When it comes to international finance and investment, one key factor that cannot be ignored is sovereign risk. This term refers to the risk associated with lending to governments or investing in their debt. A government’s ability to repay its creditors or meet its financial obligations is crucial in determining sovereign risk. In this article, we will delve into the concept of sovereign risk, its impact on the global economy, and the methods used to measure and mitigate this risk.

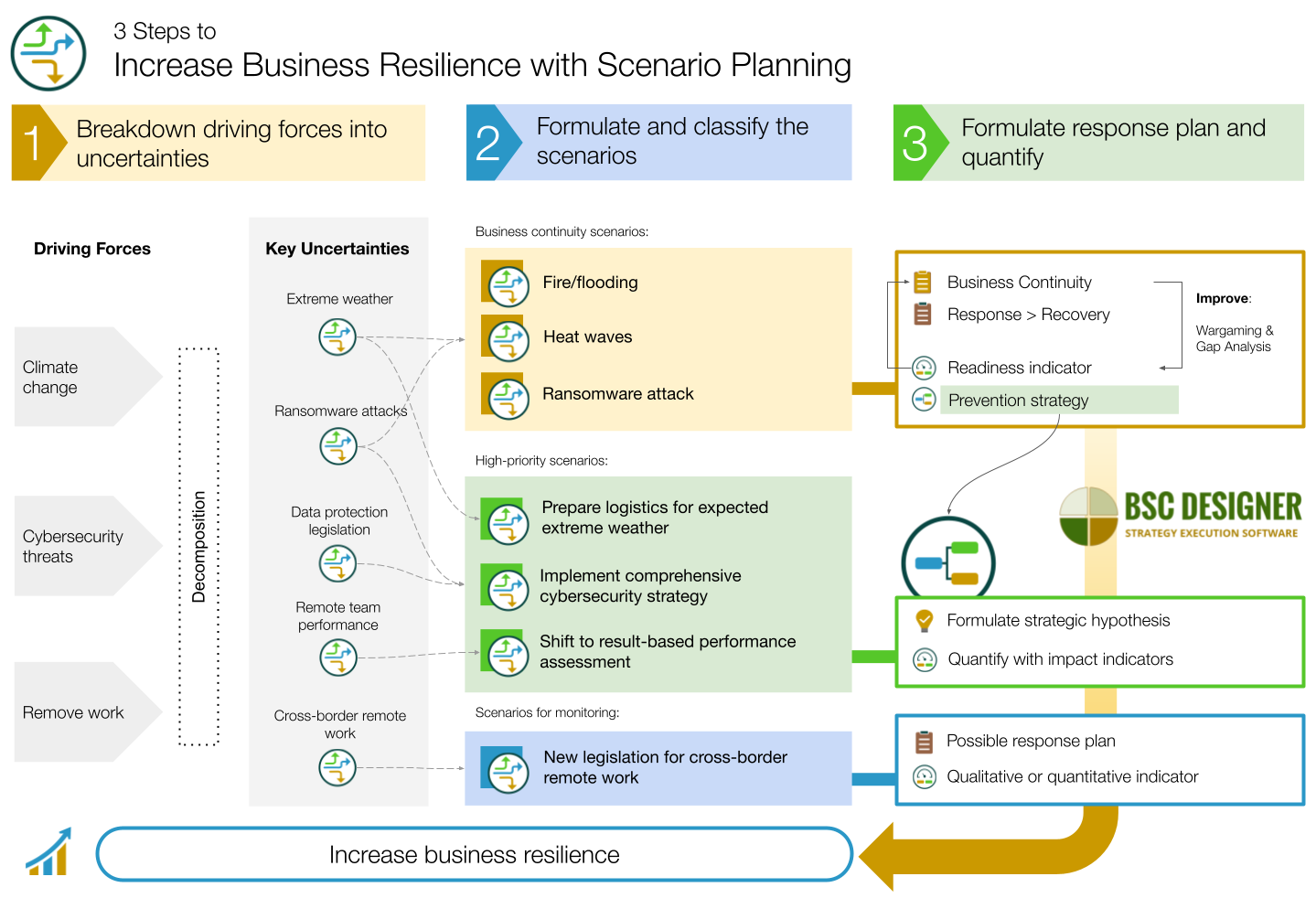

Credit: bscdesigner.com

Table of Contents

Defining Sovereign Risk

Sovereign risk emerges from a variety of factors, including a nation’s economic stability, political climate, institutional framework, and its level of indebtedness. It refers to the chances of a government defaulting on its debts or being unable to meet its financial obligations. The implications of sovereign risk are manifold and can have far-reaching consequences for domestic and international financial markets, investors, and creditors.

