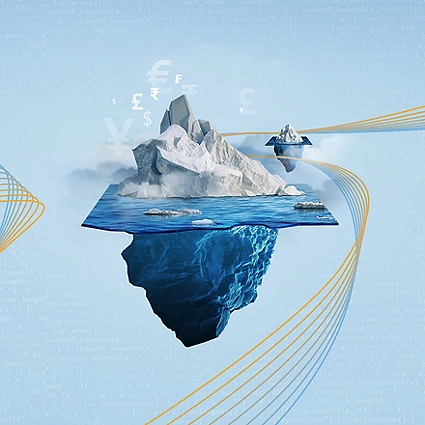

In the world of finance and investing, the term “floating stock” refers to the number of shares available for public trading of a particular company’s stock. It is also known as the “public float” or “publicly traded float”. Understanding the concept of floating stock is essential for investors, as it provides valuable insights into a company’s liquidity and market activity. In this article, we will explore the basics of floating stock, its importance, and the benefits it offers to investors.

Table of Contents

What is Floating Stock?

Floating stock represents the total number of shares of a company’s stock that are available for trading on the open market. It excludes shares held by insiders, such as company executives, directors, and major shareholders. These shares are considered restricted and are not available for public trading. The floating stock is a crucial figure for investors as it provides an indication of the company’s marketability and liquidity in the stock market.

Credit: www2.deloitte.com

Calculating Floating Stock

To calculate the floating stock, you need to subtract the restricted shares from the total outstanding shares of a company. The total outstanding shares include both the publicly traded shares and the restricted shares. The resulting figure represents the floating stock, which is freely available for trading by the general public.

Credit: www.facebook.com

Importance of Floating Stock

The floating stock plays a vital role in determining a company’s market value and its ability to respond to changes in market conditions. Here are some key reasons why the floating stock is of great importance:

- Market Liquidity: The floating stock indicates the ease with which shares of a company can be bought or sold in the market. Higher floating stock typically translates to greater liquidity, as there are more shares available for trading purposes.

- Price Stability: A company with a larger floating stock is likely to have more stable stock prices as it will be less susceptible to drastic fluctuations caused by large buy or sell orders.

- Investor Confidence: A larger floating stock often indicates investor trust and confidence in a company. It signifies that the company has a broader shareholder base, which can be seen as a positive sign for potential investors.

The Benefits of Floating Stock

Investors stand to gain several benefits by considering the floating stock when making investment decisions. Let’s look at some of these benefits:

| Benefit | Description |

|---|---|

| Improved Liquidity | A higher floating stock typically results in increased trading volume, making it easier for investors to buy or sell shares without significant price impact. |

| Diverse Investor Base | A larger floating stock attracts a broader range of investors, including institutions, which can contribute to increased stability and long-term growth. |

| Easier Market Entry | Investors looking to enter a market may find companies with sufficient floating stock more attractive, as it allows for easier entry and exit points. |

| Reduced Market Manipulation | A higher floating stock can discourage market manipulation activities, as it becomes more challenging for individuals or entities to control market prices by buying or selling large quantities of shares. |

By considering the floating stock as part of their investment research, investors can gain valuable insights into a company’s market dynamics and make more informed investment decisions.

Conclusion

Understanding floating stock is essential for investors as it provides insights into a company’s marketability, liquidity, and investor confidence. A higher floating stock generally indicates improved market liquidity and price stability, attracting a diverse range of investors. By analyzing the floating stock, investors can make informed decisions and navigate the complexities of the stock market more effectively.