Debt can make life very hard. Many people struggle with managing their finances. But, there are ways to get debt relief. This article will guide you through the steps.

Table of Contents

Understanding Debt

Debt is money you owe to someone else. This could be from credit cards, loans, or other expenses. It’s important to know how much you owe.

Types Of Debt

- Credit Card Debt

- Student Loans

- Mortgage Loans

- Personal Loans

- Medical Bills

Credit: www.bankrate.com

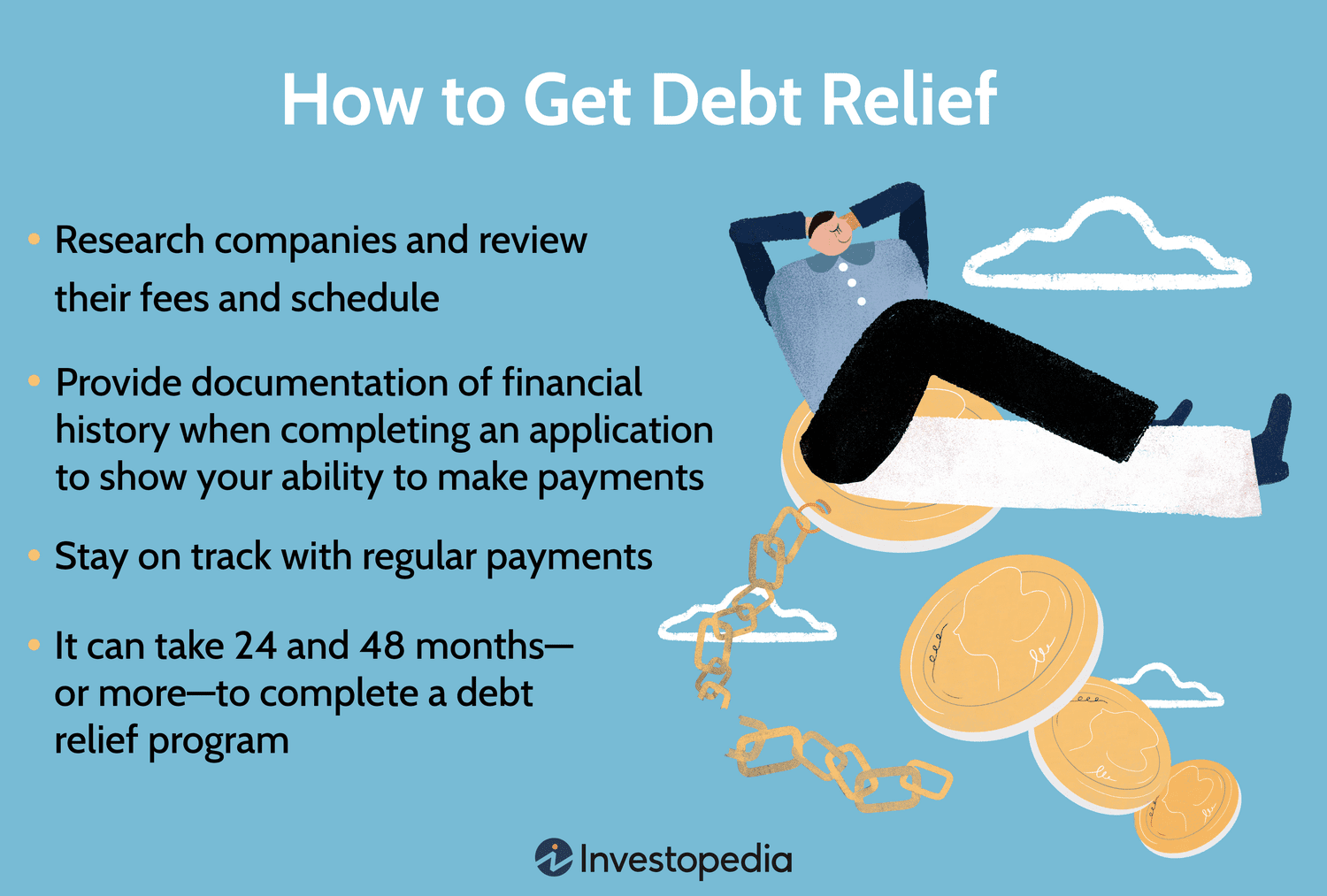

Steps to Get Debt Relief

Follow these steps to manage your debt better.

1. Make A Budget

A budget helps you track your income and expenses. Write down your monthly income. List all your monthly expenses. This will show you where your money goes.

2. Cut Unnecessary Expenses

Find ways to spend less. Cut back on things you don’t need. This will give you more money to pay off your debt.

3. Increase Your Income

Find ways to earn more money. You could take on a part-time job. You could also sell things you don’t need.

4. Pay More Than The Minimum

Paying just the minimum amount will keep you in debt longer. Try to pay more than the minimum each month. This will help you get out of debt faster.

5. Use The Debt Snowball Method

The debt snowball method is a way to pay off debt. Start with the smallest debt first. Pay it off as quickly as you can. Then move on to the next smallest debt.

6. Consider Debt Consolidation

Debt consolidation means combining all your debts into one. This can make it easier to manage your payments. You might get a lower interest rate too.

7. Negotiate With Creditors

Talk to the people you owe money to. Ask if they can lower your interest rate. They might also agree to a smaller monthly payment.

8. Seek Professional Help

If you’re struggling, seek help from a professional. A credit counselor can give you advice. They can help you make a plan to pay off your debt.

Benefits of Getting Debt Relief

Getting debt relief has many benefits. Here are a few:

- Reduced Stress

- Improved Credit Score

- More Money for Savings

- Better Financial Security

:max_bytes(150000):strip_icc()/debt-forgiveness-how-get-out-paying-your-student-loans.asp-Final-ef57becb1d764492828f548041b9ab58.jpg)

Credit: www.investopedia.com

Frequently Asked Questions

What Is Debt Relief?

Debt relief involves reducing or eliminating debt for individuals or businesses, often through settlement or consolidation.

How Can I Qualify For Debt Relief?

You typically qualify by proving financial hardship, such as unemployment or medical expenses, affecting your ability to repay.

What Are The Types Of Debt Relief?

Common types include debt consolidation, settlement, credit counseling, and bankruptcy.

Is Debt Relief A Good Option?

Debt relief can be beneficial if you’re struggling to manage debt and need help to avoid bankruptcy.

Conclusion

Getting debt relief is possible. It takes time and effort. But, the benefits are worth it. Follow the steps in this article to start your journey to debt relief.

Frequently Asked Questions (FAQs)

What Is The Best Way To Get Out Of Debt?

The best way to get out of debt is to make a plan. Start by creating a budget. Cut unnecessary expenses. Increase your income if possible. Pay more than the minimum on your debts.

How Can I Get Help With My Debt?

You can get help from a credit counselor. They can give you advice and help you make a plan. You can also talk to your creditors and ask for lower payments.

What Is Debt Consolidation?

Debt consolidation is when you combine all your debts into one. This can make it easier to manage your payments. You might also get a lower interest rate.

What Is The Debt Snowball Method?

The debt snowball method is a way to pay off debt. You start with the smallest debt first. Pay it off as quickly as you can. Then move on to the next smallest debt.

Why Is It Important To Get Debt Relief?

Getting debt relief is important because it reduces stress. It can improve your credit score. You will have more money for savings. It also gives you better financial security.