Credit card debt forgiveness allows individuals to eliminate or reduce their outstanding credit card balances. We will explore the concept of credit card debt forgiveness, including how it works, the options available, and the potential benefits and drawbacks.

We will also provide some tips for managing credit card debts effectively and avoiding the need for forgiveness in the future. Whether you are struggling with overwhelming credit card debt or simply want to gain a better understanding of this debt relief option, this article aims to provide you with the information you need to make informed decisions about your financial situation.

Let’s dive in.

Credit: www.budgetingfaithfully.com

Table of Contents

Understanding Credit Card Debt Forgiveness

When it comes to managing credit card debt, many people find themselves overwhelmed with high interest rates and mounting balances. This is where credit card debt forgiveness can come to the rescue. If you are burdened with credit card debt that seems impossible to repay, understanding how credit card debt forgiveness works can provide you with a potential solution to your financial woes.

How Does Credit Card Debt Forgiveness Work?

Credit card debt forgiveness, also known as debt settlement, is a process that allows you to negotiate with your credit card company to reduce the total amount you owe. Instead of paying off the full balance, you can settle for a reduced lump sum payment or a manageable payment plan that is more affordable for you.

The process typically involves contacting your credit card company or working with a debt settlement agency to negotiate the terms of your debt forgiveness. This negotiation can result in a reduction of the principal balance, the elimination of interest and fees, or even a combination of both. It is important to note that credit card debt forgiveness is not guaranteed and depends on the willingness of your credit card company to negotiate.

While credit card debt forgiveness can offer relief from burdensome debt, it is important to consider the potential consequences. In some cases, settling your debt for a lesser amount may have a negative impact on your credit score. It is crucial to weigh the benefits against the potential downsides and consult with a financial advisor or credit counselor to determine the best course of action for your specific situation.

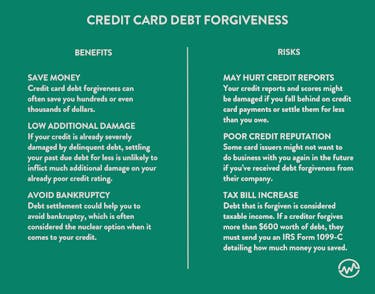

Benefits Of Credit Card Debt Forgiveness

There are several key benefits to credit card debt forgiveness:

- Debt Reduction: The primary benefit of credit card debt forgiveness is the significant reduction in the amount you owe. This can provide immediate relief and a clear path towards financial freedom.

- Lower Monthly Payments: By negotiating a settlement or a favorable payment plan, your monthly payments can become more manageable, enabling you to regain control of your finances.

- Elimination of Fees: Credit card debt forgiveness may also involve the elimination of accumulated late fees and penalties, reducing the overall burden of your debt.

- Quicker Debt Repayment: With a reduced balance and potentially eliminated interest charges, you can pay off your debt sooner, freeing up resources for other financial goals.

Remember, credit card debt forgiveness is just one potential solution for managing overwhelming debt. It is essential to carefully consider your options and seek professional guidance to determine the best approach for your financial situation.

Qualifying For Credit Card Debt Forgiveness

If you find yourself drowning in credit card debt, you may be feeling overwhelmed and wondering if there is a way out. The good news is that credit card debt forgiveness is a possibility for those who meet certain qualifications. In this article, we will explore the criteria for qualifying for credit card debt forgiveness, including financial hardship and the option of working with debt settlement companies.

Financial Hardship

To be eligible for credit card debt forgiveness, you typically need to demonstrate a significant level of financial hardship. This means showing that you are experiencing difficulties meeting your financial obligations due to circumstances beyond your control. Financial hardship can arise from various situations such as job loss, unexpected medical expenses, divorce, or a decrease in income.

When requesting credit card debt forgiveness based on financial hardship, it is important to provide supporting documentation. This can include termination letters, medical bills, divorce decrees, or documentation of income reduction. The more evidence you can provide to substantiate your claim of financial hardship, the stronger your case for debt forgiveness.

Working With Debt Settlement Companies

Another avenue to explore when seeking credit card debt forgiveness is working with debt settlement companies. These companies specialize in negotiating with creditors on your behalf to reduce the amount of debt you owe. Debt settlement companies have experience dealing with credit card companies and can often negotiate lower interest rates and reduced balances.

Before partnering with a debt settlement company, it is crucial to do your research. Look for reputable companies with positive reviews and a track record of success. Be cautious of companies that promise quick fixes or guarantee debt forgiveness, as these claims may be unrealistic or even fraudulent.

When working with a debt settlement company, they will typically require you to make regular payments into an escrow account. These funds will be used to negotiate settlements with your creditors. While debt settlement can be an effective solution for some, it is important to be aware that it may have negative impacts on your credit score and should be carefully considered before proceeding.

In conclusion, if you are struggling with credit card debt, credit card debt forgiveness may be a viable option. By demonstrating financial hardship and considering the possibility of working with a reputable debt settlement company, you can take steps towards regaining control of your financial situation.

The Process Of Credit Card Debt Forgiveness

Are you struggling to manage your credit card debt? It can be overwhelming and financially draining. However, there is a way out – credit card debt forgiveness. This process allows you to negotiate with your creditors and potentially reduce or eliminate a portion of your debt. In this article, we will explore the step-by-step process of credit card debt forgiveness to help you regain control of your financial situation.

