Debt can be stressful and overwhelming. Many people wonder if they can handle debt relief on their own. The answer is yes, you can manage debt relief yourself. This guide will show you how to do it.

Table of Contents

Understanding Debt Relief

Debt relief means reducing or eliminating your debt. It can help you manage your finances better. There are many ways to achieve debt relief.

Types Of Debt Relief

- Debt Settlement: Negotiating with creditors to pay less than you owe.

- Debt Consolidation: Combining multiple debts into one loan.

- Debt Management Plans: Working with a credit counseling agency to repay your debt.

- Bankruptcy: A legal process to eliminate debt, but it has serious consequences.

Steps to Do Debt Relief Yourself

Here are the steps to manage debt relief on your own:

1. Assess Your Financial Situation

First, you need to understand your financial situation. Make a list of all your debts. Include the amount owed, interest rates, and due dates.

Create a budget to see how much money you have left after paying for necessities. This will help you see how much you can pay towards your debt each month.

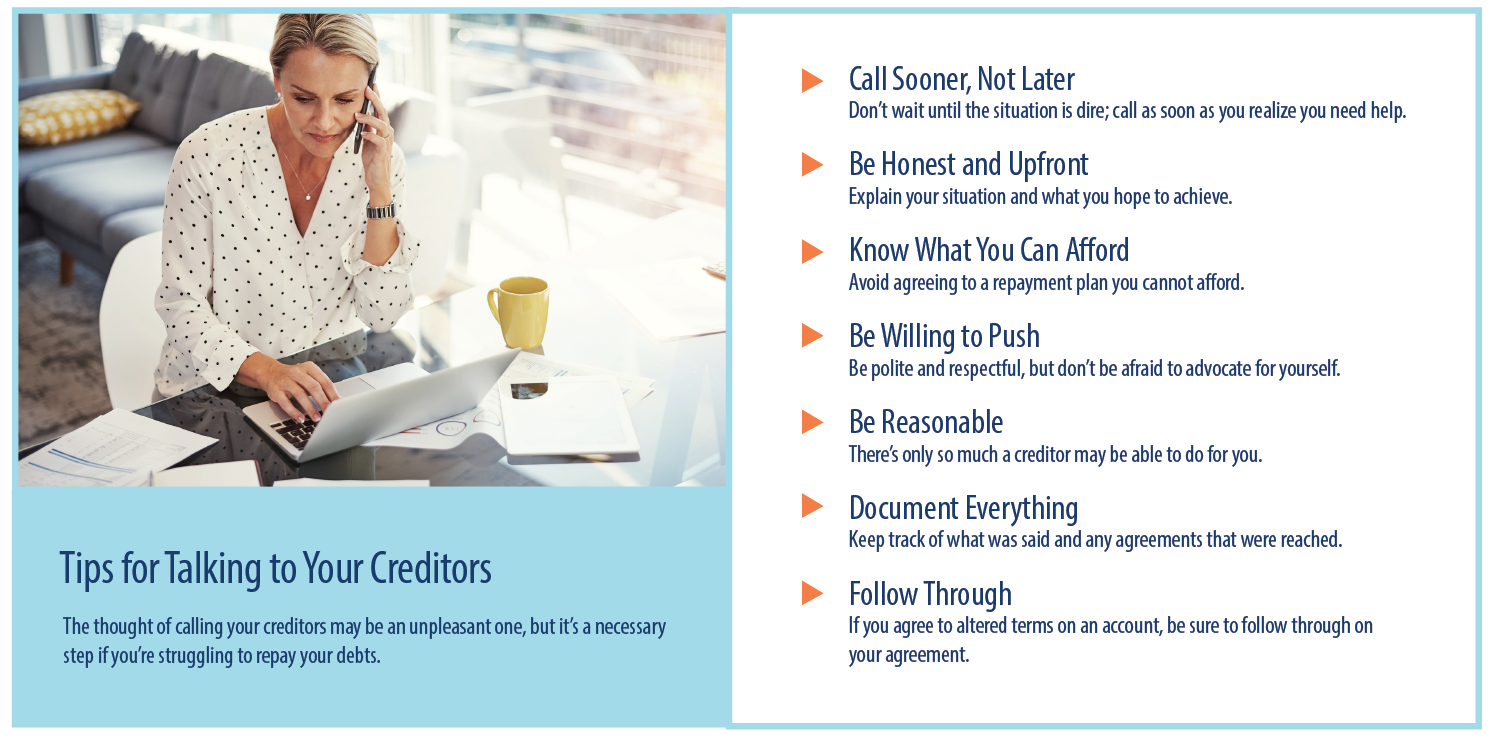

2. Contact Your Creditors

Next, reach out to your creditors. Explain your financial situation and ask for help. They may offer lower interest rates or a payment plan.

Be honest and polite when talking to your creditors. They are more likely to help if they understand your situation.

3. Negotiate A Settlement

If you have a lump sum of money, you can try to negotiate a settlement. Offer to pay a percentage of your debt in exchange for the rest being forgiven.

Start by offering a low amount, and be ready to negotiate. Make sure to get any agreement in writing.

4. Create A Debt Repayment Plan

Once you have negotiated with your creditors, create a repayment plan. Decide how much you will pay each month towards each debt.

Stick to your plan and make your payments on time. This will help you pay off your debt faster and improve your credit score.

5. Consider Debt Consolidation

If you have multiple debts, debt consolidation can help. It combines all your debts into one loan with a single payment.

Look for a loan with a lower interest rate than your current debts. This can save you money and make it easier to manage your payments.

6. Avoid Taking On New Debt

While you are working on debt relief, avoid taking on new debt. This will make it harder to pay off your existing debts.

Focus on living within your means and only spending money on necessities.

Benefits of Doing Debt Relief Yourself

There are many benefits to managing debt relief on your own:

- Save Money: You won’t have to pay fees to a debt relief company.

- Control: You have control over your finances and decisions.

- Learn Financial Skills: You will learn valuable money management skills.

Credit: www.creditassociates.com

Credit: www.moneymanagement.org

Challenges of Doing Debt Relief Yourself

Managing debt relief on your own can be challenging:

- Time-Consuming: It takes time to contact creditors and negotiate.

- Stressful: Dealing with debt can be stressful and emotional.

- Complex: Understanding debt relief options can be complicated.

When to Seek Professional Help

Sometimes, it may be best to seek professional help. Consider getting help if:

- You are overwhelmed and don’t know where to start.

- You have tried to manage your debt, but it keeps growing.

- Your creditors are not willing to negotiate with you.

- You are facing legal action from your creditors.

Frequently Asked Questions

What Is Debt Relief?

Debt relief involves strategies to reduce or eliminate debt.

Can I Negotiate With Creditors?

Yes, you can directly negotiate with creditors to reduce your debt.

Is Debt Settlement A Good Option?

Debt settlement can lower your debt but may impact your credit score.

How Does Debt Consolidation Work?

Debt consolidation combines multiple debts into one loan with a lower interest rate.

Conclusion

Yes, you can do debt relief yourself. It requires time, effort, and patience. Assess your financial situation, contact your creditors, and create a repayment plan.

Consider debt consolidation and avoid taking on new debt. Remember, there are benefits and challenges to managing debt relief on your own. If you need help, don’t hesitate to seek professional assistance.

Take control of your finances and work towards a debt-free future. You can do it!