money in the long run.

Credit: bowaterecu.org

Frequently Asked Questions Of Tricks To Pay Off Credit Cards Faster

What Are 3 Ways To Pay Off Credit Card Debt Fast?

To pay off credit card debt fast, consider these three strategies: 1. Increase your monthly payments to tackle the debt quicker. 2. Prioritize high-interest cards and pay them off first. 3. Seek a balance transfer card or personal loan with lower interest rates to consolidate and manage the debt efficiently.

How To Pay Off $3 000 In 6 Months?

To pay off $3,000 in 6 months, follow these steps: 1. Create a budget to track your income and expenses. 2. Cut back on unnecessary expenses and save as much as you can. 3. Consider picking up a side hustle to increase your income.

4. Use the extra money to make larger payments towards your debt. 5. Stay committed and remain disciplined to reach your goal within the timeframe.

What’s The Smartest Way To Pay Off A Credit Card?

The smartest way to pay off a credit card is by creating a budget, reducing expenses, and allocating extra funds towards the highest interest rate card first. Make regular payments and consider transferring balances to a card with a lower interest rate if possible.

What Is The Fastest Way To Pay Credit Card Bill?

The fastest way to pay your credit card bill is by making an online payment through your bank’s website or mobile app. Just log in, select your credit card account, and make a one-time payment. This method is quick, convenient, and secure.

Conclusion

Paying off credit card debt can feel like a daunting task, but with the right tricks and strategies, it is possible to achieve financial freedom faster. By implementing these tips such as creating a budget, prioritizing high-interest cards, and considering balance transfers, you can take control of your debt and work towards a debt-free future.

Remember, consistency and discipline are key in this journey towards financial wellness. Start now and watch your debt decrease as you pave the way for a brighter financial future.