Everything You Need to Know About Project Finance Project finance is a complex and strategic approach to funding large-scale infrastructure and industrial projects. It involves the creation of a financial structure that’s tailored to the specific project, with its revenue-generating potential as the primary source of repayment. Credit: www.linkedin.com Credit: medium.com Project Finance vs. Corporate… Continue reading Project Finance

Unmasking the Secrets of the Sticky Wage Theory: Unlock Your Earning Potential

Sticky Wage Theory: Understanding the Concept and Implications The Sticky Wage Theory is a concept in economics that explains why wages tend to be resistant to change, even in the face of changing economic conditions. This theory suggests that wages are “sticky” and do not adjust quickly to changes in labor market conditions or economic… Continue reading Unmasking the Secrets of the Sticky Wage Theory: Unlock Your Earning Potential

Neutrality Of Money: Empowering the Financial World

Neutrality Of Money – Explained and Analyzed In the world of economics, the concept of neutrality of money holds great significance. Money, as we know, is a medium of exchange and a store of value. But what does neutrality of money really mean? In this article, we will dive deep into the concept and analyze… Continue reading Neutrality Of Money: Empowering the Financial World

Gold Standard

The Gold Standard: A Reliable Measure of Value In the realm of economics, the gold standard has long been regarded as a benchmark for measuring the value of currencies. The history of the gold standard can be traced back to ancient times when gold and other precious metals were widely recognized as symbols of wealth… Continue reading Gold Standard

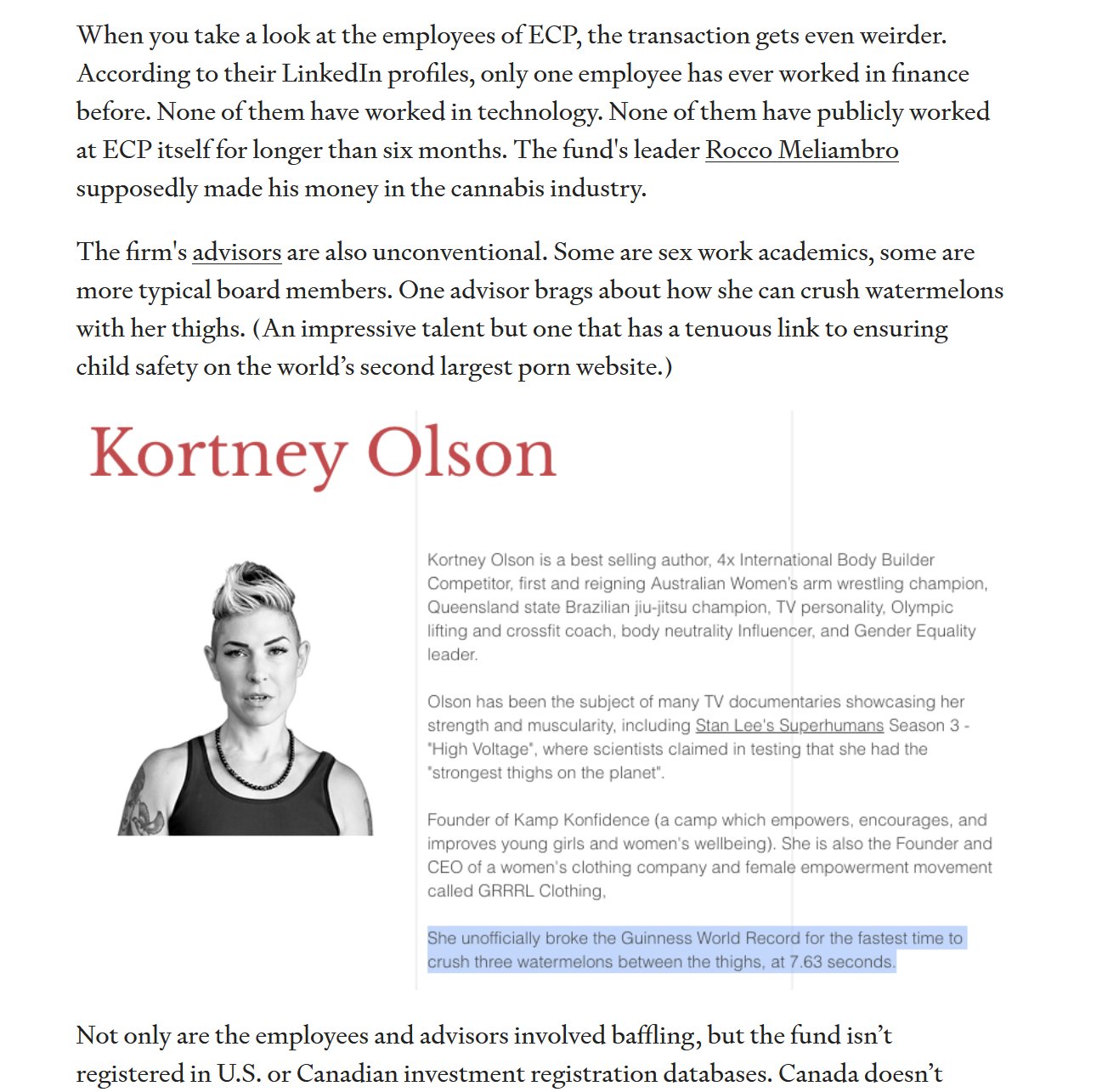

Hurdle Rate

Understanding Hurdle Rate in Investment: A Complete Guide In the world of finance and investment, the term “hurdle rate” is commonly used to evaluate the potential profitability of an investment opportunity. In this comprehensive guide, we will delve into the concept of hurdle rate, its significance, calculation methods, and its relevance in making sound investment… Continue reading Hurdle Rate

What Is Terminal Growth Rate?: Unveiling the Power of Sustainable Expansion

Terminal Growth Rate is a financial concept used in valuation methodologies to estimate the perpetual growth rate of a company’s free cash flow. It represents the expected rate at which a company is projected to grow indefinitely into the future. Understanding Terminal Growth Rate In finance, predicting the future cash flows of a company is… Continue reading What Is Terminal Growth Rate?: Unveiling the Power of Sustainable Expansion