Debt is like a cancer that slowly eats away at your financial health. It can ruin your credit score, making it difficult to get loans for major purchases. It can also lead to high interest rates and late fees, which can further damage your finances.

If you’re struggling with debt, it’s important to seek help from a financial advisor or credit counseling service. Otherwise, debt could ruin your life.

Debt is something that can ruin your life if you’re not careful. It can make it difficult to buy a house or a car, and it can even make it hard to get a job. debt can also lead to bankruptcy, which can ruin your credit score and make it hard to get loans in the future.

Table of Contents

Negative Effects of Debt on Young Adults

Debt is a major issue for many young adults. According to a study in the US by the Institute for College Access & Success, 69% of college seniors who graduated in 2015 had student loan debt, with an average balance of $28,400. That’s up from an average of $18,650 just 10 years earlier.

The effects of this debt can be far-reaching and negatively impact many aspects of a person’s life. Here are some of the ways that debt can negatively affect young adults: 1. It can make it difficult to save for other goals: When you’re struggling to pay off debt, it can be hard to also save money for things like buying a home or saving for retirement.

This can have long-term consequences and make it difficult to achieve financial stability later in life. 2. It can lead to financial stress: Debt can be a major source of stress, particularly if you’re struggling to make payments or keep up with interest rates. This stress can lead to problems like anxiety and depression, and can even impact your physical health.

3 .It can limit your career choices: If you have a lot of student loan debt, you may feel pressure to choose a high-paying job instead of one that you’re passionate about. This could lead to unhappiness in your career and make it difficult to advance professionally.

The danger of Putting Up Collateral for a Loan

If you are considering putting up collateral for a loan, it is important to be aware of the risks involved. When you put up collateral, you are essentially using your property as security for the loan. If you default on the loan, the lender can seize your collateral in order to recoup their losses.

This can be a major financial setback, as you could lose your home or other valuable assets that were used as collateral. In some cases, people have even been forced into bankruptcy because they could not repay their loans after their collateral was seized. Before putting up any collateral for a loan, make sure that you understand the risks and are comfortable with them.

It is also important to shop around and compare different lenders to get the best terms possible.

