In a historic move aimed at providing financial security and social protection to a significant portion of the population, It is the launching of the universal pension scheme in Bangladesh today. This groundbreaking initiative, spearheaded by the government, aims to encompass approximately 10 crore people from various socio-economic backgrounds. The pension scheme is poised to address the needs of the elderly and those engaged in low-income and informal sectors, marking a significant step towards ensuring the well-being of the nation’s citizens.

The journey towards implementing the universal pension system began with the initiation of the late Finance Minister Abul Mal Abdul Muhith in 2015. A concept paper was developed in 2016, and after a hiatus, the concept gained momentum in 2022. On January 31 of the current year, the National Pension Authority was established under the Universal Pension Management Act. Here’s a comprehensive overview of this innovative pension system.

Table of Contents

The Need for a Universal Pension System

In the face of significant demographic shifts and an aging population, the imperative for a comprehensive social security framework has never been more evident. Bangladesh, like many countries, is witnessing a transformation in its population structure, which underscores the necessity of introducing a robust universal pension system. This imperative arises from the increasing number of elderly citizens and the government’s commitment to ensuring the welfare of its people.

Demographic Changes and Aging Population

Over the past few decades, Bangladesh has experienced notable demographic changes characterized by a growing proportion of elderly individuals. The Finance Department of the Ministry of Finance has meticulously studied this trend and predicts a substantial increase in the elderly population over the upcoming years. In 2020, the elderly population stood at 1 crore 2 million, and this number is projected to swell to a staggering 3 crore 10 million by the year 2041. This remarkable demographic shift reflects longer life expectancies and changes in birth rates, creating a scenario where a significant portion of the population is entering their senior years.

Challenges and Vulnerabilities

As the aging population expands, a host of challenges and vulnerabilities emerge. Elderly citizens often face financial instability due to reduced earning capacity after retirement. Moreover, many individuals are engaged in low-income and informal sectors, where traditional pension options are often unavailable. The lack of a sustainable social security framework can lead to economic hardships for seniors who lack reliable financial support during their retirement years.

Empowering the Informal Sector

Recognizing the demographic changes and the prevalence of low-income and informal sectors, the government acknowledges the need to provide a safety net for its citizens. Many individuals engaged in rickshaw pulling, farming, labor, artisanal work, fishing, weaving, and other informal professions often lack access to pension plans through traditional employment channels. Addressing the financial insecurities faced by these individuals is central to the goal of promoting economic well-being across all segments of society.

Sustainable and Organized Pension System

In response to these challenges, the government is introducing a universal pension system. This innovative system aims to create a sustainable and organized framework that caters to the needs of citizens from all walks of life, particularly those engaged in informal and low-income sectors. By offering a comprehensive pension scheme, the government seeks to ensure that elderly individuals can retire with dignity, financial security, and the peace of mind that comes from having a dependable support system in place.

The introduction of a universal pension system in Bangladesh signifies the government’s commitment to address the evolving needs of its citizens in the face of demographic changes. This forward-looking initiative aims to provide a safety net for individuals engaged in informal sectors and low-income professions, empowering them to enjoy a secure and comfortable retirement. By acknowledging the challenges posed by an aging population and implementing a comprehensive pension system, Bangladesh takes a significant step towards promoting social security, economic stability, and a better quality of life for all its citizens.

Background and History of UPS in Bangladesh

The journey towards implementing the Universal Pension Scheme (UPS) in Bangladesh is rooted in the commitment made by the government back in 2008. This commitment was an integral part of the government’s broader vision for social security and elderly welfare. Over the years, the concept of the UPS has evolved to address the challenges posed by a growing elderly population and the need for a well-organized and sustainable social security framework.

2008: The Commitment and Aspiration

In 2008, during the general elections, the ruling party articulated its commitment to introduce a universal pension scheme as part of its election manifesto. This marked the first significant step towards recognizing the importance of providing support to the senior citizens of the country. The commitment was made in the backdrop of Bangladesh’s evolving socio-economic landscape, characterized by an increasing average life expectancy and a demographic shift.

Initiation of the Implementation Process

The initiative to implement the UPS gained renewed momentum in the subsequent years, as the government recognized the pressing need to address the insecurities faced by the elderly population. While the initial discussions took place in 2015, under the leadership of the late Finance Minister Abul Mal Abdul Muhith, it was during this period that the foundations of the UPS were laid. A team from the Finance Department’s visit to India in 2016 resulted in the development of a concept paper that envisioned a comprehensive pension system.