Impact On Global Economy

The global economy is inherently interconnected, with the financial well-being of one nation significantly impacting others. Sovereign risk can trigger financial crises, leading to a domino effect that spreads across countries and regions. It has the potential to disrupt capital flows, cause currency volatility, increase borrowing costs, and trigger recessions. In extreme cases, sovereign risk can even lead to a sovereign debt crisis, where a government is unable to repay its creditors and defaults on its debt.

The aftermath of the 2008 global financial crisis demonstrated the far-reaching consequences of sovereign risk. Several nations faced severe financial strain due to excessive government borrowing and mounting debt levels. Countries like Greece, Spain, and Portugal experienced significant economic downturns, with high unemployment rates, austerity measures, and social unrest. The contagion effect of sovereign risk led to a widespread economic slowdown and turmoil in financial markets.

Measuring Sovereign Risk

As sovereign risk plays a crucial role in financial decision-making and risk assessment, several tools and methods have been developed to measure and evaluate this risk. These measurements help investors, credit rating agencies, and policymakers analyze the creditworthiness and financial stability of nations.

Credit Ratings

Credit rating agencies, such as Standard & Poor’s, Moody’s, and Fitch Ratings, assess the credit quality of countries by assigning them ratings. These ratings provide an indication of a government’s ability to meet its financial obligations. Typically, higher-rated countries are considered less risky, while lower-rated nations face greater sovereign risk. Investors rely on these ratings to make informed decisions regarding their investments.

| Rating | Definition |

|---|---|

| AAA | Highest credit quality |

| AA | High credit quality |

| A | Upper-medium credit quality |

| BBB | Lower-medium credit quality |

| BB | Speculative (high) credit risk |

| B | Speculative (very high) credit risk |

Market-based Measures

Market-based measures, such as sovereign bond yields and credit default swaps (CDS), provide real-time information about the perceived riskiness of government debt. Higher yields and CDS spreads indicate higher levels of sovereign risk. These measures are essential for understanding market sentiment and for investors to gauge market appetite for a nation’s debt.

Mitigating Sovereign Risk

Given the potential consequences of sovereign risk on the global economy, it is vital for governments and policymakers to take measures to mitigate this risk. Some potential strategies and steps include:

- Improving fiscal discipline: Governments should strive to maintain sound financial practices, avoid excessive borrowing, and control budget deficits.

- Implementing structural reforms: Enhancing market competition, promoting transparency, and fostering good governance can contribute to reducing sovereign risk.

- Diversifying funding sources: Governments should explore ways to diversify their sources of funding, such as attracting foreign direct investment or utilizing multilateral financing options.

- Monitoring macroeconomic indicators: Timely monitoring and addressing signs of economic vulnerability, including inflation rates, exchange rates, and debt-to-GDP ratios, can help prevent sovereign risk from escalating.

- Seeking international cooperation: Global coordination and cooperation, such as through international financial institutions like the International Monetary Fund (IMF), can play a vital role in assisting nations during times of financial stress.

:max_bytes(150000):strip_icc()/Unsystematicrisk_final-31b6d4ce82394ebe8fbebeb331c3fc29.png)

Credit: www.investopedia.com

Conclusion

Sovereign risk is an essential aspect of international finance with significant implications for global economic stability. Understanding and effectively managing this risk is crucial for investors, financial institutions, and governments alike. By employing various measures and strategies to measure and mitigate sovereign risk, economies can strive towards greater financial stability and minimize the potential negative impacts that this risk poses.