After filing bankruptcy, your credit score is likely to be significantly affected and will generally lower your credit score. Bankruptcy has a negative impact on your creditworthiness and can stay on your credit report for several years, making it difficult to secure new credit or loans.

However, with time and responsible financial behavior, it is possible to rebuild your credit score. Rebuilding credit after bankruptcy requires consistent and on-time payments, keeping credit utilization low, and gradually adding positive credit history to your report. By following these steps, you can improve your credit score over time.

Credit: www.debt.org

Table of Contents

Factors Affecting Your Credit Score After Filing Bankruptcy

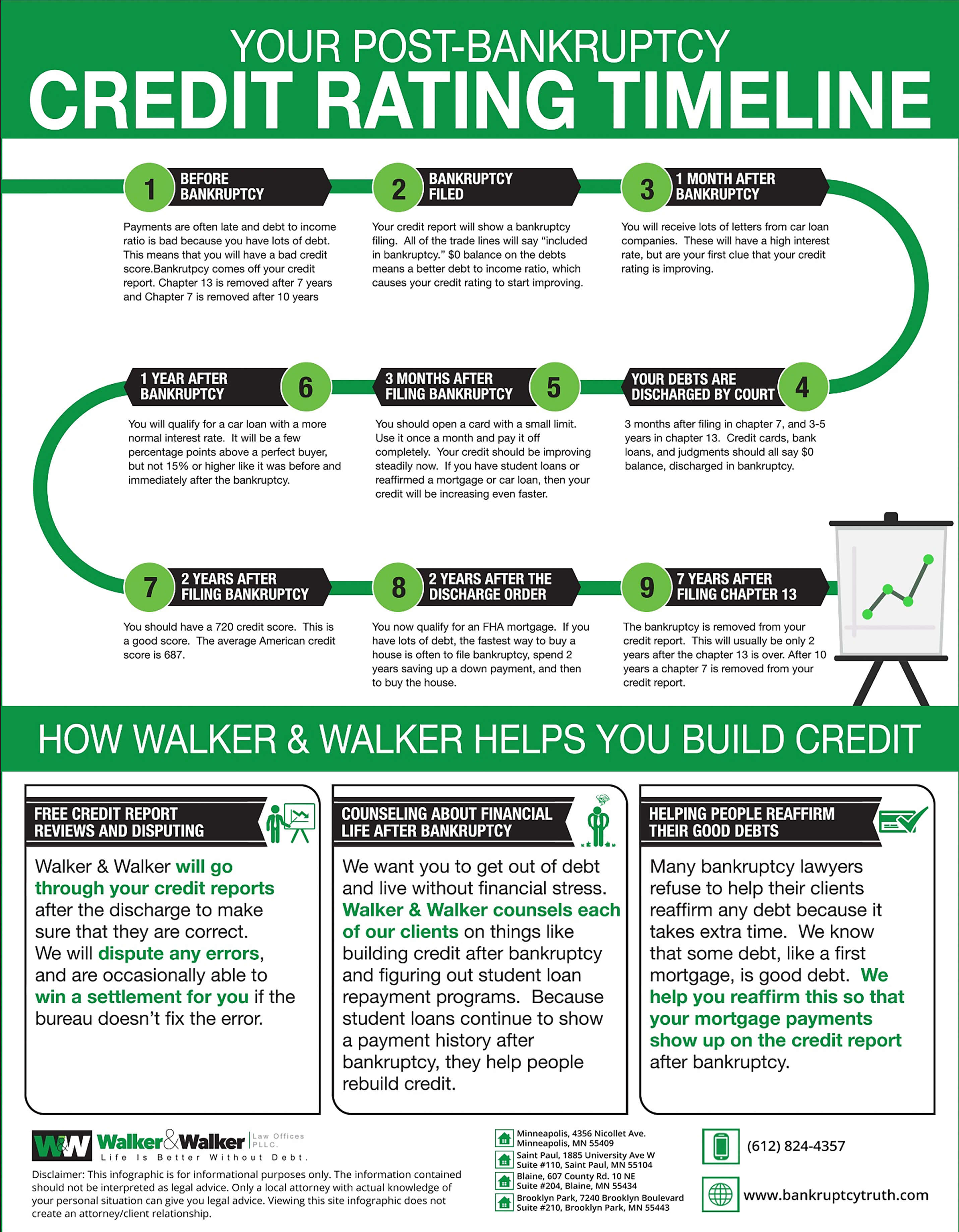

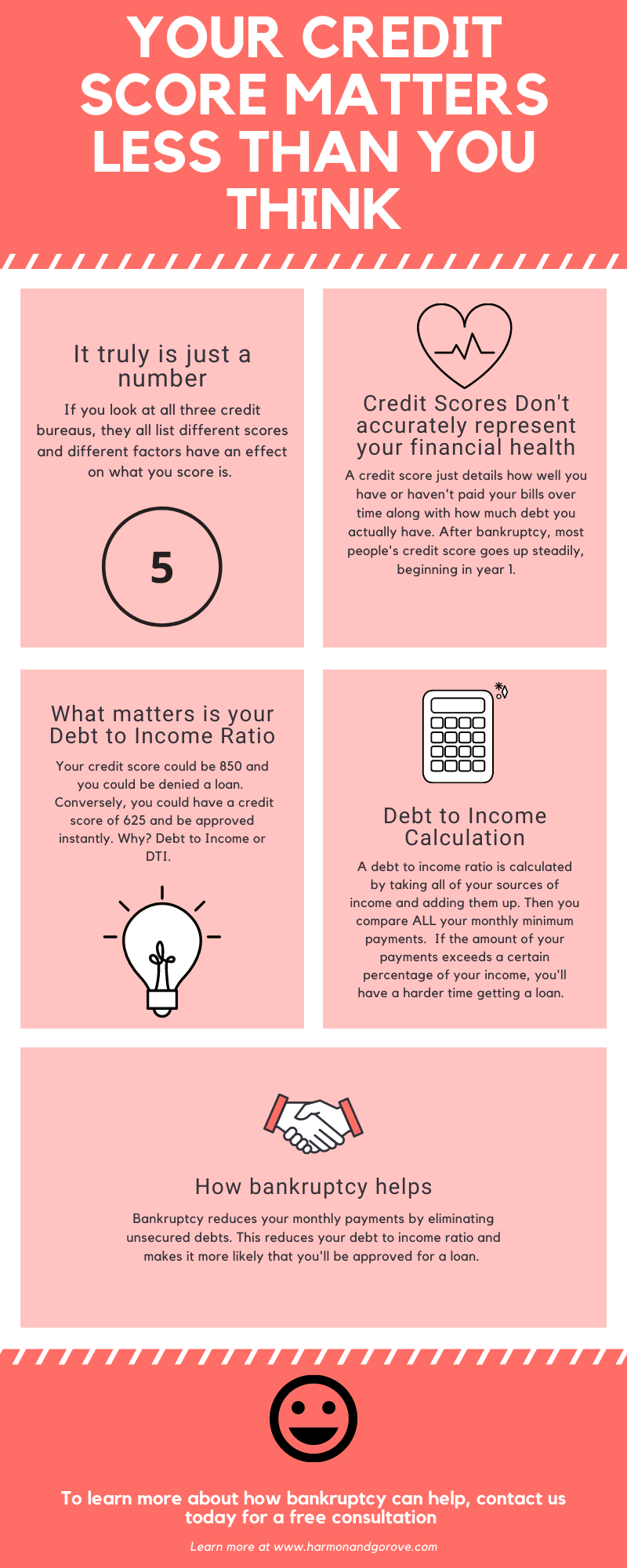

Filing for bankruptcy can have a significant impact on your credit score. After filing, factors such as payment history, debt-to-income ratio, and credit utilization play a crucial role in rebuilding your creditworthiness. It’s important to establish positive financial habits to improve your score over time.

Impact Of Bankruptcy On Your Credit Score |

|---|

Declaring bankruptcy can have a significant impact on your credit score. It is a negative mark that stays on your credit report for several years, making it more challenging to obtain credit in the future. Bankruptcy can lower your credit score substantially, often plummeting it by 100 or more points. This reduction can make it difficult to secure loans, credit cards, or even rent an apartment. However, it’s important to understand that this is not the end of the road for your credit score.

Despite the challenges, it is possible to rebuild your credit score after bankruptcy. By taking positive steps and implementing responsible financial strategies, you can gradually improve your creditworthiness. Here are some crucial steps to help you rebuild your credit:

- Importance of Timely Payments: Paying your bills on time is critical in rebuilding your credit score. Establishing a history of making on-time payments demonstrates financial responsibility to lenders and shows your commitment to meeting your financial obligations.

- Managing Your Finances Wisely: Take control of your finances by creating a budget and sticking to it. This will help you avoid unnecessary spending and ensure that you have enough money to cover your essential expenses and debt payments.

Managing Your Finances Wisely |

|---|