2022 and Beyond: Reviving the Vision

The concept of the UPS resurfaced with greater urgency in 2022, reflecting the growing concerns surrounding the elderly population’s financial security. A new concept paper was drafted by the Finance Department, highlighting the importance of creating an integrated, participatory, and well-structured pension system to protect citizens during their old age.

Formation of the National Pension Authority

A crucial milestone was reached when, on January 31, 2023, the National Pension Authority was established under the Universal Pension Management Act. This institutional framework laid the groundwork for the implementation of the pension system, streamlining management and administration.

Budget Speach (2023): In the budget speech of the current financial year, the Finance Minister reiterated the government’s commitment to introducing a universal pension system. This underscored the alignment of the pension scheme with the government’s broader social security goals.

Four Schemes for Diverse Needs

The UPS was thoughtfully designed to cater to the diverse needs of different segments of the population. The migration, progress, protection, and equality schemes were crafted to ensure that various occupational categories and income groups could access the benefits of the pension system.

Website Launch and Registration (2023): The National Pension Authority’s website, www.upension.gov.bd, was launched to facilitate the registration process for the UPS. This online platform serves as the gateway for individuals to enroll in the pension scheme.

Implementation and Looking Ahead

August 17, 2023, is a gigantic day for the people of Bangladesh as UPS starts its implementation journey. The journey towards implementing the UPS in Bangladesh is a testament to the government’s commitment to the welfare of its citizens, particularly the elderly population. The initial promise made in 2008 set the stage for the subsequent evolution of the concept and the creation of an institutional framework. As the scheme takes effect, its success will be measured by its ability to provide financial security to the elderly, realizing the aspiration that was set forth in the government’s commitment more than a decade ago.

Universal Pension System Inauguration

In a momentous and visionary step towards ensuring a better life for every citizen, Prime Minister Sheikh Hasina inaugurated Bangladesh’s Universal Pension System through a virtual link from her official residence, Ganabhaban, on Thursday, August 17th, 2023. With the aim of uplifting the lives of citizens above 18 years of age, the inauguration marked a significant milestone in the country’s commitment to social welfare and inclusive development.

Prime Minister Sheikh Hasina articulated the significance of the universal pension system as a means to uplift the quality of life for every individual across the nation. As she inaugurated the system, she underlined the government’s dedication to creating an environment where all citizens could thrive and prosper. The visionary essence of the initiative lay in its ambition to encompass every individual within its protective embrace.

With unwavering determination, the Prime Minister announced the launch of four out of the six schemes that constitute the universal pension system: Pragati, Sukhara, Samata, and Pravasi. These initial schemes symbolized the government’s dedication to taking incremental steps towards a comprehensive and all-encompassing system of financial support for citizens. The remaining two schemes are set to be introduced at a later stage, underlining the commitment to phased implementation.

Prime Minister Sheikh Hasina’s words echoed the legacy of the Father of the Nation, Bangabandhu Sheikh Mujibur Rahman, whose lifelong dedication was focused on ensuring a better life for every citizen. The universal pension system’s launch during a month of mourning added a layer of reverence and dedication to the program. In invoking the memory of Bangabandhu Sheikh Mujibur Rahman and Mother Banga, the Prime Minister emphasized that their visionary spirits would find solace in witnessing the government’s efforts to uplift the lives of the people.

Acknowledging the uniqueness of the occasion, the Prime Minister expressed her intention to establish the pension scheme exclusively during her party’s rule. This exclusivity was born from a genuine concern that future administrations might not undertake such a monumental program. The Prime Minister’s foresight underlined her understanding of the transformational impact that the universal pension system could bring to the lives of citizens.

The inaugural program was not confined to national boundaries; it transcended geographical distances to connect with local public representatives, beneficiaries from districts including Gopalganj, Bagerhat, and Rangpur, and the Consulate General of Bangladesh in Jeddah, Saudi Arabia. Through a video conference, these stakeholders joined hands to celebrate the launch of a program that symbolized hope, inclusivity, and progress.

The occasion was graced by key figures instrumental in the formulation and execution of the universal pension system. Finance Minister AHM Mustafa Kamal and Bangladesh Bank Governor Abdur Rauf Talukdar shared their perspectives, underlining the economic and financial dimensions of the initiative. Senior Secretary of the Finance Division, MoF, contributed her insights, adding a versatile perspective to the event.

