When it comes to retirement, there are a lot of myths out there. Perhaps the most prevalent one is that retirement is a time when you can finally relax and enjoy your golden years. Unfortunately, this simply isn’t true for most people.

For many, retirement is a time of financial insecurity. With rising costs of living and limited Social Security benefits, many seniors are struggling to make ends meet.

There are many myths about retirement planning that can lead people astray. Here are 20 of the most common myths and why you should avoid them:

Table of Contents

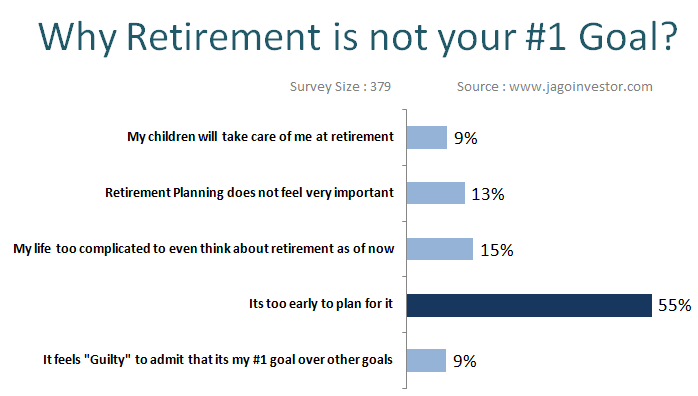

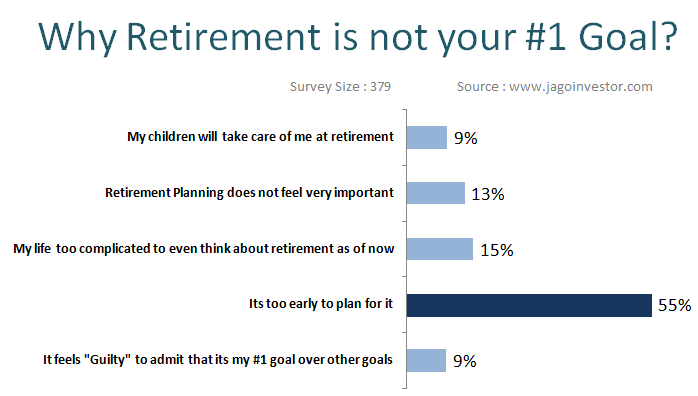

1. It’s a “Selfish” Goal

Some people are so much caring to others and careless to themselves that they find planning retirement is selfish.

2. It’s too early to plan

The sooner you start saving for retirement, the better off you’ll be. That’s because compound interest will have more time to work its magic and grow your nest egg. If you wait until later in life to start saving, you’ll likely end up having to save much more money each month to catch up.

Not having a clear plan is another mistake that people often make when planning for retirement. It’s important to know how much money you’ll need to have saved in order to cover your expenses during retirement. Without a plan, it can be difficult to stay on track and make progress towards your goal.

The sooner you start saving for retirement, the better off you will be. Even if you can only afford to put away a small amount each month, it will add up over time.

3. Investing Too Conservatively

Many people are risk-averse when it comes to investing their retirement savings. While it’s important to be mindful of preserving your hard-earned money, investing too conservatively can actually do more harm than good in the long run.

Why? Because inflation will erode the value of your savings if they’re not invested in assets that have the potential to grow over time. As such, it’s important to strike a balance between safety and growth when choosing investments for your retirement portfolio.

Over time, the cost of living will almost certainly go up, but your income may not keep pace. This means that the purchasing power of your retirement savings will decrease unless you take steps to account for inflation. Investing too conservatively is another potential mistake.

If you invest too conservatively, you may not earn enough growth on your investments to keep up with inflation or reach your long-term financial goals. On the other hand, investing too aggressively can be risky and lead to losses if the markets take a downturn. Finally, another common mistake is withdrawing money from retirement accounts before age 59½ without paying the 10% early withdrawal penalty.

While there are some exceptions (such as using the money for qualifying medical expenses), generally speaking, it’s best to leave your retirement savings untouched until you reach retirement age.

4. Underestimating Longevity Risk

One of the biggest risks facing retirees is outliving their savings. This is especially true for women, who tend to live longer than men on average.

If you don’t plan carefully, it’s easy to underestimate how long your retirement might last and end up running through all of your savings too early. So, avoid this myth of living a few years and accumulate assets support to you in longer life ahead.

