In the world of finance, the term “Red-Herring Prospectus” often surfaces in the context of initial public offerings (IPOs). This document plays a significant role in the process of offering securities to the public. Understanding the intricacies of a Red-Herring Prospectus is essential for both investors and companies looking to go public.

Credit: www.yumpu.com

Table of Contents

What is a Red-Herring Prospectus?

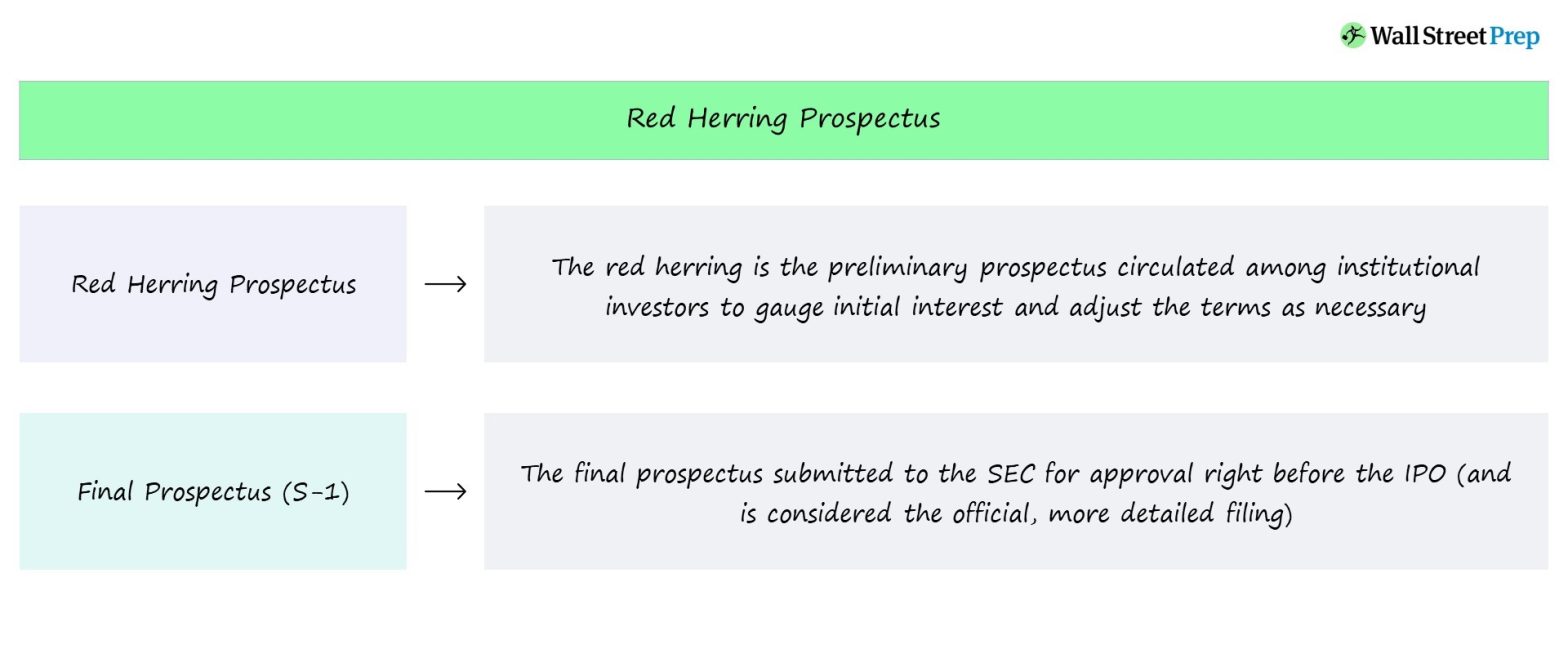

A Red-Herring Prospectus, also known as a preliminary prospectus, is a document filed with the Securities and Exchange Commission (SEC) by a company that intends to issue securities through an IPO. This document provides essential information to potential investors about the company, its business operations, financial performance, and the securities being offered.