The launch event was skillfully moderated by Tofazzel Hossain Mia, underscoring the importance of effective facilitation in realizing such transformative initiatives. A pivotal moment during the program was the screening of a video documentary on the Universal Pension System. This documentary encapsulated the system’s essence, goals, and journey that led to its inauguration, providing attendees with a comprehensive overview of the initiative.

Prime Minister Sheikh Hasina, in her closing remarks, expressed profound gratitude to all stakeholders who contributed to the inception of the universal pension system. She singled out former Finance Minister Abul Mal Abdul Muhith and the current Finance Minister for their relentless efforts in making this vision a reality. Their dedication and commitment were essential pillars in the foundation of a program that aspires to touch the lives of millions, uplift communities, and steer the nation towards a brighter and more prosperous future.

Inaugurating the universal pension system was not just a symbolic gesture; it was a declaration of the government’s unyielding dedication to the welfare of its citizens. It was a step forward in building a society that values and safeguards the well-being of its members, ensuring that every individual, regardless of age, socio-economic background, or location, has the opportunity to lead a life of dignity and security.

What are the Four Pension Schemes

Bangladesh’s Universal Pension System is a government-run pension scheme that is open to all citizens of Bangladesh, regardless of their employment status or income level.

The scheme offers four different packages, each with its own monthly contribution and pension benefits tailored to address the diverse needs of different groups:. The packages are:

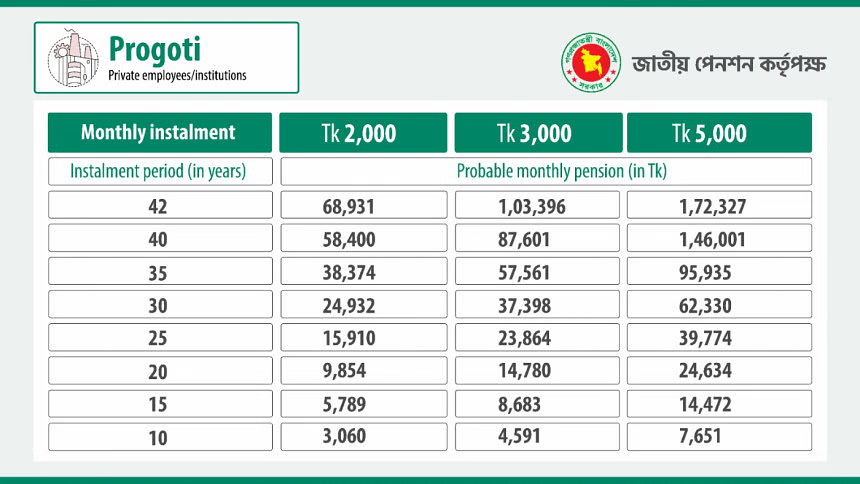

Progoti: This package is for private sector employees and offers a monthly pension of Tk 2,000, Tk 3,000, or Tk 5,000, depending on the monthly contribution.

