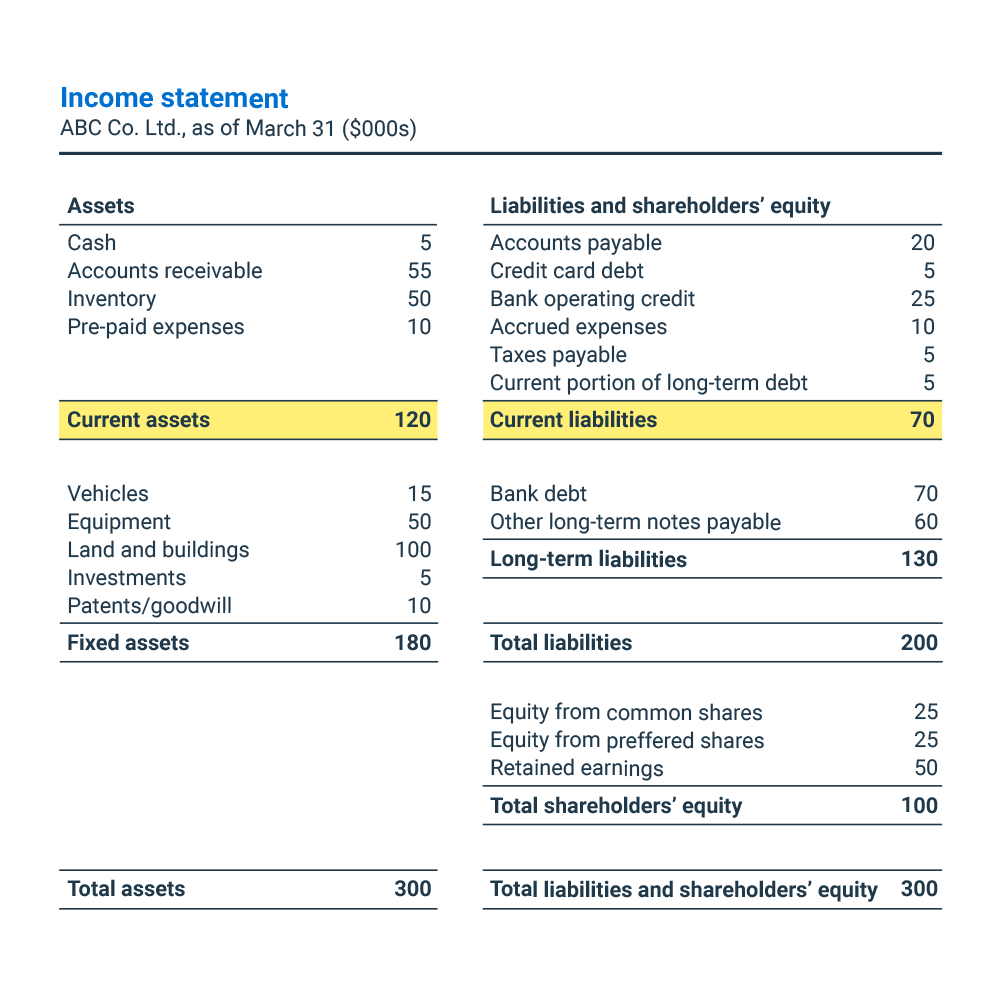

Net Working Capital (NWC) is a financial metric that measures an organization’s ability to meet its short-term obligations. It represents the difference between a company’s current assets and its current liabilities.

To calculate the net working capital, you subtract the current liabilities from the current assets. Current assets include cash, accounts receivable, inventory, and other assets that are expected to be realized within one year. On the other hand, current liabilities include accounts payable, short-term debt, and other obligations due within one year.

Table of Contents

Importance of Net Working Capital

Net working capital is a crucial measure of a company’s liquidity and financial health. It indicates whether a business has enough resources to cover its short-term obligations and continue its operations smoothly.

Having a positive net working capital is generally considered favorable, as it signifies that a company has more current assets than current liabilities. This surplus can be used to manage unexpected expenses, seize growth opportunities, and ensure the company’s stability during economic downturns.

In contrast, negative net working capital suggests that a company may struggle to meet its short-term obligations. It might be an indication of liquidity problems, such as slow-paying customers, excessive inventory, or excessive short-term debt. Companies with negative net working capital may face difficulties in paying suppliers, employees, or other immediate expenses.

Interpreting Net Working Capital Ratio

The net working capital ratio helps analyze a company’s financial health by comparing its current assets to its current liabilities. The formula for the net working capital ratio is:

Net Working Capital Ratio = Current Assets / Current Liabilities

The higher the net working capital ratio, the better a company’s ability to cover its short-term obligations. Generally, a ratio above 1 is considered preferable, indicating that the company has more assets than liabilities to meet its obligations comfortably.

However, it’s important to interpret the net working capital ratio in the context of the specific industry and company’s operations. Different industries have varying working capital requirements, and excessively high or low ratios may signal inefficiencies or other underlying issues.

Managing Net Working Capital

Effectively managing net working capital is crucial for the financial stability and growth of a company. Here are some strategies to optimize net working capital:

- Monitor and streamline inventory: Excessive inventory ties up cash and increases storage and holding costs. Regularly evaluate inventory levels and optimize ordering and stocking processes.

- Improve accounts receivable collection: Promptly collect outstanding payments from customers by implementing efficient billing and payment collection systems. This can reduce the need for short-term borrowing to cover expenses.

- Manage accounts payable effectively: Negotiate favorable payment terms with suppliers and strive to take advantage of early payment discounts. However, be cautious not to jeopardize relationships or miss out on crucial supplies.

- Optimize cash management: Monitor cash flow closely to ensure that there are sufficient funds to meet short-term obligations. Implement effective cash flow forecasting and manage surplus cash wisely.

- Regularly review and adjust pricing: Evaluate pricing strategies to enhance profitability while considering the potential impact on sales volume and competitive position. Proper pricing can support positive cash flow and improve net working capital.

Credit: corporatefinanceinstitute.com

Credit: www.bdc.ca

Conclusion

Net working capital is an important financial metric that measures a company’s ability to meet its short-term obligations. It provides insights into the business’s liquidity and financial standing. Maintaining a positive net working capital and managing it effectively can contribute to a company’s growth and stability.