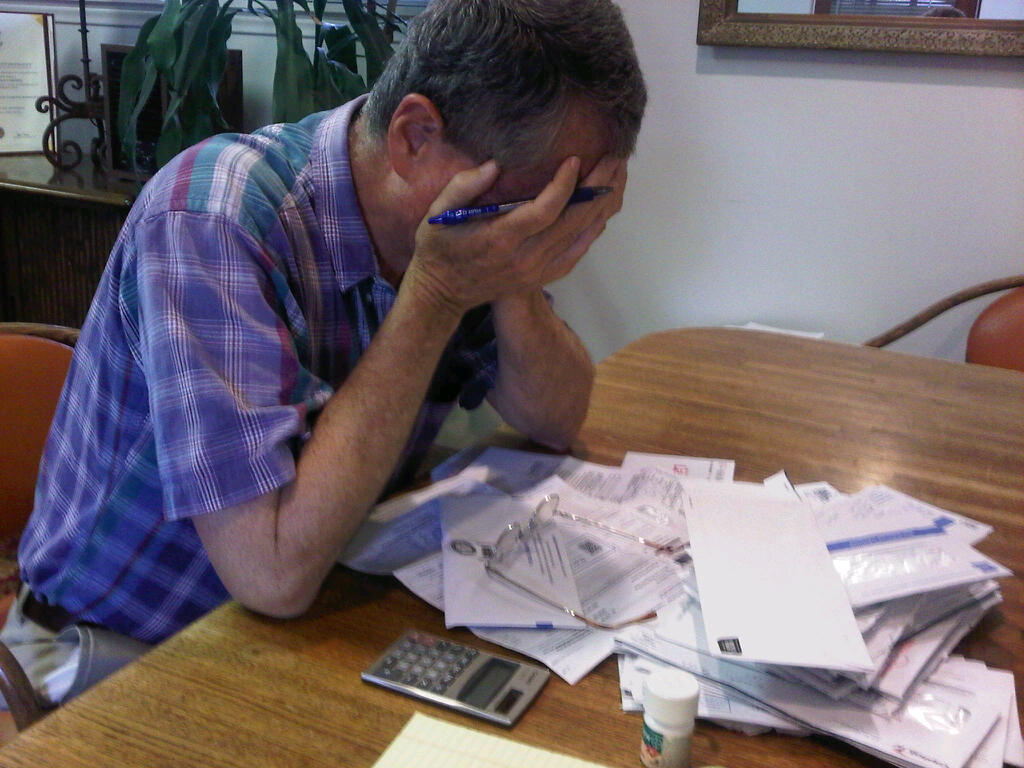

Debt Stress Syndrome

Debt stress syndrome is a condition that can be caused by financial difficulties. It can lead to physical and mental health problems, as well as relationship difficulties. Symptoms of debt stress syndrome include anxiety, depression, irritability, difficulty sleeping, and headaches.

If you are experiencing any of these symptoms, it is important to seek help from a qualified professional. There are many resources available to help you manage your finances and reduce your stress levels. With the proper support, you can overcome debt stress syndrome and improve your overall wellbeing.

Credit: www.edswitzerlaw.com

What are the Consequences of Excessive Debt?

There are three primary consequences of excessive debt: financial, psychological, and physical.

Financial Consequences

Excessive debt can lead to financial ruin. It can cause someone to lose their job, home, and possessions. It can also lead to bankruptcy.

It can lead to financial instability. If you have a lot of debt, you may find it difficult to make your monthly payments. This can put you at risk of falling behind on your bills and damaging your credit score. Additionally, debt can be emotionally stressful. dealing with large amounts of debt can be overwhelming and cause anxiety or depression.

Psychological Consequences

Excessive debt can cause immense stress and anxiety. It can lead to depression and even suicide. The pressure of trying to keep up with payments can be overwhelming.

Finally, debt can also lead to problems in your personal relationships. If you are constantly fighting with your partner about money, it can strain your relationship. If you’re considering taking on a large amount of debt, it’s important to weigh the risks and benefits carefully.

Physical Consequences

Debt can also take a toll on one’s health. The stress from debt can cause headaches, stomach problems, and sleeplessness.

Make sure you understand all the potential dangers before making any decisions. It is important to manage debt so that it does not become excessive and have negative consequences on your life.

Personalized course on Personal Finance

Nafeez Al Tarik, CFA, FRM, Managing Director, Dhaka Bank Securities Limited has brought a Personal Finance course with 10 Minute School to help you out of debt. Follow this link to know more and be debt free:

What Debt Does to Your Mental Health?

Debt is often described as a financial burden. But what many people don’t realize is that debt can also take a toll on your mental health. For some people, the stress of being in debt can lead to anxiety and depression.

And it’s not just the worry about making ends meet that can cause these problems – it’s also the shame and stigma that can come with being in debt. If you’re struggling to keep up with your debts, it’s important to seek help sooner rather than later. There are plenty of resources available to help you get back on track financially.

And if you’re finding that your debt is impacting your mental health, there are also counselors and therapists who can help you deal with the emotional side of things.

How Much Debt is Considered Too Much?

Debt is a tool that can be used to finance large purchases or investments, and when managed responsibly, it can be a useful way to manage your finances. However, when debt levels become too high, it can put strain on your finances and may even lead to financial difficulties. So how much debt is considered too much?

There is no definitive answer to this question as it depends on a number of factors, including your income, expenditure and other debts. However, as a general guide, if your total debts (including any mortgage) exceed 30% of your gross annual income (before tax), then you may be in danger of getting into financial difficulty. This is because you may struggle to make the monthly repayments on all your debts and could end up defaulting on some payments.

If you’re worried that your level of debt may be too high, there are steps you can take to reduce it. These include making more regular or bigger payments towards your debts, consolidating multiple debts into one single loan with a lower interest rate or speaking to a debt counsellor for advice.

Conclusion

Debt is something that can ruin your life if you’re not careful. It can cause problems with your credit score, make it difficult to get a loan, and even lead to bankruptcy. If you’re in debt, it’s important to take steps to get out of it as soon as possible.

You can do this by making a budget, cutting expenses, and paying off your debts little by little. It’s also important to avoid taking on new debt, and to make sure you’re only using credit cards for emergencies. If you’re struggling with debt, there are plenty of resources available to help you get back on track.