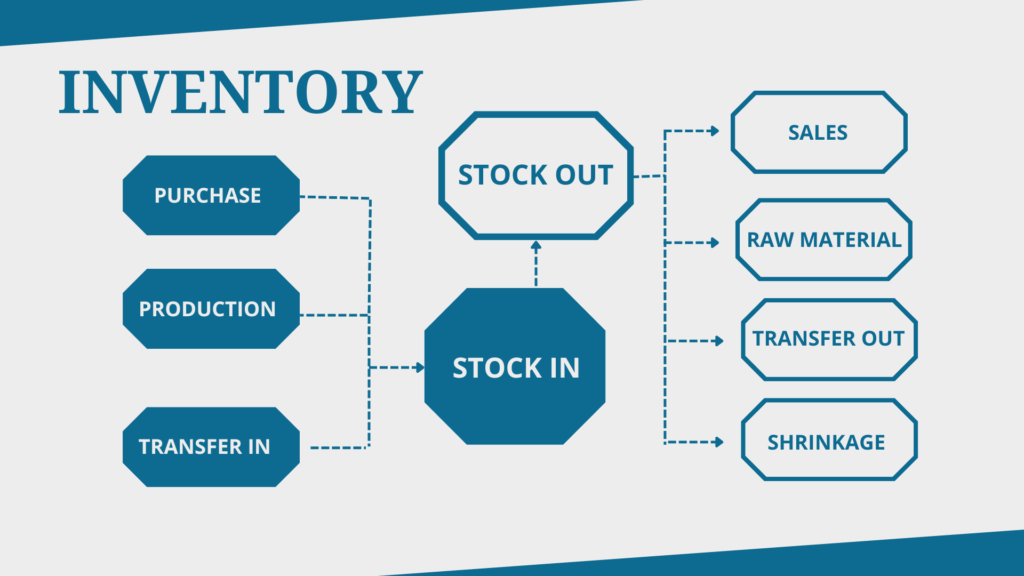

An inventory write down is a common accounting practice used by businesses to adjust the value of their inventory to reflect its current market value. This adjustment is necessary when the inventory’s cost exceeds its net realizable value, which is the estimated selling price minus any costs of completion, disposal, and transportation.

Inventory write downs are typically performed at the end of an accounting period or when there is evidence of a decline in the market value of the inventory items. It is important for businesses to regularly assess their inventory to ensure that it is recorded at the correct value.

Credit: www.netsuite.com

Table of Contents

Reasons for Inventory Write Downs

There are several reasons why businesses may need to write down their inventory. These include:

- Obsolescence: Technology advancements or changes in consumer preferences can quickly render certain products obsolete. If a business has excess inventory that is no longer in demand, it may need to write down its value.

- Damaged or expired goods: Inventory that is damaged, expired, or otherwise unsalable cannot be sold at its original cost. In such cases, the business must adjust the inventory’s value accordingly.

- Price fluctuations: Market conditions, changes in the economy, or unexpected events can cause the value of certain inventory items to decline. Businesses must recognize these changes and adjust their inventory accordingly to prevent overstating its value.

By conducting inventory write downs, businesses can provide a more accurate representation of their financial condition and prevent assets from being carried on the balance sheet at inflated values.

Credit: cashflowinventory.com

Accounting Treatment of Inventory Write Downs

When a business determines that its inventory needs to be written down, it must record a loss in the financial statements. This loss is recognized as an expense on the income statement, which reduces the net income and ultimately affects the company’s profitability.

The accounting treatment for inventory write downs depends on the accounting method used by the business. Under the Generally Accepted Accounting Principles (GAAP), there are two main methods:

- Specific identification method: This method is used when each item in the inventory is individually identified and assigned a specific cost. If a specific item’s market value declines below its cost, the business writes down the value of that particular item.

- First-in, first-out (FIFO) method: This method assumes that the first inventory items purchased are the first ones sold. If the market value of the inventory declines, the business writes down the value of the oldest inventory first, followed by the newer inventory.

Regardless of the method used, the inventory write down is recognized as a reduction in the value of the inventory asset and an increase in the cost of goods sold. This adjustment directly impacts the profitability of the business.

Reporting Inventory Write Downs

Inventory write downs are reported in the financial statements of a business. The specific accounts affected include the inventory account and the cost of goods sold account.

On the balance sheet, the inventory write down is shown as a reduction in the inventory asset. The value of the inventory is adjusted to its net realizable value, which represents the estimated amount the business expects to receive from selling the inventory.

On the income statement, the inventory write down is included as an expense under the cost of goods sold. This reduces the gross profit and ultimately the net income of the business.

Conclusion

Inventory write downs are a necessary practice for businesses to accurately reflect the value of their inventory. By adjusting their inventory to its current market value, businesses can provide a more accurate representation of their financial position. The accounting treatment of inventory write downs impacts the financial statements and affects the profitability of the business. Regular assessment of inventory and proactive management of potential write downs are crucial for maintaining accurate financial records.