In the financial world, duration drift is a term used to describe the phenomenon in which the effective duration of a bond or bond portfolio changes over time. Duration measures the sensitivity of a bond’s price to changes in interest rates, and it plays a crucial role in assessing the risk and potential return of fixed-income investments.

Duration drift can occur due to various factors such as market conditions, changes in interest rates, and adjustments in the composition of a bond portfolio. It is essential for investors to understand duration drift as it can have a significant impact on their investment performance.

Credit: www.omnilabs.ai

Table of Contents

The Impact of Duration Drift

When duration drifts, the price of a bond or bond portfolio can experience significant fluctuations. If interest rates rise, the duration will typically increase, resulting in a decrease in the bond’s price. Conversely, if interest rates fall, the duration will decrease, leading to an increase in the bond’s price.

The impact of duration drift can be particularly pronounced for bonds with longer maturities and lower coupons. These bonds tend to have higher durations and are more sensitive to changes in interest rates. As a result, investors holding these bonds may experience greater volatility in their portfolio values.

Furthermore, duration drift can also affect the overall risk and return characteristics of a bond portfolio. As the effective duration changes, the portfolio’s performance relative to its benchmark may deviate. This deviation can lead to either outperformance or underperformance compared to the benchmark, depending on the direction of the duration drift.

Mitigating Duration Drift

Investors can take several measures to mitigate the impact of duration drift and manage the risk associated with it:

- Regular Monitoring: It is crucial for investors to regularly monitor the duration of their bond portfolio. By staying informed about any changes in duration, investors can make timely adjustments to maintain their desired risk and return profile.

- Diversification: Investing in a diversified portfolio of bonds can help mitigate the impact of duration drift. By spreading investments across different maturities, sectors, and credit qualities, investors can reduce the overall sensitivity to interest rate changes.

- Active Portfolio Management: Active portfolio management techniques, such as using derivatives or adjusting bond holdings, can be employed to actively manage duration. By actively rebalancing the portfolio, investors can align the duration with their investment objectives.

- Professional Advice: Seeking advice from experienced financial professionals can help investors navigate the complexities of duration drift. Financial advisors can provide valuable insights and guidance on managing duration risk.

The Importance of Duration Drift Awareness

Understanding duration drift is critical for investors to make informed decisions about their bond investments. By being aware of the potential impact of duration drift, investors can evaluate the risk-return trade-off of different fixed-income securities and adjust their investment strategies accordingly.

Additionally, duration drift awareness is particularly important in a changing interest rate environment. When interest rates are expected to rise, investors may consider shorter-duration bonds to minimize the potential negative impact of duration drift on their portfolios.

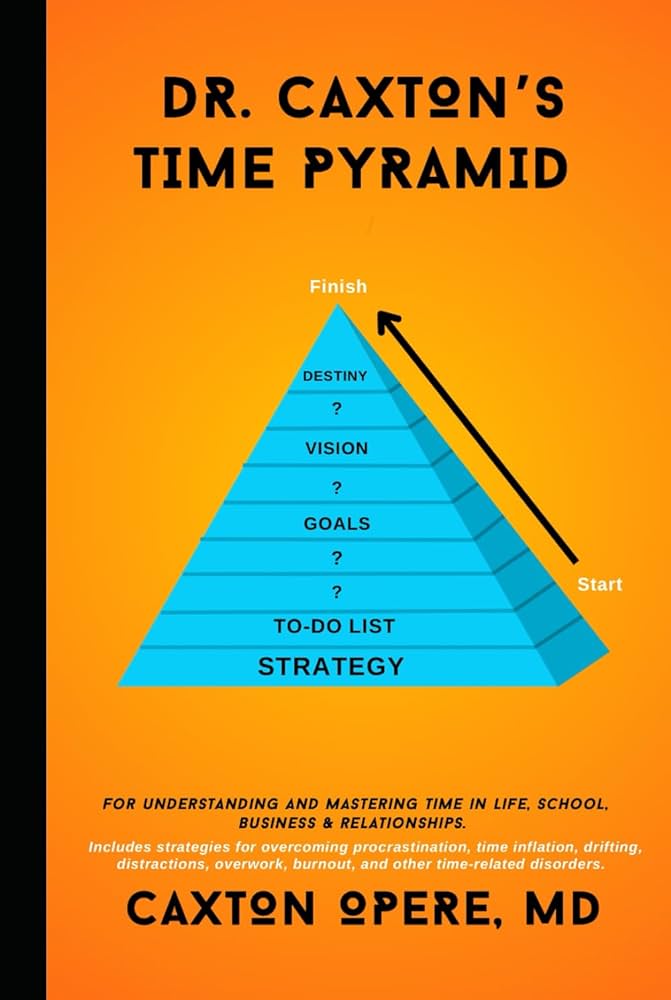

Credit: www.amazon.com

Conclusion

Duration drift is a significant consideration for investors looking to maximize their bond investment returns while managing risk. By understanding the impact of duration drift and implementing appropriate measures to mitigate its effects, investors can navigate the complex world of fixed-income investing with confidence.