One unique aspect of the Red-Herring Prospectus is that it does not include the offering price or the number of shares being offered. Hence, the term “Red-Herring” emphasizes that the document is not complete and is subject to further details, which are omitted intentionally at the time of the initial filing.

Key Components of a Red-Herring Prospectus

To provide a comprehensive view, a Red-Herring Prospectus typically includes various sections such as:

- Company Overview

- Business Operations and Strategy

- Financial Performance and Projections

- Risk Factors

- Management and Directors

- Corporate Governance

- Legal and Regulatory Information

- Use of Proceeds from the Offering

- Underwriting Information

- Other Pertinent Details

These sections aim to provide potential investors with a holistic understanding of the company’s background, the industry in which it operates, its competitive landscape, and the associated risks and opportunities.

Importance of the Red-Herring Prospectus

For investors, the Red-Herring Prospectus serves as a valuable source of information to evaluate the investment opportunity. By reviewing the details presented in the document, investors can make informed decisions about whether to participate in the IPO and at what price.

From the company’s perspective, the Red-Herring Prospectus acts as a marketing tool to generate interest and attract potential investors. It allows the company to present its business model, growth prospects, and financial position in a transparent manner, thereby building credibility among the investing community.

The Process of Finalizing the Prospectus

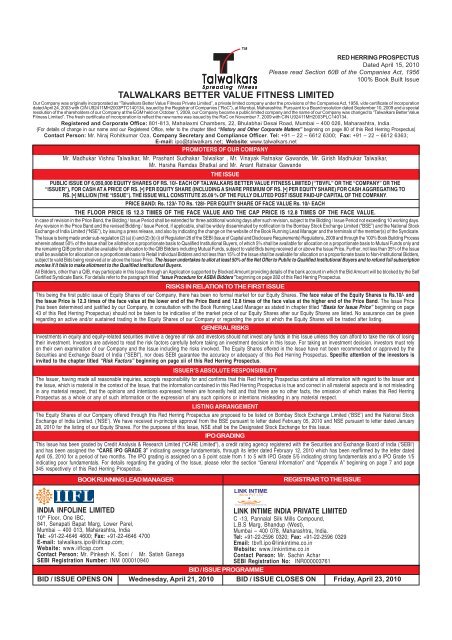

After the initial filing of the Red-Herring Prospectus, the company and its underwriters engage in a roadshow to promote the upcoming offering to institutional investors. During this period, known as the “waiting period,” the SEC conducts a thorough review to ensure compliance with disclosure requirements.

Following the SEC’s review and any necessary amendments, the final offering price and the number of shares offered are determined and included in the document. At this stage, the Red-Herring Prospectus is no longer “red-herring” and becomes the final prospectus, ready for distribution to potential investors.

Credit: www.futuhk.com

Frequently Asked Questions Of What Is A Red-herring Prospectus?

What Is A Red-herring Prospectus?

A red-herring prospectus is a preliminary document filed by a company before an IPO, providing essential information about the company’s offerings, risks, and financials.

How Is A Red-herring Prospectus Different From A Prospectus?

A red-herring prospectus is a preliminary document, while a prospectus is the final version that includes the offer price and the opening and closing dates of the IPO.

Why Is It Called A Red-herring Prospectus?

The term “red-herring” refers to a decoy or distraction. In the context of an IPO, it conveys that the document does not contain the final offer price or date, serving as a precaution to prevent potential investors from making uninformed decisions.

Conclusion

In the realm of capital markets, the Red-Herring Prospectus plays a pivotal role in the IPO process, providing critical information to both investors and companies. It serves as a bridge between the company seeking to go public and the investing public, facilitating transparency and informed decision-making.

Understanding the contents and significance of the Red-Herring Prospectus is fundamental for anyone involved in the financial markets, facilitating the efficient allocation of capital and contributing to the overall functioning of the economy.