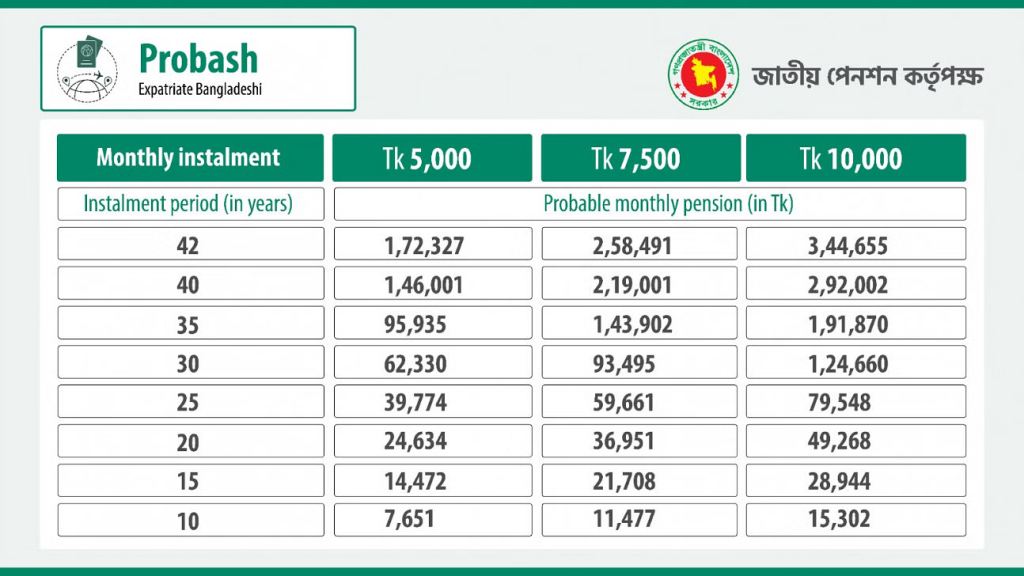

Probash: This package is for expatriate Bangladeshis and offers a monthly pension of Tk 5,000, Tk 7,500, or Tk 10,000, depending on the monthly contribution.

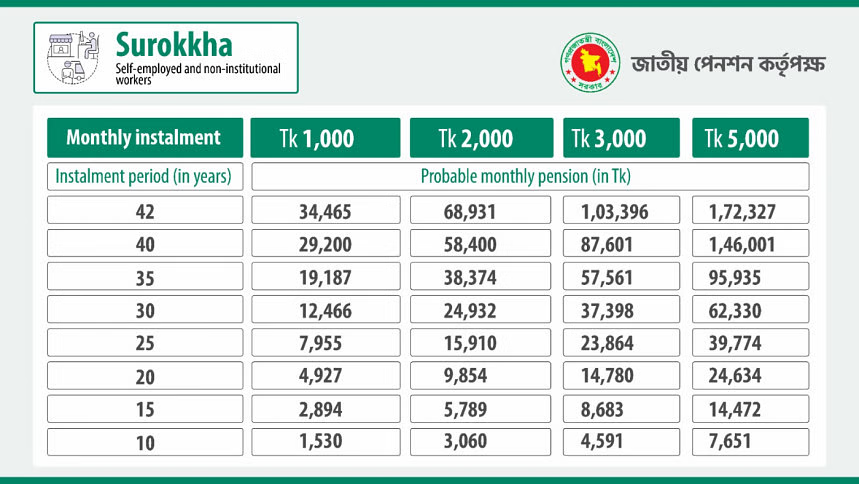

Shurokkha: This package is for the self-employed and informal sector workers and offers a monthly pension of Tk 1,000, Tk 2,000, Tk 3,000, or Tk 5,000, depending on the monthly contribution.

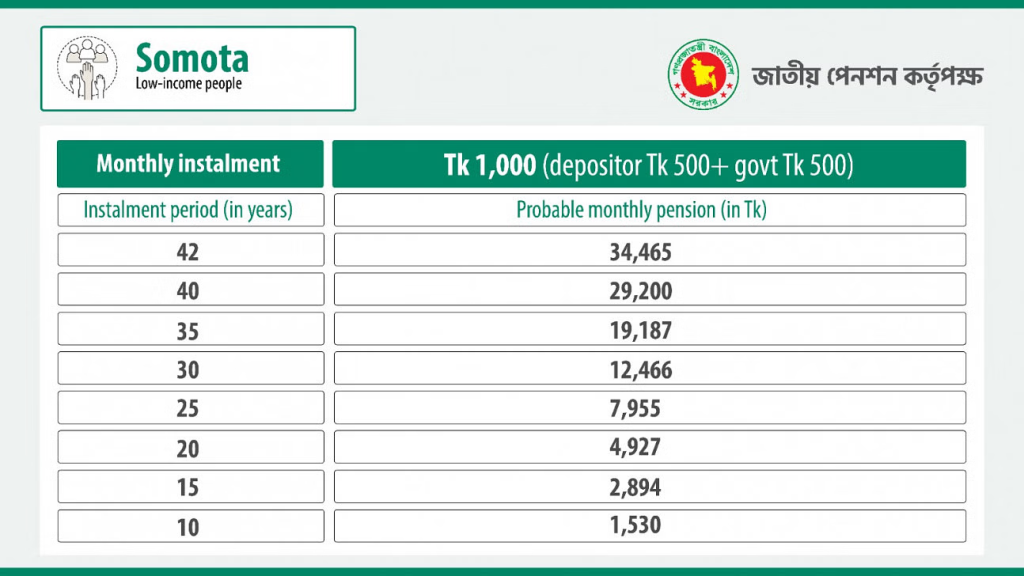

Samata: This package is for the ultra-poor and offers a monthly pension of Tk 1,000, with the government contributing Tk 500 and the beneficiary contributing Tk 500.

