| Date: [Date] | Category: Finance |

Have you ever wondered what happens to shares when their owners fail to meet certain obligations? In the world of finance, forfeited shares are an intriguing topic that often leaves investors baffled. In this article, we will explore the basics of forfeited shares, their implications, and how they can affect both companies and shareholders.

Credit: fastercapital.com

Table of Contents

What are Forfeited Shares?

Forfeited shares are shares that were once owned by a shareholder but have been repossessed or canceled by the issuing company. This usually occurs when a shareholder fails to pay the required amount on their shares within a specified time frame or breaches certain terms and conditions set by the company.

Reasons for Forfeited Shares

There are several reasons why shares may be forfeited. These include non-payment of calls on shares, non-compliance with share transfer restrictions, or a violation of shareholder agreements. Companies have the authority to forfeit shares if the shareholders fail to meet their obligations and may proceed to sell the forfeited shares to recover any outstanding debts.

Implications for Shareholders

When shares are forfeited, shareholders lose their ownership rights and any dividends or benefits associated with the shares. The forfeited shares are typically sold to new shareholders, diluting the ownership of existing shareholders. Forfeited shares can also have financial ramifications for shareholders, as any outstanding debts owed by the defaulting shareholders may be transferred to the remaining shareholders.

Consequences for Companies

Forfeited shares can have both positive and negative consequences for companies. On the positive side, the company can recover any outstanding debts by selling the forfeited shares. Additionally, the sale of forfeited shares can generate additional capital for the company. However, the negative aspect lies in the potential dilution of ownership of existing shareholders and the impact on the company’s reputation if there are numerous cases of forfeited shares.

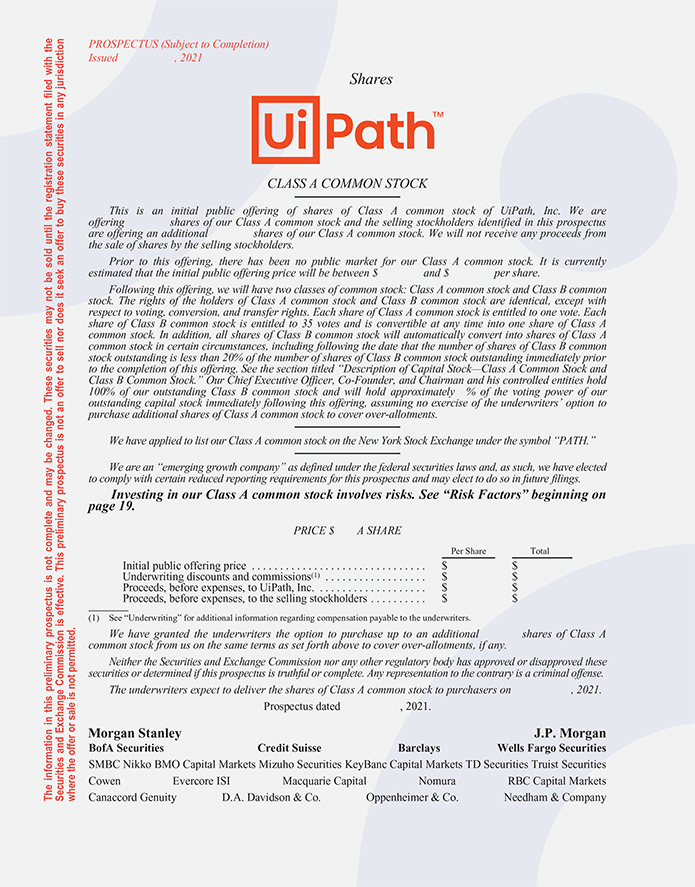

Credit: www.sec.gov

Legal Procedures for Forfeit

The process of forfeiting shares involves following legal procedures. These procedures can vary depending on the jurisdiction and the specific terms set out in the company’s articles of association. Typically, the company must provide a notice to the defaulting shareholder, allowing them a specified period to rectify the breach. If the shareholder fails to comply, the shares can be forfeited and sold.

Conclusion

Understanding forfeited shares is crucial for both investors and companies. It is essential for shareholders to comply with their obligations to avoid the loss of their shares. For companies, the management of forfeited shares is important for recovering debts and maintaining a healthy financial position. By knowing the implications of forfeited shares, investors can make informed decisions, while companies can protect their interests and maintain a strong shareholder base.

Additional Resources:

- [Link to Related Article 1]

- [Link to Related Article 2]

- [Link to Related Article 3]