- Avoid new debt: While seeking to rebuild your credit, it’s crucial to avoid accumulating new debt that you may struggle to repay. Focus on managing existing debt responsibly, rather than taking on additional financial obligations.

- Establish an emergency fund: Building an emergency fund can provide a safety net during unforeseen circumstances. This fund can help you avoid relying on credit cards or loans for unexpected expenses and prevent future financial setbacks.

By implementing these steps and creating responsible financial habits, you can slowly but surely improve your credit score after bankruptcy. Remember, rebuilding your credit takes time and patience, but with dedication and discipline, you can regain your financial footing.

Credit: www.bankruptcytruth.com

Credit: www.harmonandgorove.com

Frequently Asked Questions Of After Filing Bankruptcy What Is Your Credit Score

What Is The Average Credit Score After Bankruptcy?

The average credit score after bankruptcy varies. It depends on various factors, such as your financial behavior post-bankruptcy and how you manage your debts. Building credit from scratch is possible, and with responsible financial decisions, you can improve your credit score over time.

Does My Credit Score Start Again After Bankruptcy?

Your credit score does not start again after bankruptcy. It takes time to rebuild your credit history and improve your score. Successfully managing your finances and making on-time payments can help you rebuild your credit over time.

How Much Will My Credit Score Go Up When Bankruptcy Falls Off?

Your credit score will likely increase when bankruptcy is removed, but the exact amount is hard to determine. It depends on other factors like your credit history, payment behavior, and current financial situation. Be patient, practice responsible borrowing, and eventually, your score will improve.

What Would Your Credit Rating Be If You Are Declare Bankruptcy?

If you declare bankruptcy, your credit rating will be negatively impacted.

Conclusion

Ultimately, filing for bankruptcy will have an impact on your credit score. However, it is not the end of the road. With time and responsible financial behavior, you can start rebuilding your credit. Stay diligent in making timely payments, keeping your debt levels low, and regularly checking your credit report.

Remember, the key is perseverance and patience as your credit score will gradually improve over time. Stay committed to your financial goals, and you will be on the path to a healthier credit future.