5. I’ll Delay Saving For Retirement Until Later When It’s Easier

6. Investing is too complicated and risky

7. not able to visualize the “Retirement” goal

8. Not able to save enough money

Not saving enough money is one of the biggest mistakes that people make. Other common mistakes include not having a clear plan, not diversifying your investments, and taking on too much debt.

Saving enough money for retirement is crucial, but it’s not always easy. A lot of people procrastinate when it comes to saving for retirement, and by the time they’re ready to retire, they don’t have nearly enough saved up. It’s important to start saving early and to make sure you’re contributing enough to reach your goals.

9. Not contributing enough to your retirement savings –

If you want to have a comfortable retirement, you need to make sure that you are putting away enough money each month. A good rule of thumb is to try and contribute at least 10% of your monthly income.

10. Withdrawing from your retirement account too early

It is important to resist the temptation of tapping into your retirement savings before you reach retirement age. Doing so can significantly reduce the amount of money that you have available later on in life.

11. They see their kids as retirement corpus

12. My Spouse Will Take Care Of My Retirement

13. Social security will take care of retirement needs

14. My Company Or Government Will Take Care Of My Retirement,

My Company And Medicare Will Take Care Of My Health Insurance Needs During Retirement

15. Need less income after retirement

16. Medicare will cover all health expenses

Failing to plan for healthcare costs One of the biggest expenses in retirement is healthcare costs, yet many people fail to plan for this expense adequately . Healthcare costs can include insurance premiums , out-of-pocket expenses , long-term care , and prescription drugs .

If you’re not covered by Medicare , health insurance can be very expensive . Long-term care insurance is another important consideration , especially if you want to avoid becoming a burden on your family .

17. Work until full retirement age

18. Inheritance will cover the retirement needs

19. Rely on Bonds than Equity

Diversifying your investments is also important in retirement planning. Having all of your eggs in one basket is risky, and if something happens to the investment you’ve put all of your money into, you could be left without anything. Diversifying helps protect you against loss and gives you a better chance of seeing returns on your investment over time. Diversification is key when investing for retirement (or really any other goal). By investing in a variety of asset classes, you can help reduce the risk of losing money in any one particular investment.

20. Making poor spending decisions in retirement.

Just because you’re retired doesn’t mean you can suddenly start living like there’s no tomorrow. It’s important to be mindful of your spending in retirement so that your savings last as long as possible.

Lower tax bracket after retirement

Retirement Planning Myth Bonus: Retirement Planning Is All About Money

7 Mistakes to Avoid in Retirement

There are a number of risks that come along with retirement, and it’s important to be aware of them before making the decision to retire. 1. Financial insecurity: One of the biggest risks of retirement is financial insecurity. Without a regular paycheck coming in, it can be difficult to make ends meet and cover all your expenses.

This is why it’s so important to have a solid financial plan in place before you retire.

2. Health problems: Another risk to consider is your health. As we age, our health can decline and we become more susceptible to chronic illnesses and injuries.

This can make retirement much more difficult and expensive if you’re not prepared for it.

3. Loneliness: Retirement can also be quite lonely for some people. If you don’t have a strong social network or close relationships, you may find yourself feeling isolated and alone after retiring from work.

4. Boredom: Some people also find retirement quite boring without the structure and routine of work life. It’s important to have hobbies or activities lined up that will help keep you mentally stimulated during your retirement years.

5 . Risk of long-term care needs: Finally, another risk associated with retirement is the need for long-term care services such as nursing home care or in-home caregiving services. This can be very costly and stressful for both retirees and their families. Overall, there are a number of risks to consider before retiring.

6. Financial Stress: Money woes are one of the biggest sources of stress for retirees.

7. Not Having a Plan: It’s important to have a solid plan for retirement, both financially and emotionally.

Without a plan, it’s easy to get off track and end up stressed out or worse off than you intended.

However, by being aware of these risks, you can take steps to mitigate them and still enjoy a happy, healthy, and fulfilling retirement.

What is the 4 Rule Retirement?

The 4% rule is a guideline for retirement spending that says you can withdraw 4% of your portfolio each year in retirement and not run out of money.

The rule is based on the work of William Bengen, a financial planner who published a study in 1994 in which he found that a portfolio consisting of 50% stocks and 50% bonds would support withdrawals of up to 4% annually for 30 years, adjusted for inflation, without running out of money.

