Dealing with debt collectors can be stressful. You might wonder, “Should I pay a debt collector?” This guide will help you make an informed decision. Let’s dive in and understand your options.

:max_bytes(150000):strip_icc()/what-happens-if-you-dont-pay-a-collection-960591-v3-5bbe02b546e0fb00510fde7e.png)

Credit: www.thebalancemoney.com

Table of Contents

What is a Debt Collector?

A debt collector is a person or company that collects debts. They usually work on behalf of creditors. Sometimes, they buy debts from other companies. Their job is to get you to pay what you owe.

Understand Your Rights

You have rights when dealing with debt collectors. Knowing these rights can help you. Here are some key points:

- Debt collectors must treat you fairly.

- They cannot harass or threaten you.

- They must provide proof of the debt.

- You have the right to dispute the debt.

Steps to Take Before Paying

Before you decide to pay, follow these steps:

1. Verify The Debt

First, make sure the debt is real. Ask the collector for proof. They must provide details about the debt. This includes the amount owed and the original creditor.

2. Check The Statute Of Limitations

Debts have a time limit called the statute of limitations. After this time, you may not have to pay. Check the laws in your state. If the debt is too old, the collector cannot sue you.

3. Review Your Finances

Look at your budget. Can you afford to pay the debt? Paying a debt collector might strain your finances. Make sure you can handle it without causing more problems.

4. Negotiate

Debt collectors may accept less than the full amount. Try to negotiate. Offer a lump sum or a payment plan. Get any agreement in writing.

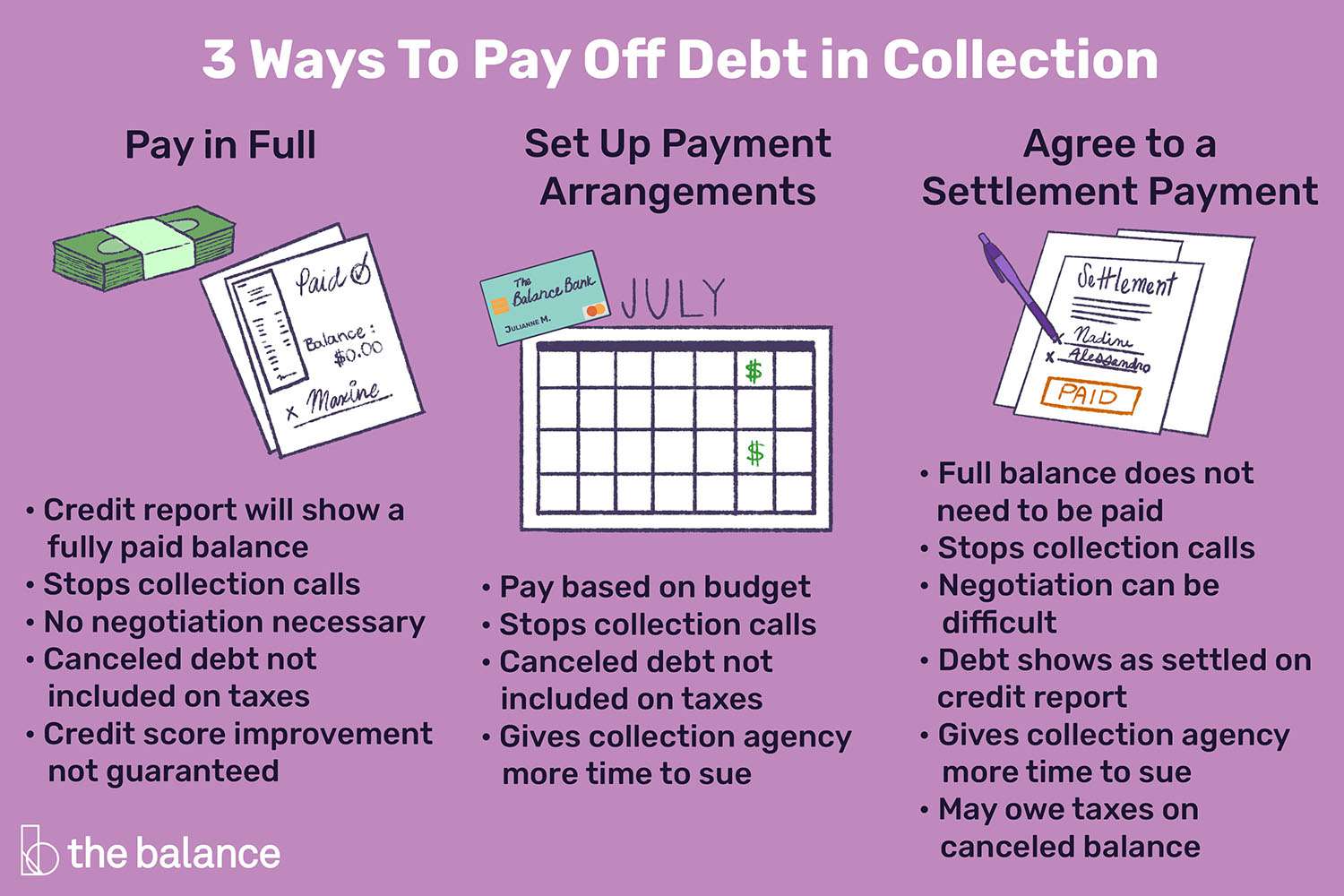

Reasons to Pay a Debt Collector

There are good reasons to pay a debt collector. Here are some:

- It can improve your credit score.

- It can stop collection calls and letters.

- It can prevent legal action.

Reasons Not to Pay a Debt Collector

Sometimes, paying a debt collector is not the best choice. Here are some reasons:

- The debt is too old.

- You cannot afford to pay.

- You are unsure if the debt is valid.

What Happens If You Do Not Pay?

If you do not pay, several things can happen:

- The debt collector may keep contacting you.

- Your credit score may go down.

- The collector might sue you.

It is important to understand the consequences. Make an informed decision.

Credit: obryanlawoffices.com

How to Handle Debt Collectors

Here are some tips for dealing with debt collectors:

- Stay calm and polite.

- Keep records of all communication.

- Do not share personal information.

- Know your rights and use them.

Frequently Asked Questions

What Happens If I Ignore A Debt Collector?

Ignoring a debt collector can lead to legal action or negative impacts on your credit score.

Can A Debt Collector Sue Me?

Yes, debt collectors can sue you for unpaid debts, resulting in potential wage garnishment or asset seizure.

Should I Negotiate With A Debt Collector?

Negotiating with a debt collector can help reduce the debt amount or set up a manageable payment plan.

Will Paying Off Debt Improve My Credit?

Paying off debt can improve your credit score by reducing your credit utilization and showing positive payment history.

Conclusion

Deciding whether to pay a debt collector is not easy. You need to consider your rights, the age of the debt, and your financial situation. Remember to verify the debt and negotiate if possible. By understanding your options, you can make the best decision for your situation.