Assessing Your Debt

Before you can begin the credit card debt forgiveness process, you need to assess your debt situation. Start by gathering all your credit card statements and making a list of the outstanding balances, interest rates, and minimum monthly payments for each card. This will give you a clear picture of the amount of debt you need to address.

Next, calculate your total monthly income and expenses. This will help you determine how much you can afford to pay towards your credit card debt each month. It’s important to be realistic and create a budget that allows for both debt repayment and essential living expenses.

Additionally, consider factors such as missed payments, late fees, and accrued interest. These can significantly impact your debt amount and may need to be factored into your negotiation strategy.

Negotiating With Creditors

Once you have a firm grasp on your debt situation, it’s time to negotiate with your creditors. Reach out to each credit card company and explain your financial hardship. Be prepared to provide documentation to support your claims, such as pay stubs or medical bills, if applicable.

During the negotiation process, express your willingness to work towards a resolution. Credit card companies are often open to negotiations as they prefer to receive some payment rather than none at all. Offer to pay a reduced lump sum or propose a new payment plan with lower interest rates or extended terms.

Remember to stay calm and maintain open lines of communication with your creditors. Be persistent and patient, as the negotiation process can take time. Keep detailed records of phone conversations, emails, and any agreements reached to ensure a smooth resolution.

If negotiating with your creditors proves challenging or unproductive, consider seeking assistance from a reputable credit counseling agency. They can provide expert advice and guidance to help you navigate the debt forgiveness process.

In conclusion, the process of credit card debt forgiveness begins with assessing your debt and creating a realistic budget. Then, you can negotiate with your creditors to reduce or eliminate a portion of your debt. By following these steps and seeking professional assistance if needed, you can alleviate the burden of credit card debt and regain control of your financial future.

Credit: wealthfit.com

Impact Of Credit Card Debt Forgiveness

Understanding the impact of credit card debt forgiveness is crucial for anyone struggling with overwhelming financial burdens. While the prospect of having your credit card debt forgiven may seem like a relief, it’s important to consider the potential consequences that come along with it. In this article, we will explore two key aspects of credit card debt forgiveness: its effects on your credit score and the legal ramifications.

Effects On Credit Score

Your credit score is a significant factor in determining your financial health and access to future credit opportunities. With credit card debt forgiveness, there can be both positive and negative implications for your credit score.

On one hand, having your credit card debt forgiven can alleviate a significant financial burden, allowing you to regain control over your finances. This newfound relief can potentially lead to improved financial management and prompt bill payments, positively impacting your credit score in the long run.

On the other hand, credit card debt forgiveness may have an initial negative impact on your credit score. When a debt is forgiven, it may be reported to credit bureaus as “settled” or “charged-off,” which can lower your credit score temporarily. It is important to note that this negative impact may vary depending on the specific reporting practices of the credit card issuer and how they classify the forgiven debt.

Despite the potential short-term impact, it is essential to focus on rebuilding your credit score after credit card debt forgiveness. By establishing responsible financial habits, such as making timely payments and keeping credit utilization low, you can gradually improve your creditworthiness over time.

Legal Ramifications

While credit card debt forgiveness offers relief from financial stress, it is crucial to understand the legal ramifications associated with this process.

When seeking credit card debt forgiveness options, it is essential to work with reputable organizations and understand the specific terms and conditions involved. Engaging with fraudulent or unethical debt relief companies can lead to severe consequences, including scams, collection lawsuits, and further financial distress.

Credit card debt forgiveness may also have potential tax implications. In some cases, forgiven debt can be considered taxable income, leading to additional financial obligations. It is advisable to consult with a qualified tax professional to understand the potential tax consequences specific to your situation.

By remaining vigilant and informed about the legal aspects of credit card debt forgiveness, you can navigate the process while safeguarding your financial well-being.

Credit: www.self.inc

Frequently Asked Questions On Credit Card Debt Forgiveness

Can Credit Card Debt Really Be Forgiven?

Yes, credit card debt can be forgiven.

How Can I Legally Get Rid Of My Credit Card Debt?

To legally eliminate your credit card debt, you have a few options: negotiating with creditors for lower payments, enrolling in a debt management plan, filing for bankruptcy, or working with a credit counseling agency. Consider consulting a financial advisor to determine the best course of action for your specific situation.

How Do I Get My Credit Card Debt Written Off?

To get your credit card debt written off, you can negotiate with your credit card provider for debt settlement or explore debt consolidation options. Seek professional advice from credit counseling services to help consolidate and negotiate your debts. Be aware of debt relief scams and keep up with your payments to avoid damaging your credit score.

Is There A Government Credit Card Debt Relief Program?

Yes, there are government credit card debt relief programs available. They provide assistance in reducing or eliminating credit card debt for qualified individuals. These programs aim to provide financial relief and help individuals regain control of their finances.

Conclusion

Credit card debt forgiveness can provide much-needed relief to individuals struggling with overwhelming financial burdens. By taking advantage of debt forgiveness programs, you can potentially have a portion of your debt waived or reduced, allowing you to regain control of your finances.

However, it is essential to fully understand the terms and conditions of these programs, as they may have implications for your credit score. Seeking professional advice and exploring all available options is crucial in your journey towards financial freedom.