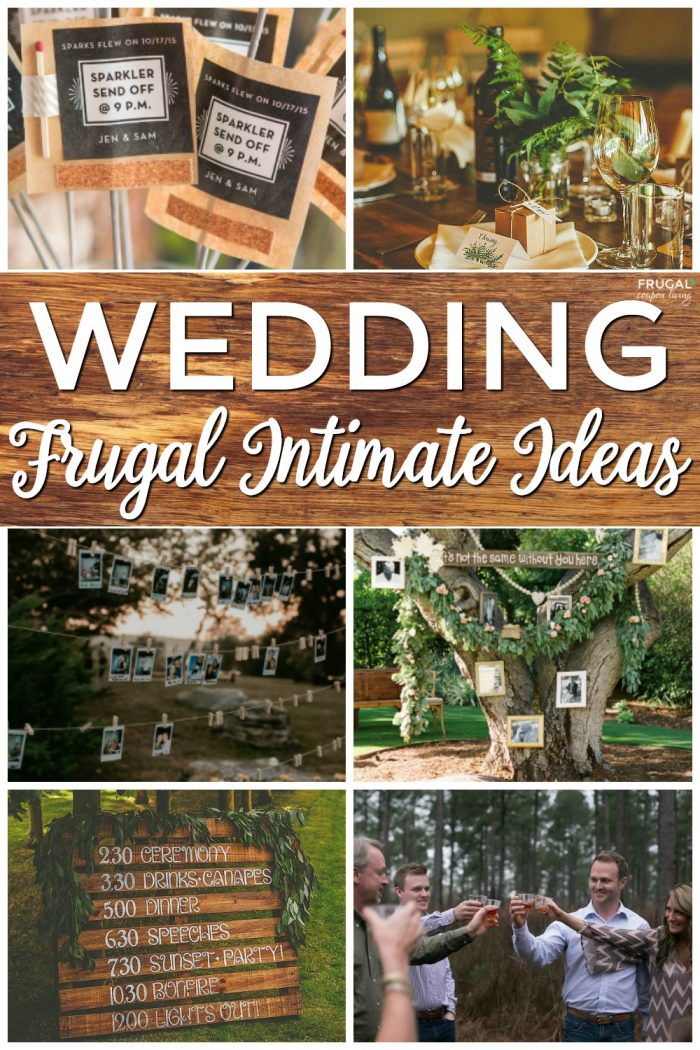

To budget for a wedding, determine your priorities and set a realistic budget range based on your income and savings. Planning a wedding can be exciting, but it can also be overwhelming when it comes to finances. Setting a budget is an essential step in the planning process, and it requires careful consideration of your… Continue reading How to Budget for a Wedding: Cost-effective Celebration.

The Ultimate Guide to Saving Money on Your Car Insurance

The best way to save money on car insurance is to shop around for quotes and compare coverage options. To get the best deals, it’s important to compare rates from different insurance providers, and look for discounts on policies based on your driving record, vehicle, and other factors. The more you’re able to customize your… Continue reading The Ultimate Guide to Saving Money on Your Car Insurance

How to Budget for a Vacation: Top Tips for Affordable Travel.

To budget for a vacation, determine your expenses and prioritize them. Consider utilizing vacation packages and setting aside money in advance. A vacation can be an exciting way to break from the monotony of everyday life. However, it can also be costly, and without proper preparation, it can easily become a financial burden. For many,… Continue reading How to Budget for a Vacation: Top Tips for Affordable Travel.

Unlocking the Secrets to Finding an Ideal Insurance Agent

To find a good insurance agent, ask for referrals and research their credentials. Finding a good insurance agent can be a daunting task, especially if you’re not familiar with the industry. A good agent should not only provide reliable coverage, but also help you understand the intricacies of your policy. It’s important to ask friends,… Continue reading Unlocking the Secrets to Finding an Ideal Insurance Agent

How to Budget for Retirement: 7 Expert Tips.

To budget for retirement, determine your living expenses and calculate your retirement income sources. Afterward, create a plan for saving and investing for retirement. Retirement is a time to relax and enjoy the fruits of your labor. Having a solid financial plan can help you achieve this goal. Unfortunately, many individuals fail to budget effectively… Continue reading How to Budget for Retirement: 7 Expert Tips.

How to Save Money on Funeral Expenses?

Saving on funeral expenses can be achieved by opting for direct cremation and avoiding unnecessary add-ons. Planning ahead with a pre-need agreement is also a great way to save money on funeral expenses. Funeral expenses are often unexpected, making it difficult to budget for associated costs. However, there are ways to save on these expenses… Continue reading How to Save Money on Funeral Expenses?