Table of Contents

Introduction

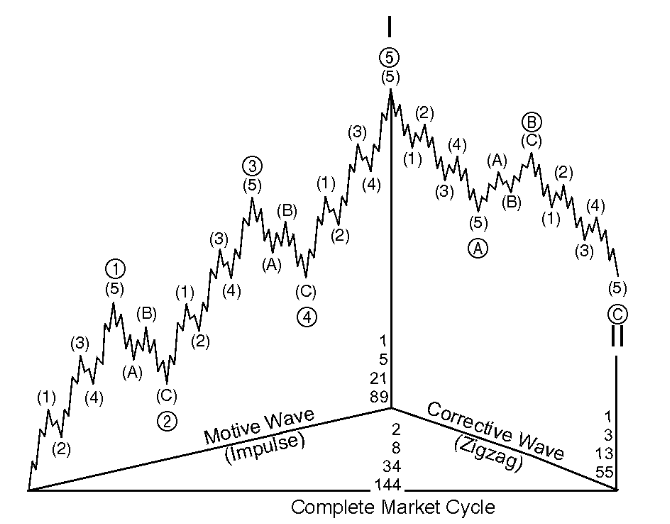

The Elliott Wave Theory is a popular technical analysis tool used by traders and investors to identify potential market trends and reversals. Developed by Ralph Nelson Elliott in the 1930s, this theory suggests that financial markets move in repetitive patterns or waves.

The Basics of Elliott Wave Theory

According to Elliott, market trends are formed by a series of five waves in the direction of the main trend (known as “impulse waves”), followed by three corrective waves against the primary direction (known as “corrective waves”). These waves create a cycle that repeats across different time frames, from minutes to years.

The impulse waves are numbered 1, 2, 3, 4, and 5, while the corrective waves are labeled A, B, and C. The impulse waves represent the main trend, while the corrective waves are counter-trend movements. This pattern of five waves followed by three waves is known as an “Elliott Wave” or “Elliott Wave Cycle.”

Key Concepts of Elliott Wave Theory

To effectively use the Elliott Wave Theory, it’s essential to understand the key concepts that underpin it:

- Wave 1: The first wave in an Elliott Wave Cycle is an impulse wave that follows the completion of a previous cycle. It represents the start of a new trend in the direction of the larger time frame trend.

- Wave 2: The second wave is a corrective wave that typically retraces a portion of the first wave’s advance. It is commonly observed as a pullback or correction against the primary trend.

- Wave 3: Wave 3 is considered the longest and most powerful wave in an Elliott Wave Cycle. It usually demonstrates significant momentum and often surpasses the peak of Wave 1 in an uptrend or the trough of Wave 1 in a downtrend.

- Wave 4: The fourth wave is another corrective wave that retraces a portion of the Wave 3 advance. It often frustrates traders and may take the form of a prolonged consolidation or sideways movement.

- Wave 5: The fifth wave is the final wave of an impulse wave sequence. It typically marks the end of the larger trend and can be accompanied by increased media attention and extreme market sentiment.

- Wave A: The first corrective wave follows the completion of a five-wave impulse sequence. It typically retraces a portion of the impulse wave’s move.

- Wave B: The second corrective wave in an Elliott Wave Cycle is a counter-trend move that retraces a significant portion of Wave A’s decline.

- Wave C: The third corrective wave is the final wave of the Elliott Wave Cycle. It completes the correction and most often exceeds the extreme of Wave A.

Applying Elliott Wave Theory in Trading

Elliott Wave Theory can be applied to various financial markets, including stocks, forex, commodities, and cryptocurrencies. Traders use this theory to identify potential entry and exit points, as well as to determine stop loss and take profit levels.

By understanding the wave patterns and wave counts, traders can improve their accuracy when forecasting future market moves. Elliott Wave analysis is often used in conjunction with other technical indicators and patterns to make well-informed trading decisions.

Credit: zodiactrading.medium.com

Limitations and Challenges

While Elliott Wave Theory can be a valuable tool, it is not without limitations. It requires a high level of subjectivity and interpretation, which can lead to different analysts arriving at different wave counts. The complexity of the theory can also make it challenging to master.

Furthermore, Elliott Wave Theory may not always accurately predict market movements, as financial markets are influenced by various factors such as economic news, geopolitical events, and investor sentiment. It is crucial to combine Elliott Wave analysis with other fundamental and technical analysis tools for a more comprehensive market perspective.

Credit: fastercapital.com

In Conclusion

Elliott Wave Theory provides traders with a framework for understanding market cycles and trends. By identifying patterns and wave counts, traders can gain insights into potential entry and exit points in the market. However, it is essential to acknowledge the limitations and challenges associated with this theory and use it in conjunction with other analytical tools.