In the world of economics, the concept of neutrality of money holds great significance. Money, as we know, is a medium of exchange and a store of value. But what does neutrality of money really mean? In this article, we will dive deep into the concept and analyze its implications.

Table of Contents

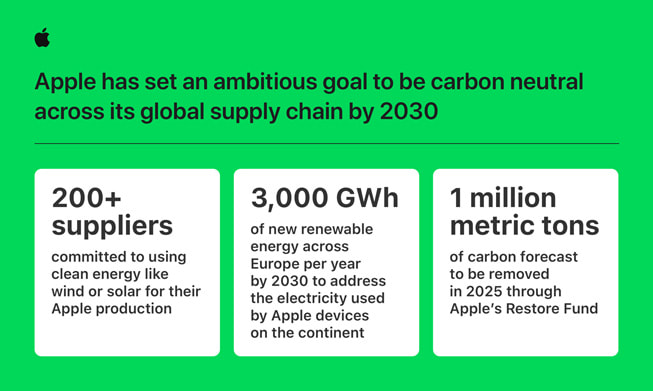

Understanding Neutrality of Money

Neutrality of money, in simple terms, refers to the idea that changes in the supply of money do not affect real economic variables in the long run. This means that an increase in the money supply will lead to a proportional increase in prices, without having any long-term impact on output, productivity, or employment. Similarly, a decrease in the money supply will cause deflationary pressures but will not alter the structure of the economy.

This concept has its roots in the Quantity Theory of Money, which states that the quantity of money multiplied by its velocity of circulation is equal to the price level multiplied by real output. According to this theory, changes in the money supply only affect nominal variables, such as prices, wages, and exchange rates, while leaving the real variables, such as real GDP and employment, unaffected.

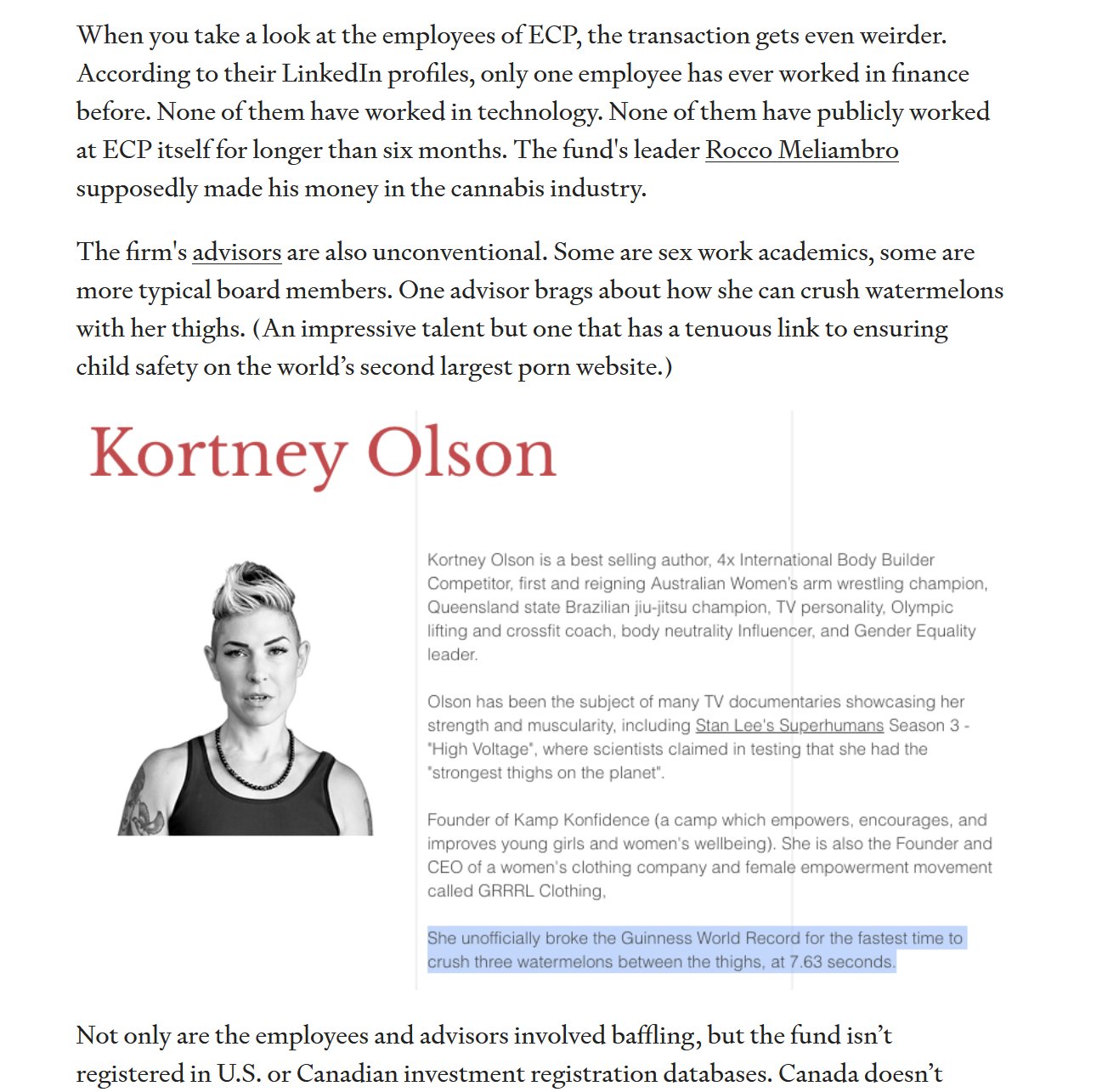

Credit: www.apple.com

Analyzing the Implications

Neutrality of money has both theoretical and practical implications for economists, policymakers, and businesses. Let’s take a closer look at some of the key implications:

1. Long-run Effects

From a theoretical perspective, neutrality of money implies that monetary policy only has short-term effects on the economy. In the long run, changes in the money supply are expected to be offset by corresponding adjustments in prices and wages. Therefore, central banks should be cautious in using monetary policy as a tool to influence economic growth and stability, as its impact may be temporary.

2. Inflation And Deflation

Neutrality of money suggests that changes in the money supply directly impact the overall price level. An increase in the money supply leads to inflation, while a decrease in the money supply results in deflation. This concept helps economists better understand the relationship between money supply and price levels, allowing central banks to formulate appropriate monetary policy measures to maintain price stability.

3. The Fisher Effect

Neutrality of money is closely related to the Fisher Effect, which states that changes in the nominal interest rate are equal to changes in the real interest rate plus expected inflation. As money is considered neutral in the long run, changes in the money supply are expected to be fully reflected in changes in the price level, leading to corresponding adjustments in interest rates.

4. Investment And Capital Formation

Another implication of neutrality of money is its impact on investment and capital formation. Since changes in the money supply do not affect real variables, such as output and productivity, the neutrality of money suggests that monetary policy should not be relied upon to stimulate long-term investment. Instead, policies that focus on improving productivity, promoting innovation, and reducing structural barriers are vital for sustainable economic growth.

Credit: www.amazon.com

Conclusion

Neutrality of money is a concept rooted in economic theory, stating that changes in the money supply have no long-term impact on real economic variables. While monetary policy can influence short-term outcomes, its effects are expected to be neutralized over time. By understanding and analyzing the implications of neutrality of money, economists, policymakers, and businesses can make informed decisions to promote stable and sustainable economic growth.