Financial stability is crucial for the success and sustainability of any business. However, fluctuations in income can pose challenges and uncertainties. This is where income smoothing comes into play. Income smoothing is a financial strategy that involves managing and adjusting a company’s reported earnings to achieve a more stable and predictable income stream. In this article, we will explore the concept of income smoothing and its benefits.

Income smoothing, also known as profit smoothing, aims to reduce the volatility of a company’s reported earnings by mitigating large fluctuations. By smoothing out income, businesses can present a more consistent and reliable financial performance to investors, lenders, and stakeholders.

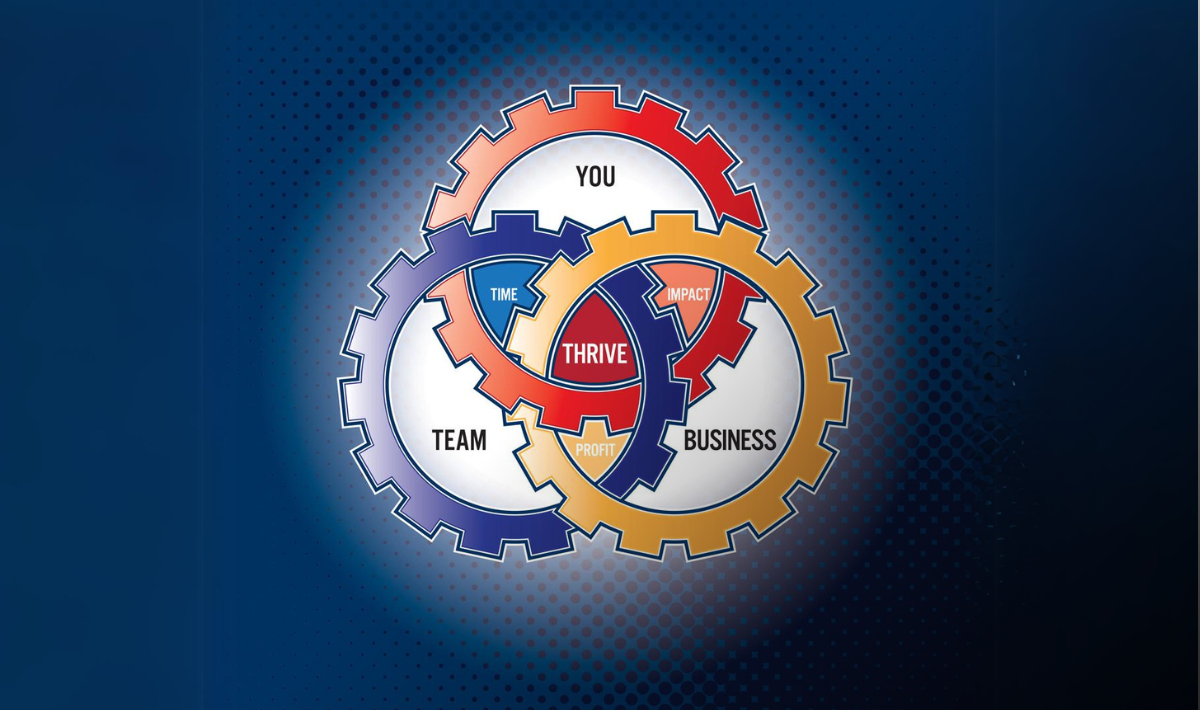

Credit: www.dentalgrouppractice.com

Table of Contents

The Need for Income Smoothing

Companies often experience variations in their income due to several factors, including seasonal fluctuations, economic cycles, and unforeseen events. These fluctuations can lead to uncertainty and may impact a company’s ability to plan and make strategic decisions effectively.

Income smoothing provides companies with the opportunity to even out their reported earnings, thereby bringing stability to the financial statements. This stability enhances the credibility of the company and instills confidence in investors and other external stakeholders.

Methods of Income Smoothing

There are several methods that companies can employ to smooth their income:

- Reserve Accounts: Companies can set up reserve accounts to allocate excess income during favorable periods in order to offset any future losses or downturns.

- Smoothed Earnings: By using accounting techniques such as the moving average method or the use of accruals, companies can adjust their earnings to prevent extreme fluctuations.

- Expenses Manipulation: Companies can manage their expenses by deferring costs into future periods or accelerating costs from future periods, thus evening out their overall income.

It is important to note that income smoothing must be done within the boundaries of legal and ethical practices. It should not involve any fraudulent activity or misrepresentation of financial statements.

The Benefits of Income Smoothing

Implementing income smoothing strategies can offer several advantages for businesses:

| Benefits | Explanation |

|---|---|

| Improved Credibility | Stable and consistent earnings inspire trust and confidence in investors and lenders. |

| Enhanced Planning | With a more predictable income stream, businesses can plan for the future and make informed decisions. |

| Reduced Market Volatility | Smoothed earnings help reduce market volatility, protecting the company’s stock price from sharp fluctuations. |

| Attractiveness to Investors | Investors are more likely to be drawn to companies with stable income patterns, increasing the chances of securing funding. |

Credit: fastercapital.com

The Criticism Surrounding Income Smoothing

While income smoothing can offer benefits, it has also been subject to criticism. Critics argue that smoothing earnings can distort the true financial picture of a company and make it difficult for investors to assess its actual financial health and performance.

There are concerns that income smoothing can potentially mislead stakeholders and create false expectations. It is essential for companies to be transparent and disclose any income smoothing strategies they employ.

In Conclusion

Income smoothing is a strategy that helps businesses navigate income fluctuations and achieve financial stability. By implementing the appropriate methods and techniques, companies can present a more consistent and reliable financial performance. However, it is essential for businesses to adhere to legal and ethical boundaries and maintain transparency in their financial reporting.

When used responsibly, income smoothing can contribute to the long-term success and sustainability of businesses, improving their credibility, attracting investors, and enabling effective planning and decision-making.