Administration and Implementation

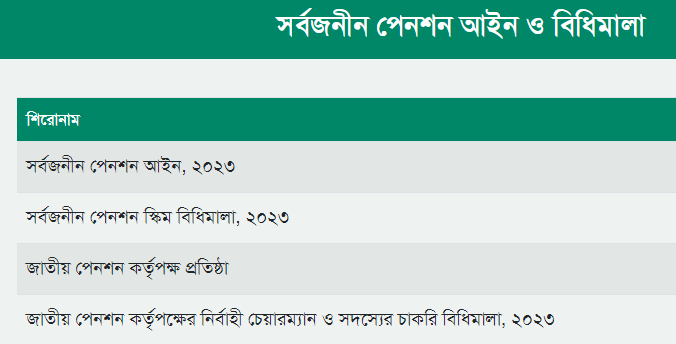

The National Pension Authority, operating under the Finance Department, is responsible for managing and implementing the pension system. The authority’s official website, www.upension.gov.bd, was launched to provide essential information and facilitate the registration process for interested individuals. The legal aspects include the following:

Eligibility and Registration

To be eligible for the universal pension system, individuals must be above the age of 18 and not employed by the government. National Identity Card (NID) holders can register directly, while expatriates lacking an NID can register using their passport information. The registration process involves selecting one of the four schemes and providing personal, professional, and banking details.

Pension Features

The Universal Pension Scheme (UPS) in Bangladesh has been meticulously designed to address the financial security needs of its citizens, particularly those in their old age. This innovative scheme is characterized by several key features that ensure inclusivity, flexibility, and long-term stability:

1. Inclusive Age Range: The UPS opens its doors to all Bangladeshi citizens aged between 18 and 50 years. This wide age range reflects the government’s commitment to provide pension coverage to a significant portion of the population and cater to individuals at various stages of their lives.

2. Flexibility for Citizens above 50: While the standard eligibility range is between 18 and 50 years, the UPS also accommodates citizens above the age of 50 under special consideration. These individuals can participate in the scheme and, upon meeting certain conditions, receive a lifetime pension. This provision acknowledges the diversity of situations and ensures a safety net for those entering the scheme later in life.

3. Inclusion of Expatriate Workers: The UPS goes beyond national borders by allowing Bangladeshi workers employed abroad to be included in the program. This recognition of the contributions made by expatriates highlights the government’s commitment to protecting the interests of its citizens regardless of their geographic location.

4. Individual Pension Accounts: Each participant in the UPS is allocated a distinct and separate pension account. This individualized approach ensures transparency and accountability, allowing contributors to keep track of their pension contributions and the growth of their funds over time.

5. Survivor Benefits: The UPS addresses the uncertainty of life by offering survivor benefits. In the unfortunate event of a contributor’s passing before reaching 75 years of age, the nominee of the pensioner is entitled to receive a monthly pension for the remaining period up to the age of 75. This provision assures the well-being of the pensioner’s dependents.

6. Refund Option: To account for unforeseen circumstances, the scheme provides a safeguard for contributors. If a subscriber passes away at least 10 years before the completion of their subscription period, the deposited money will be returned to their nominee along with accrued profits. This feature guarantees that the funds invested in the scheme do not go to waste.

7. Tax Benefits: The UPS acknowledges the financial realities of its participants by considering the fixed pension contribution as an investment. This not only encourages savings but also offers potential tax deductions, providing an added incentive for individuals to engage with the scheme. Moreover, the monthly pension received from the scheme is exempt from income tax, ensuring that the pensioners can fully benefit from their contributions during retirement.

In essence, the Universal Pension Scheme exemplifies the government’s dedication to securing the financial well-being of its citizens throughout their lives. By offering comprehensive coverage, flexibility, and beneficial features, the scheme contributes to the larger goal of ensuring social welfare and protection for all members of society.