Bengen’s study has been widely cited by financial planners as evidence that retirees can safely withdraw 4% of their portfolios each year.

However, some critics argue that the 4% rule is too conservative and doesn’t allow for enough flexibility in retirement spending.

If you’re using the 4% rule to plan your retirement, there are a few things to keep in mind. First, the rule is based on historical data and may not be accurate if future market conditions are different from what they’ve been in the past.

Second, the rule assumes you’ll invest equally in stocks and bonds, but you may want to adjust your asset allocation depending on your risk tolerance. Finally, remember that the 4% rule is just a guideline – you may need to adjust your spending up or down depending on how long you live or what unexpected expenses come up in retirement.

What Should You Not Do When You Retire?

When you retire, there are a few things you should avoid doing in order to make the most of your golden years. Here are four things you should steer clear of:

1. Don’t skimp on your health insurance

One of the biggest mistakes you can make when you retire is to skimp on your health insurance. Even if you’re healthy now, it’s important to have comprehensive coverage in case anything happens down the road. No one knows what the future holds, so it’s best to be prepared with a good health insurance plan.

2. Don’t forget about long-term care insurance Another type of insurance that’s important for retirees is long-term care insurance. This will help cover the costs of nursing home care or other types of assistance if you need it later in life.

It’s something that many people don’t think about, but it can be vital in ensuring that you have the resources you need as you age.

3. Don’t withdraw money from your retirement accounts too early It can be tempting to cash out your retirement savings when you first retire, but this is usually not a good idea.

Withdrawing money from your account too early can trigger taxes and penalties, and it also means that your money won’t have as much time to grow. If possible, wait until later in retirement to start tapping into those savings so that they can last longer.

4. Don’t neglect your estate planning documents

Finally, don’t forget to update your estate planning documents once you retire. This includes things like wills, trusts, and power of attorney forms.

How Much to Retire at 60

If you’re looking to retire at 60, there’s a good chance you’ll need to have saved up quite a bit of money. How much exactly? It depends on several factors, including how much money you’ll need to cover your expenses and how long you expect to live in retirement.

Assuming you want to retire comfortably and have your nest egg last as long as possible, most financial experts recommend saving enough money to cover about 80% of your pre-retirement income. So, if you currently earn 20,00,000 per year, you should aim to have around 16,00,000 per year in retirement income. Of course, this is just a general guideline – the actual amount you’ll need will depend on your specific situation.

If you have lower living expenses or are in good health and expect to live a longer than average life span, you may be able to get by with less than 80%. On the other hand, if your costs are high or your health is not great, you may need even more than 80%. The best way to figure out how much money you’ll need in retirement is to sit down and do some serious planning.

There are a number of online calculators that can help you estimate how much money you’ll need in retirement based on different factors like inflation rates and life expectancy. Once you’ve got a ballpark figure for how much income you’ll need each year, start working on ways to make it happen. If saving up that much seems daunting (or impossible), don’t despair – there are plenty of ways to make it easier.

Start by taking advantage of any employer matching programs for 401(k)s or other retirement accounts. Every little bit helps!

Is 20 Million Enough to Retire

When it comes to retirement, there is no magic number. But for many people, 2 million is enough to comfortably retire. Here’s a look at why 20 million may be enough for you:

1. You can live off the interest If you have 20 million saved for retirement, you can expect to withdraw about 8,00,000 per year (assuming a 4% interest rate). That should cover your basic living expenses and leave you with some extra cash to enjoy your golden years.

2. You’ll have other sources of income In addition to your savings, you’ll likely have other sources of income in retirement, such as Social Security or a pension. This will help supplement your savings and give you more financial security in retirement.

3. Your costs will go down in retirement Once you retire, your costs are likely to go down significantly. You’ll no longer need to save for retirement, so you can use that extra money to pay off debts or fund other goals.

And, if you own your home outright, your housing costs will decrease as well. All of this means that 20 million may be more than enough to support yourself in retirement.

Conclusion

Retirement planning is a complex process, and there are many myths and mistakes that can trip people up. This blog post looks at some of the most common retirement planning myths and mistakes, including the belief that you don’t need to start saving for retirement until you’re in your 30s, that Social Security will be enough to cover your costs, and that you shouldn’t concern yourself with estate planning. The reality is that retirement planning requires careful consideration and a solid understanding of the various factors involved.

If you want to ensure a comfortable retirement, it’s important to start early, plan carefully, and avoid making these common mistakes.