Table of Contents

Introduction

Debt relief is a way to reduce or eliminate debt. It helps people who owe money. But, did you know debt relief goes by other names too? In this article, we will explore other names for debt relief. We will also discuss different ways to achieve debt relief.

Other Names for Debt Relief

Debt relief has many other names. Some of these names include:

- Debt Management: This is a plan to pay off debts. It involves negotiating with creditors.

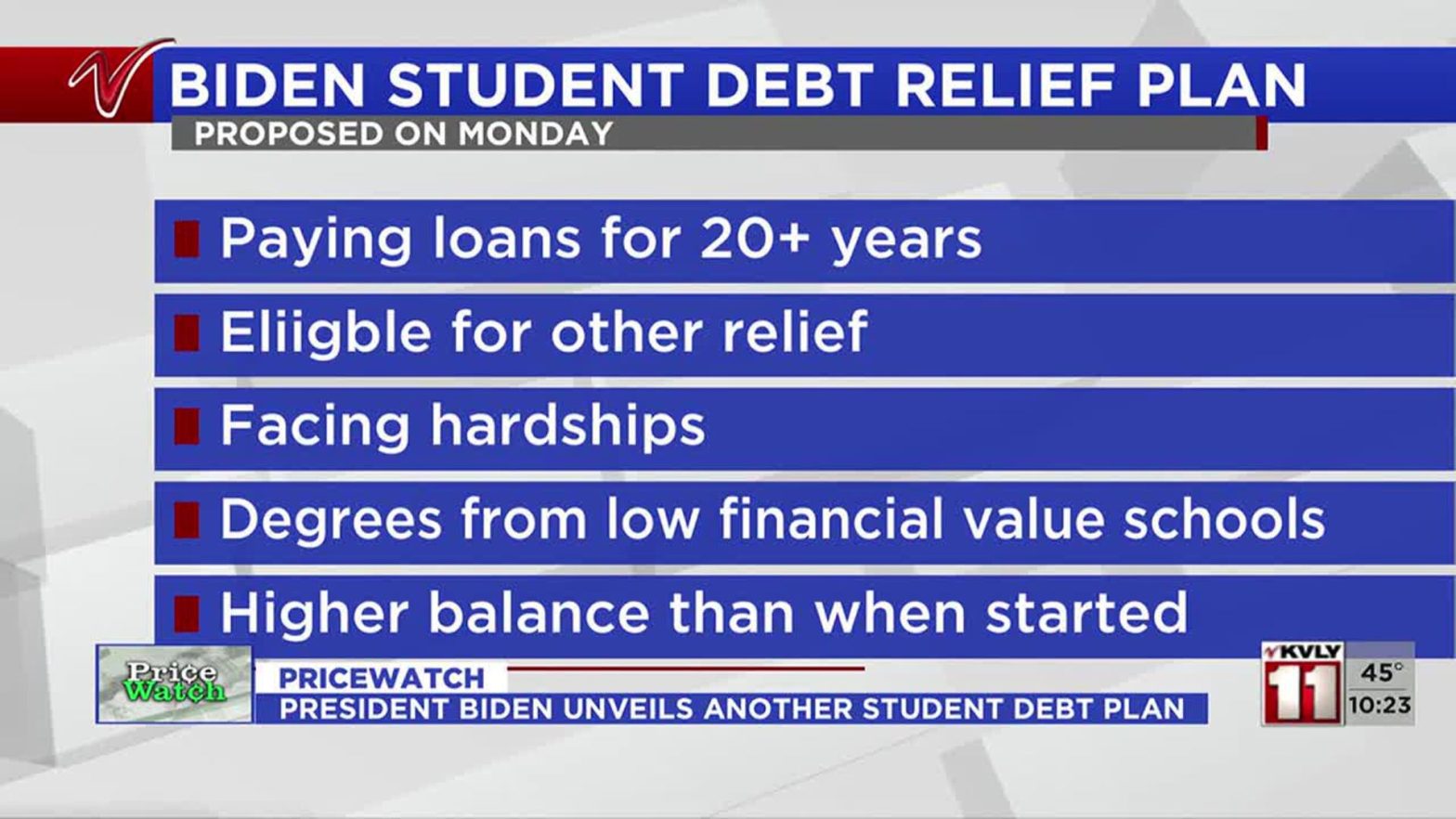

- Loan Forgiveness: This means canceling part or all of a debt. Often used for student loans.

- Debt Consolidation: This combines multiple debts into one. It simplifies payments.

- Credit Counseling: This is advice to manage debts. It helps create a budget.

- Bankruptcy: This is a legal process to eliminate debts. It has long-term effects.

Types of Debt Relief

Debt relief comes in many forms. Here are some common types:

| Type | Description |

|---|---|

| Debt Settlement | Negotiating with creditors to reduce the total debt. |

| Debt Management Plan | Making a plan to pay off debts over time. |

| Debt Consolidation Loan | Combining multiple debts into one loan with a lower interest rate. |

| Credit Counseling | Getting advice from experts to manage and reduce debts. |

| Bankruptcy | Legal process to eliminate or repay debts under court supervision. |

Benefits of Debt Relief

Debt relief offers many benefits. These include:

- Reduced Stress: Knowing you have a plan reduces financial stress.

- Lower Payments: Debt relief often means lower monthly payments.

- Improved Credit Score: Managing debt can improve your credit score over time.

- Financial Freedom: Once debts are paid, you can start saving money.

Credit: www.afscme.org

Credit: www.valleynewslive.com

How to Achieve Debt Relief

Achieving debt relief involves several steps. Here is a simple guide:

- Assess Your Debt: Know how much you owe and to whom.

- Explore Options: Research different debt relief options.

- Seek Professional Help: Consider consulting a credit counselor.

- Create a Plan: Make a realistic plan to pay off your debts.

- Stick to the Plan: Follow your plan and make regular payments.

Common Myths About Debt Relief

Many myths surround debt relief. Let’s debunk some of these myths:

- Myth 1: Debt relief ruins your credit score forever.

Fact: Debt relief can initially lower your score, but managing debt improves it over time. - Myth 2: Only irresponsible people need debt relief.

Fact: Many responsible people face financial difficulties due to unforeseen events. - Myth 3: Debt relief companies are scams.

Fact: Many reputable companies offer legitimate debt relief services. - Myth 4: Debt relief is a quick fix.

Fact: Debt relief takes time and commitment to achieve.

Frequently Asked Questions

What Is Debt Relief Also Called?

Debt relief is also referred to as debt forgiveness or debt cancellation.

Is Debt Restructuring The Same As Debt Relief?

No, debt restructuring involves modifying loan terms, while debt relief often means reducing or eliminating debt.

Can Debt Settlement Be Considered Debt Relief?

Yes, debt settlement is a form of debt relief where creditors agree to accept less than the owed amount.

What Is Debt Forgiveness?

Debt forgiveness means a lender agrees to cancel part or all of a borrower’s debt.

Conclusion

Debt relief is essential for managing financial burdens. It is also known by other names such as debt management, loan forgiveness, and credit counseling. Understanding the different types of debt relief can help you choose the best option for your situation. Remember, achieving debt relief takes time and effort. Seek professional help if needed. By following a plan and staying committed, you can achieve financial freedom.