In the world of finance, understanding capital structure is essential for businesses and investors alike. This comprehensive guide will delve into the intricacies of capital structure, its components, and its significance in financial decision-making.

Table of Contents

What is Capital Structure?

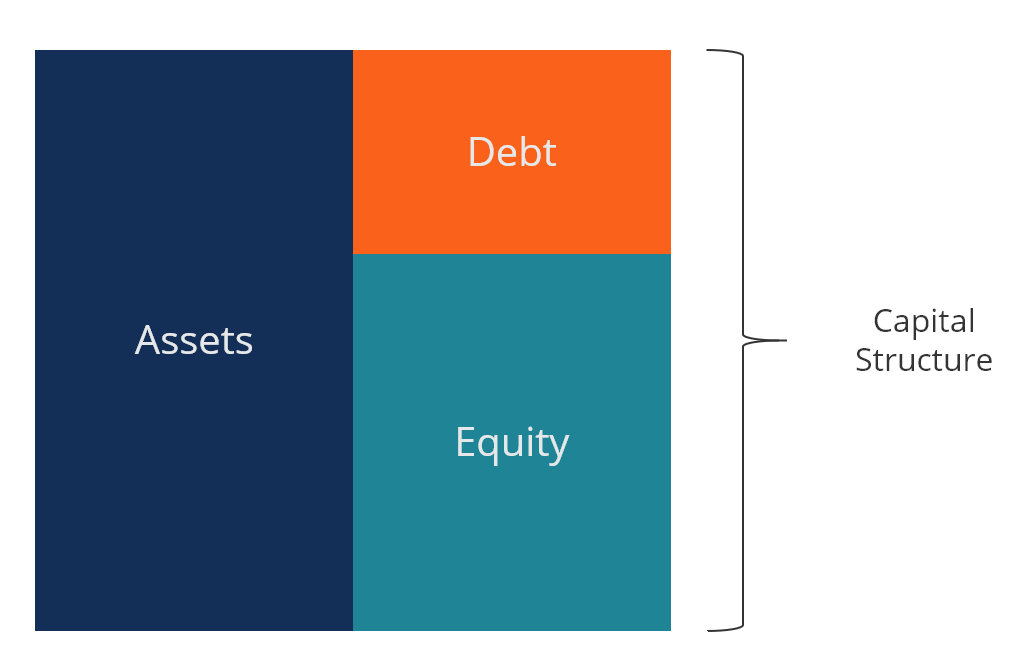

Capital structure refers to the way a company finances its assets through a combination of equity and debt. It encompasses the composition of a company’s liabilities, including long-term debt, preferred stock, and common equity.

Components of Capital Structure

The key components of capital structure include:

- Equity: Represents ownership in the company and can be in the form of common stock or preferred stock.

- Debt: Refers to funds borrowed by the company, typically through bank loans, bonds, or other debt instruments.

Significance of Capital Structure

The capital structure of a company influences its financial stability, risk profile, and cost of capital. Striking the right balance between equity and debt is crucial for maximizing shareholder value and ensuring sustainable growth.

Factors Affecting Capital Structure

Several factors influence a company’s capital structure decisions, including:

- Business Risk: Companies with higher business risk may opt for lower debt levels to mitigate financial distress.

- Tax Considerations: Debt interest is tax-deductible, making it an attractive financing option for companies seeking tax advantages.

- Cost of Debt vs. Cost of Equity: Evaluating the costs associated with both debt and equity is vital in determining the optimal capital structure.

- Market Conditions: External market factors, such as interest rates and investor sentiment, can impact capital structure decisions.

Capital Structure Theories

Various theories have been advanced to guide capital structure decisions, including:

- Modigliani-Miller Theorem: Proposes that, under certain assumptions, the value of a firm is independent of its capital structure.

- Trade-off Theory: Suggests that companies aim to balance the tax advantages of debt with the costs of financial distress.

- Pecking Order Theory: Argues that companies prefer internal financing, followed by debt, and equity issuance as a last resort.

Optimal Capital Structure

The concept of optimal capital structure revolves around finding the ideal mix of debt and equity to minimize the cost of capital and maximize the company’s value. Achieving this balance requires a thorough assessment of various financial and non-financial factors.

Credit: dealroom.net

Credit: corporatefinanceinstitute.com

Importance of Capital Structure in Valuation

Understanding a company’s capital structure is integral in the valuation process. Analysing the composition of its capital and the associated risks provides insights into its financial health and future prospects, influencing investment decisions and stock valuation.

Frequently Asked Questions Of Capital Structure

Faq 1: What Is The Importance Of Capital Structure?

The capital structure plays a crucial role in determining a company’s financial health and stability. It influences the company’s cost of capital, risk profile, and ability to raise funds for growth and operations.

Faq 2: How Does The Capital Structure Affect A Company’s Profitability?

The capital structure directly impacts a company’s profitability by determining the cost of capital. Finding the right balance between debt and equity can optimize the cost of funds and maximize returns for shareholders.

Faq 3: What Are The Factors To Consider When Deciding On The Capital Structure?

When deciding on the capital structure, factors like industry norms, business risk, tax implications, growth prospects, and financial flexibility must be carefully evaluated. Optimal capital structure aligns with the company’s goals and risk appetite.

Conclusion

Capital structure plays a pivotal role in shaping the financial landscape of businesses. Striking the right balance between equity and debt is vital for long-term sustainability and growth. By understanding the nuances of capital structure, companies and investors can make informed decisions that drive value creation and financial success.