Registration Process

Step-by-Step Registration Process for the Universal Pension Scheme

The registration process for the UPS involves multiple steps to ensure accurate and comprehensive enrollment:

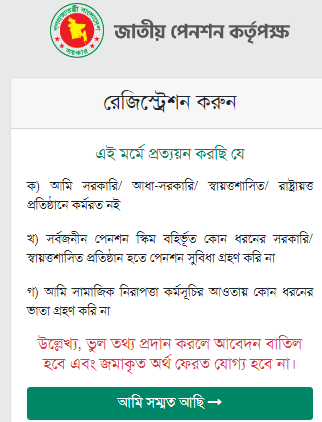

- Agreement to Eligibility Criteria: The first step requires applicants to certify that they are not employed by any government, semi-government, autonomous, or non-government organization. They must confirm that they are not receiving benefits from any sources other than the public pension scheme or social security program.

- Scheme Selection: Applicants then proceed to select the appropriate scheme among the four options: Immigration, Equality, Protection, or Progression. This step allows individuals to choose the scheme that aligns with their occupational category and needs.

- Personal Information: The applicant’s National Identity Card (NID) number, photo, Bengali and English names, parent’s names, current and permanent addresses are automatically populated based on the NID provided.

- Occupation and Income Details: Applicants enter their annual income and select their occupation from a list of options, including teachers, private employees, small traders, laborers, professionals, and more.

- Bank Account Information: Individuals provide their bank account details, including the account number, type (savings or current), routing number, bank name, and branch name. This information ensures the proper deposit of contributions and pension disbursements.

- Nominee Information: Applicants enter the nominee’s National Identity Card number, date of birth, mobile number, and relationship with the nominee. In case of multiple nominees, the availability rate is also specified.

- Confirmation and Submission: The final step involves reviewing all provided information. If accurate, applicants agree to the terms and conditions and submit the application. The option to download the completed application is also provided.

FAQs for Universal Pension Scheme in Bangladesh

What is the Universal Pension Scheme (UPS)?

Answer: The Universal Pension Scheme is a pioneering initiative launched by the government of Bangladesh to provide financial security and social protection to citizens, aiming to encompass around 10 crore people from diverse socio-economic backgrounds.

What is the main goal of the UPS?

Answer: The main goal of the Universal Pension Scheme is to ensure the well-being of citizens, particularly the elderly and those engaged in low-income and informal sectors, by offering a sustainable and organized pension framework.

How did the journey towards implementing the UPS begin?

Answer: The journey began with the commitment of the government in 2008, and over time, it evolved into an inclusive and comprehensive system to address the challenges posed by an aging population and the need for social security.

What are the four pension schemes under the UPS?

Answer: The four pension schemes are Progoti, Probash, Shurokkha, and Samata. Each scheme is tailored to cater to different categories of individuals, such as private sector employees, expatriate Bangladeshis, self-employed individuals, informal sector workers, and the ultra-poor.

Who is responsible for the management and implementation of the UPS?

Answer: The National Pension Authority is responsible for managing and implementing the Universal Pension Scheme.

What is the eligibility criterion for joining the UPS?

Answer: Individuals above the age of 18 who are not employed by the government are eligible to join the UPS. Both National Identity Card (NID) holders and expatriates can register.

What benefits does the UPS offer to individuals above the age of 50?

Answer: While the standard eligibility range is 18 to 50 years, citizens above the age of 50 can also participate under special consideration and receive a lifetime pension upon meeting certain conditions.

How is the UPS designed to support expatriate workers?

Answer: The UPS allows Bangladeshi workers employed abroad to enroll, ensuring that citizens regardless of their geographic location can benefit from the pension scheme.

What is the registration process for the UPS?

Answer: The registration process involves confirming eligibility criteria, selecting a scheme, providing personal and occupation details, bank account information, and nominating beneficiaries.

What are the key features of the UPS that ensure inclusivity and flexibility?

Answer: The UPS offers an inclusive age range, flexibility for citizens above 50, inclusion of expatriate workers, individual pension accounts, survivor benefits, a refund option, and potential tax benefits to encourage savings and ensure financial security during retirement.

Conclusion

Bangladesh’s universal pension system marks a significant milestone in the country’s efforts to provide comprehensive social security and financial stability to its citizens. With distinct schemes catering to different segments of the population and a streamlined registration process, this initiative holds the potential to positively impact the lives of millions, fostering a more secure and prosperous future for all. The launch of this system underscores the government’s commitment to creating an inclusive and resilient social security framework, setting the stage for enhanced quality of life and dignified retirement for its citizens.